Recession Remedies Home

Abstract

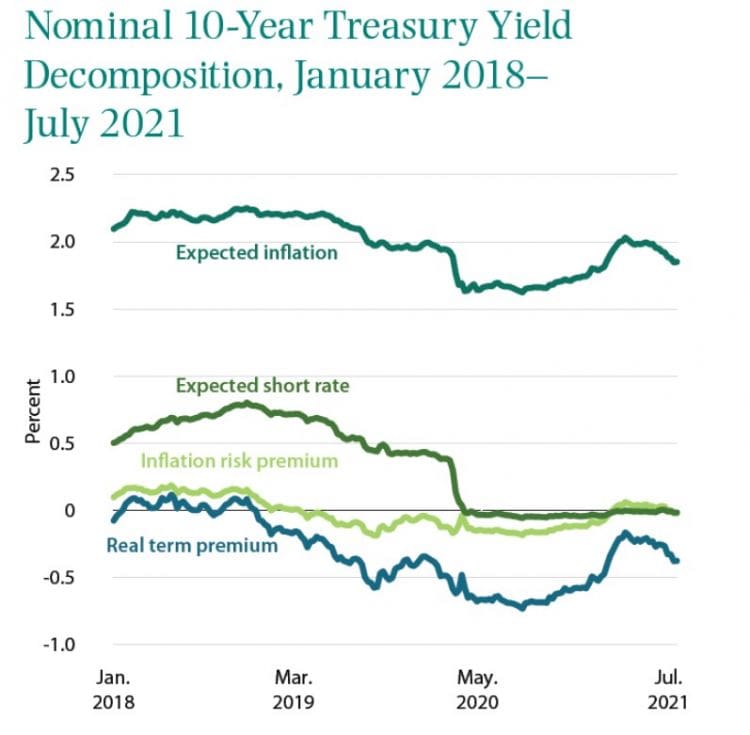

The authors examine the role of monetary policy in keeping interest rates low in the wake of a surge in federal borrowing to assess whether a similar increase in borrowing could be repeated in future recessions. It’s too soon to know if the pre-pandemic trend toward lower global interest rates will persist or be reversed. During the pandemic, the upward pressure on interest rates from substantial U.S. borrowing was offset by factors other than monetary policy that keep rates from rising. Policymakers should not assume that will always be the case. They conclude that the Federal Reserve’s purchases of more than $3.3 trillion in U.S. Treasury debt helped dampen rates and estimate that the yield on 10-year Treasury notes would have been 0.70 percentage points higher if not for the Fed’s purchases. How often can the Fed engage in such large-scale quantitative easing? As often as necessary, they say. Inflation is the crucial limiting factor: The Fed might not have been able to contribute to keeping interest rates down if inflation had been more of a threat in the early months of the pandemic.