Recession Remedies Home

Abstract

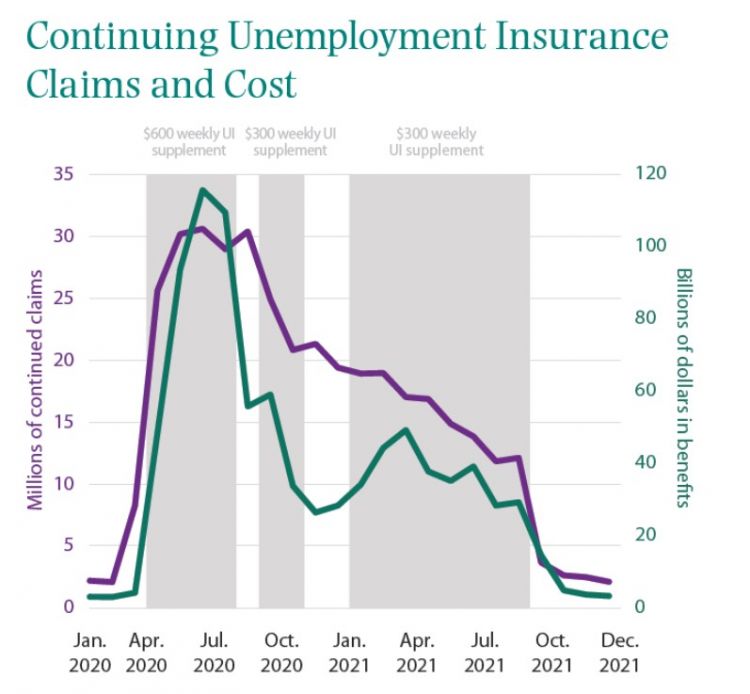

The authors review the substantial expansion of Unemployment Insurance (UI)—supplementing state-provided benefits, expanding eligibility to those not traditionally eligible, and extending the duration of benefits. They draw five conclusions: First, UI expansions were highly progressive in that they offset income losses and delivered the most benefit to lower-income workers. Second, UI benefits provided a powerful stimulus to the macroeconomy by boosting consumption. Third, work disincentive effects from UI benefits were small during the pandemic, especially when compared to history. Fourth, Congress increased access to benefits for workers on the margins of the labor market, and there is no clear evidence of greater work disincentive effects for them than for other workers. Fifth, the rapidly expanded UI programs faced a range of administrative challenges in meeting the surge in UI demand, including delays, unnecessary red tape, and overpayments, all of which were costly in terms of consumer welfare and government expense.