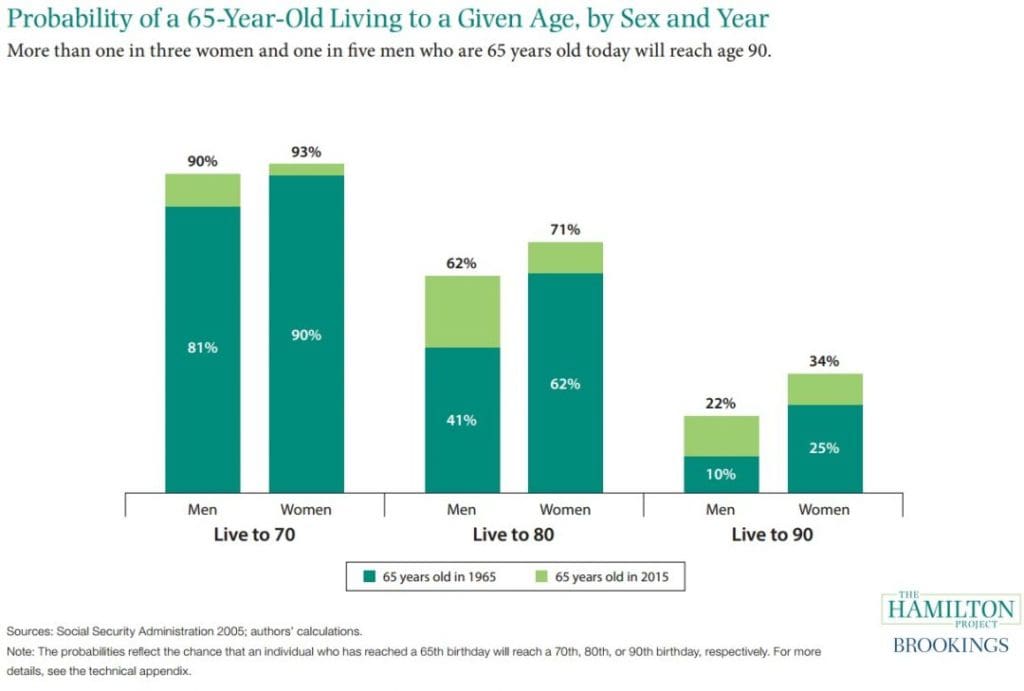

More than three out of five 65-year-olds today will reach age 80.

Rising life expectancy and potentially exorbitant long-term care costs have increased the financial resources required to support oneself and one’s spouse in retirement and old age. Americans today are living longer than did previous generations, thanks to advances in medicine and changes in lifestyle. As shown in the dark green bars, 50 years ago a man who had reached 65 had an 81 percent chance of reaching 70, a 41 percent chance of hitting 80, and a 10 percent chance of turning 90. By comparison, the chances of reaching those same ages for a man who reaches 65 in 2015 are (as shown in the light green bars) 90 percent, 62 percent, and 22 percent, respectively. Put differently, the likelihood of a 65-year-old man seeing his 80th birthday has increased by 50 percent, and the likelihood of him seeing his 90th birthday has more than doubled. Women live longer than men on average, and they have experienced smaller but still substantial gains in life expectancy over the past 50 years.

Read more: “Ten Economic Facts about Financial Well-Being in Retirement“