Recession Remedies Home

Abstract

Part I: Support for Mortgage-Borrowers

Paul Willen, Kristopher Gerardi, and Lauren Lambie-Hanson

The authors review the aid offered to the roughly 50 million homeowners with mortgages included in a forbearance program and the Federal Reserve’s actions that pushed down mortgage rates, allowing many mortgage holders to reduce their monthly payments by refinancing. They deem these policies to be quite effective in relieving financial distress and allowing homeowners to stay in their homes, especially in contrast with the policies pursued during the Great Recession. They emphasize that these policies in part worked because of rising housing prices and home equity, before and during the pandemic, and note that such conditions might not hold in future downturns. They observe that minority mortgage borrowers were much more likely to miss mortgage payments, so forbearance was particularly important to them. Black and Hispanic borrowers, however, were less likely to refinance than white or Asian borrowers.

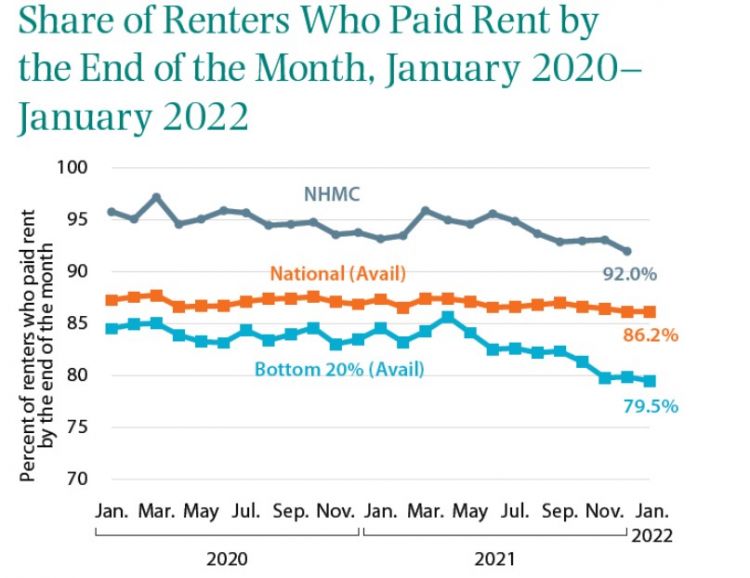

Part II: Support for Renters

Laurie S. Goodman and Susan Wachter

The authors evaluate aid offered to the 44 million renting households. These include federal, state, and local eviction moratoriums and the two rounds of Emergency Rental Assistance. Here the distribution of financial assistance was distressingly slow. Data on renters are unfortunately skimpy, a major impediment to precisely measuring the effects of these policies. General income replacement might have sufficed if policymakers were concerned only with the negative effect of the recession on renters’ finances, but the eviction moratoriums and Emergency Rental Assistance were particularly important to those struggling to make their rental payments before the recession. Eviction moratoriums, while particularly justified in a pandemic, impose hardships on landlords.