This coming September, the Census Bureau will release annual income data and will report the growth in median household income for 2019, among other notable statistics. Despite being released nine months after the end of the year it describes, it is an important measure of changing living standards and always newsworthy when released. But that long lag makes it a less timely indicator of current labor market developments.

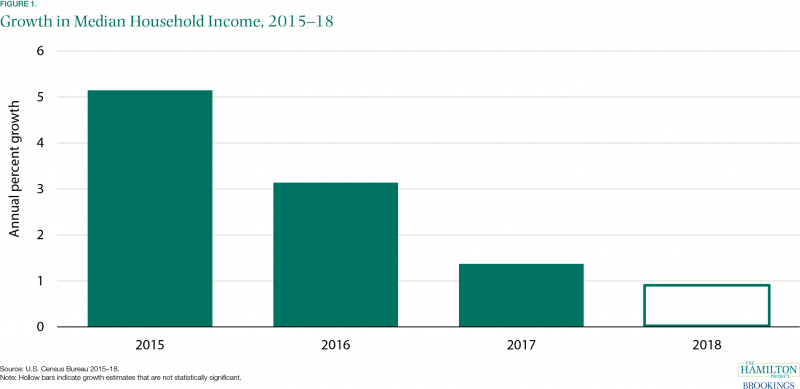

Fortunately, it is possible to analyze data from the Bureau of Labor Statistics’ monthly jobs reports to get a sense of household income growth much earlier. In this analysis, we use these wage, employment, and hours data to estimate median household income growth from 2018 to 2019. We find that while real median household income growth has been slowing in recent years (see figure 1 for the published annual growth rates), growth for 2019 will likely be strong when it is reported in September.

The Hamilton Project has previously analyzed three components of income—wages, hours worked, and employment—to estimate median household income growth. These components give a rough indication of household income growth, but do not capture it perfectly. By this analysis, monthly labor market data implied a 1.7 percent growth rate in 2018, well above the reported household income growth of 0.9 percent.

The Hamilton Project has previously analyzed three components of income—wages, hours worked, and employment—to estimate median household income growth. These components give a rough indication of household income growth, but do not capture it perfectly. By this analysis, monthly labor market data implied a 1.7 percent growth rate in 2018, well above the reported household income growth of 0.9 percent.

Discrepancies between the two measures have several explanations: first, monthly component statistics are drawn from different data sources. Second, the relationship between median household income growth and the components we track will be affected by changing household size, non-wage income (including income from self-employment) that affects household income but is not included in wages, and changes in the distribution of wages. For example, if wages grow quickly at the top of the distribution, average wages could rise while median incomes are stagnant. As we note in a separate analysis, much of the recent gains in wages have come at the very bottom or very top of the distribution—not in the middle. Still, the major labor market indicators typically do a reasonably good job of predicting household income, so it is helpful to track their movements.

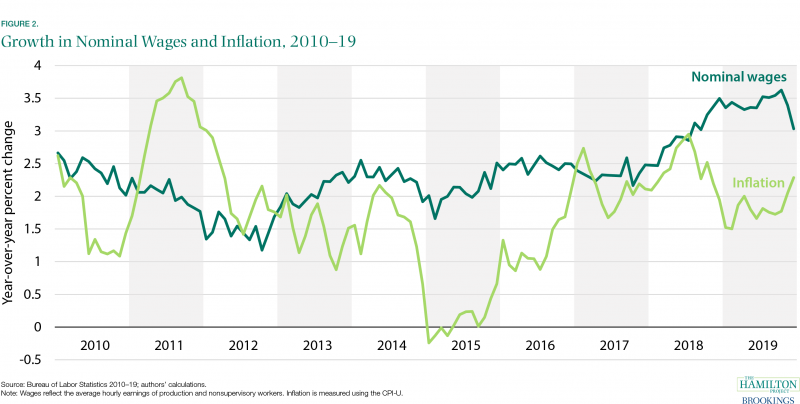

Figure 2 shows year-over-year changes in nominal wages and inflation since 2010. Nominal wage growth was faster than inflation in 2019, indicating that real wage growth (the gap between the two lines) propelled household income growth last year. It is worth noting that wage growth was slowing at the end of 2019 and inflation was picking up, but for 2019 on net (comparing the annual average for 2019 to the annual average for 2018), real wage growth supported income growth. However, if the slowdown in real wage growth persists, it would slow household income growth in 2020.

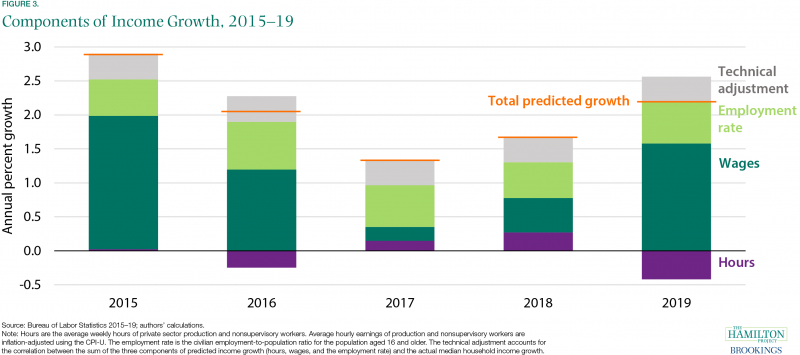

Figure 3 shows our estimate of income growth based on the growth in average real wages, hours worked, and employment for 2015 through 2019. We also include a technical adjustment in our calculation to account for the typical gap between the sum of the three components and actual median income growth. In 2019, the three components of income growth imply a growth of 2.1 percent in median household income for the 2018 to 2019 period, suggesting a rebound from slower growth in 2017 and 2018, though still below the rapid household median income growth in 2015. This is largely driven by growth in real wages. Hours actually fell in 2019, subtracting from income growth, while employment provided roughly the same boost as in the last four years.

Figure 3 shows our estimate of income growth based on the growth in average real wages, hours worked, and employment for 2015 through 2019. We also include a technical adjustment in our calculation to account for the typical gap between the sum of the three components and actual median income growth. In 2019, the three components of income growth imply a growth of 2.1 percent in median household income for the 2018 to 2019 period, suggesting a rebound from slower growth in 2017 and 2018, though still below the rapid household median income growth in 2015. This is largely driven by growth in real wages. Hours actually fell in 2019, subtracting from income growth, while employment provided roughly the same boost as in the last four years.

It is also worth noting that when the labor market prediction is incorrect in one year, it is typically made up for in the following year. The fact that 2018 actual household income growth was below expectations suggests we might anticipate household income growth will exceed the sum of the labor market components for 2019.

Wages, inflation, hours, employment, and many other data series all provide pieces of information that add up to overall real household income growth. Our analysis of the monthly data for 2019 suggest that when household income growth is reported in September, it will show strong growth.

Wages, inflation, hours, employment, and many other data series all provide pieces of information that add up to overall real household income growth. Our analysis of the monthly data for 2019 suggest that when household income growth is reported in September, it will show strong growth.