Expanding the Child Tax Credit would meaningfully reduce child poverty and improve the long-term outcomes of children. At the same time, policymakers have posed concerns that these additional resources would be negatively offset: by reduced labor supply, because struggling parents will not spend the additional cash in ways that are beneficial to children, and due to the net fiscal cost. The authors analyze the tradeoffs of an enhanced CTC to address all three of these concerns. They propose a novel and efficient CTC design that increases the value of the CTC and provides benefits to families with no income to support millions of American children.

Introduction

The economic case for expanded income assistance to low-income families with children in this country is exceptionally strong. We have ample evidence showing that increased income assistance to low-income families with children yields improvements in educational outcomes and earnings in adulthood. This is in addition to evidence showing that expansions in programs that provide low-income children with other forms of support such as food benefits, public health insurance, and early childhood education lead to improvement in immediate childhood outcomes as well as outcomes as adults.

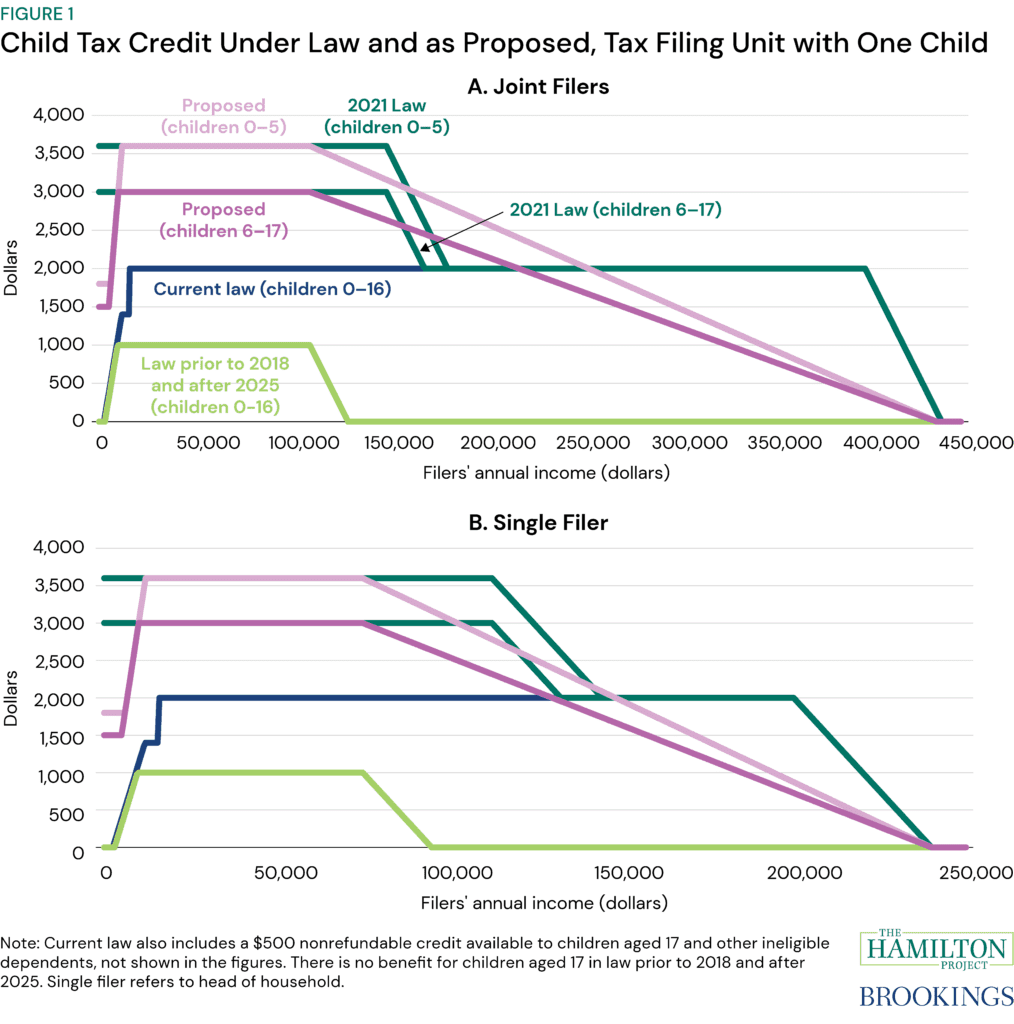

Against this backdrop of evidence, our country recently experimented with providing more income assistance to families with children in the form of an expanded Child Tax Credit (CTC) that was in place for the 2021 tax year. The expanded CTC featured a full credit amount of $3,600 for children under age 6 and $3,000 for children ages 6 to 17, as compared to a full amount of $2,000 for all ages to age 16 in effect before the expansion. In addition, the 2021 CTC was fully refundable, meaning that even families with no earnings (and hence no income tax liability) were eligible to receive the full credit amount. That full refundability delivered the maximum credit to roughly 2 million children (ages 0 through 16) who would otherwise be ineligible for any credit on the basis of low or no parental earnings.

Our nation’s experiment with an expanded CTC in 2021 revealed the possibilities, promises, and political pitfalls of expanded income assistance to low-income families delivered in the form of a tax credit. The 2021 CTC expansion increased the economic security of millions of children. There was a large decrease in child poverty and food insecurity, with some estimates suggesting that child poverty was reduced by one third as a result of the expansion. However, it was very costly, with the Joint Committee on Taxation estimating that the one-year expansion cost the federal government $109.5 billion, in addition to the extant cost of the existing credit (Joint Committee on Taxation, 2021). There have been many calls to build on the success of this policy experiment, but the failure of Congress to renew the 2021 expansions makes it clear that doing so requires political will and policy compromise.

In this essay, we propose a compromise-enhanced CTC design that is distinct from both the 2021 expansion design and current law. In the absence of political constraints, we would propose a design that awards the full credit amount to those with no earnings to advance the goal of delivering income assistance to the most economically vulnerable families. However, the design we propose here, with a partial award to non-earners and a sharp phase-in, helps address the three main concerns that various policymakers and commentators have expressed about re-introducing the 2021 expansions. First, there is a concern about the labor supply reduction that would result from a fully refundable expanded tax credit—that is, one that would award $3,000 or $3,600 per child to parents with no earnings. Second, there is a concern that sending that much income to out-of-work parents could be counterproductive if out-of-work parents struggle with substance abuse and would not spend the additional cash in ways that are beneficial to children; this concern takes on heightened salience amidst the ongoing opioid crisis in the US. Finally, some find the fiscal cost associated with the 2021 expanded design unjustifiably high.

Our design recommends a full credit amount of $3,000 for children between the ages of 6 and 17 and $3,600 for children under 6, consistent with the 2021 CTC expansion. Other features of our proposed design differ from both the 2021 expansion and current law. Under our proposed design, families with no earnings are eligible for half the full credit amount for each child and there is a steep phase-in of the full credit. Those specifications help address concerns about the negative effects on labor force participation of a fully refundable credit and indeed significantly increase the after-tax and transfer return to working additional hours for low-income parents. The partial award to non-earners also mitigates concerns about sending amounts as high as $3,600 per child in unrestricted cash to out-of-work parents who might not use such substantial financial resources in ways that benefit children but still delivers critical income assistance to children living in economically-disadvantaged households. In addition, our design features a slow phase-out of the full credit beginning at $75,000 for single filers and $110,000 for married joint filers; these are lower threshold amounts than the 2021 CTC and current law, and thus lower the fiscal costs.