Introduction

There is ongoing debate in policy circles, the media, and around kitchen tables about the value of a college degree. Given the investments of time and money involved, some skeptics—and likely some students and their families—are asking if the returns to college are really worth the costs. Do college graduates tend to earn more than non-college graduates? The answer is yes. It is well-documented that on average college graduates earn more than those with less education, and our analysis presented here confirms this. What is less understood is how earnings vary across college majors.

As a new school year gets underway, The Hamilton Project presents this economic analysis—with an accompanying interactive feature—that explores career earnings by college major. Drawing upon data from the Census Bureau’s American Community Survey, we examine earnings for approximately 80 majors, focusing on both annual earnings for each year of the career and cumulative lifetime earnings. The new interactive feature allows you to compare career earnings among bachelor’s degree graduates for all 80 majors along with earnings for workers with less education.

The analysis yields the following key conclusions:

First, a college degree—in any major—is important for advancing one’s earnings potential.

- Median earnings of bachelor’s degree graduates are higher than median earnings of high school graduates for all 80 majors studied. This is true at career entry, mid-career, and end of career.

- Median earnings of bachelor’s degree graduates are at least as high as median earnings for associate degree holders—again, throughout the career—for 76 out of 80 majors; the exceptions are early childhood education, elementary education, home economics, and social work.

- Looking at cumulative earnings over the entire career, the typical bachelor’s degree graduate worker earns $1.19 million, which is twice what the typical high school graduate earns, and $335,000 more than what the typical associate degree graduate earns.

- As usual, there are exceptions to the rule: even the highest-earning majors contain some graduates who have lower career earnings than some workers with less than a bachelor’s degree. Notably, the top tenth of high school graduates out-earn the bottom tenth of college graduates in every major.

Second, lifetime earnings vary tremendously by major.

- For the median bachelor’s graduate, cumulative lifetime earnings across majors range from just under $800,000 to just over $2 million.

- Majors that emphasize quantitative skills tend to have graduates with the highest lifetime earnings. The highest-earning majors are those in engineering fields, computer science, operations and logistics, physics, economics, and finance.

- Majors that train students to work with children or provide counseling services tend to have graduates with the lowest earnings. The lowest-earning majors are early childhood education, family sciences (home economics), theology, fine arts, social work, and elementary education.

- There is also substantial variation in earnings within majors. Cumulative earnings double—or even triple—when moving from the bottom quarter to the top quarter of earners in a given major. These increases are larger for lower-earning majors.

We emphasize that there are some nuanced—but crucially important—issues to consider when interpreting these figures. First, earnings differences across majors are driven by many factors and do not necessarily reflect a wage premium for that particular major. The estimates cannot distinguish why graduates in certain majors earn more than those in others. For example, perhaps individuals who select into particularly difficult majors have skills that they would bring to the workforce even if they had chosen another major. (See Appendix 1 for a detailed consideration of this issue, including caveats about interpreting these differences as causally related to choice of major.) Second, future earnings are not the only factor in choosing a major: personal enjoyment, engaging in meaningful work, and filling a social need should all also enter into a student’s decision-making.

The purpose in presenting these earnings estimates is to provide students, parents, policymakers, and researchers with information for which there is great interest and—until now—little availability. We hope the estimates will be a springboard for discussion regarding educational investments, financial aid, career choices, and social opportunity.

A separate technical appendix describes the data and our methodology in more detail. Finally, appendix tables 1 and 2 provide detailed earnings at different career points for each of the 80 majors studied.

A Look at Annual Earnings Over the Career by Degree and Major

Using data from the Census Bureau’s American Community Survey, we have calculated annual median earnings from career start to retirement for 80 majors among workers with exactly a bachelor’s degree. To be clear, the earnings presented here are based on individuals who complete a bachelor’s degree in a particular major and do not go on to earn an advanced or professional degree. Certain majors might have more individuals who pursue additional degrees; this is not something that we attempt to account for in this analysis, but readers can do so through the new Hamilton Project interactive.

It is also important to note that these earnings profiles are not limited to full-time workers and include part-time workers and those who experience unemployment throughout the year [1]. As The Hamilton Project and others have noted, the risks of unemployment and underemployment are higher for those with less education, and they also differ by college major among bachelor’s degree holders.

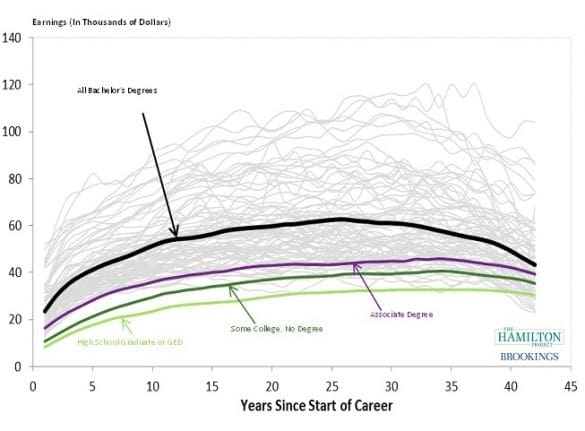

In figure 1 below, each of the thin gray lines shows the earnings trajectory of a different major, highlighting the tremendous variation in earnings across majors. A few majors, particularly engineering, crest $100,000 at career peak, while others, including fine arts, social work, and a few education fields, barely break $40,000. For comparison, the solid black line shows the median earnings profile of all bachelor’s degree workers put together, and the purple, dark green, and light green lines show the respective profiles of workers with an associate degree, some college without a degree, and just a high school diploma.

Figure 1: Median Annual Earnings Over the Career, by Education Level and College Major

The data confirm that individuals with higher levels of education have higher earnings throughout their career. Indeed, the earnings profile of bachelor’s degree graduates is completely above that of associate degree graduates, with the typical bachelor’s graduate earning just above $60,000 at career peak, about $20,000 more per year than an associate degree graduate. In turn, the median earnings of associate degree graduates is completely above that of high school graduates, although the earnings differences between these groups are smaller than those between bachelor’s degree graduates and associate degree graduates.

Strikingly, the earnings profile for every major lies above the profile for high school graduates over the first 40 career years. Even in the lowest-earning major, early childhood education, the median bachelor’s graduate earns more at every point during the career than does the median high school graduate. Across the vast majority of majors—though not all—bachelor’s graduates will usually earn more throughout their careers than workers with only an associate degree.

Lifetime Earnings By Major

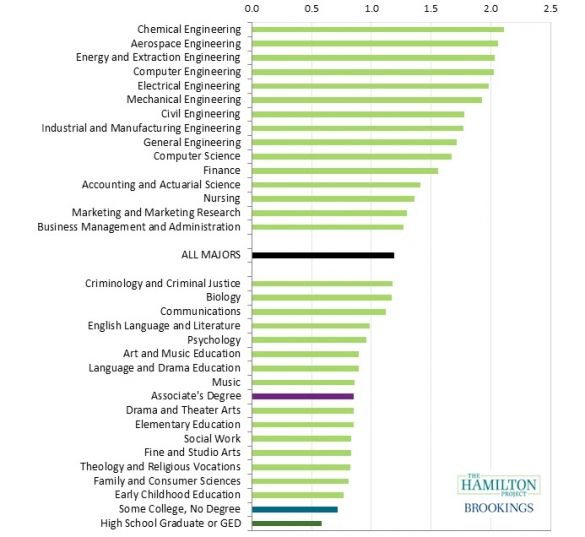

Over the entire working life, the typical college graduate will earn $1.19 million in today’s dollars [2]. This is more than twice as much as the lifetime earnings of a typical high school graduate ($580,000), and $335,000 more than that of a typical associate degree graduate. Figure 2 shows median lifetime earnings for select majors, including those with the highest earnings, those with the lowest earnings, and those that are among the most common. As can be seen in the figure, lifetime earnings vary widely across majors. Over the entire career, the highest-earning majors will earn about two-and-a-half times what the lowest-earning majors will earn, a range from over $2 million for some engineering majors to about $800,000 for early childhood education.

Figure 2: Median Lifetime Earnings for Select Majors (In Millions of Dollars)

(Click here to see a chart with all 80 majors)

Despite the size of this spread, the typical graduate in every college major will out-earn the typical high school graduate by at least $200,000 over the career. In a previous analysis, The Hamilton Project estimated that the total cost of getting a bachelor’s degree averages $102,000. (This estimate includes the direct costs of tuition and fees, room and board, and course materials, as well as the opportunity costs of lost wages while enrolled.) Even if this amount were subtracted from career earnings, it would still be the case that median net lifetime earnings in every major would exceed those of the median high school graduate.

Lifetime Earnings Differences Within Major

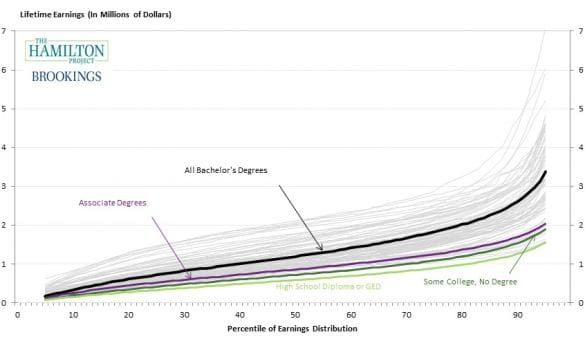

Of course, median earnings convey what the graduate in the middle of the earnings distribution can expect, and half of graduates will earn more and half will earn less. In fact, the variation of lifetime earnings within any given major is at least as large as the variation across majors. For all majors combined, lifetime earnings at the 25th percentile—the level at which one-quarter of graduates earn less—are $720,000, but they are $1.82 million at the 75th percentile—the level at which three-quarters of graduates earn less. This is an increase of 154 percent—almost precisely the relative spread at the median from the lowest-earning to the highest-earning major shown in Figure 2.

In general, majors that are associated with low earnings have larger relative spreads between earnings at the 25th and 75th percentiles than majors associated with high earnings. Loosely put, this means that graduates in nursing or engineering fields who have high earnings for their major do somewhat better than the graduates who have low earnings in that major, but that art history graduates who have high earnings for their major do much, much better than low-earning art history graduates.

To give a fuller illustration of the range of lifetime earnings, Figure 3 plots (nearly) the entire distribution of lifetime earnings for every major and the three sub-baccalaureate education levels. The horizontal axis shows the relative point in the earnings distribution, from near the bottom at the 5th percentile to near the top at the 95th percentile, and the vertical axis shows lifetime earnings. For example, the thick black line shows that median (50th percentile) earnings over the career for all bachelor’s graduates are $1.19 million, the same as in Figure 2, but it also shows that earnings range from just a few hundred thousand dollars at the bottom to over $3 million at the top. As in Figure 1, each of the thin gray lines shows earnings for a different major. It is quite apparent that earnings differences across majors grow larger—or fan out—higher up in the earnings distributions. For instance, at the 10th percentile the difference in lifetime earnings between the highest-earning major and the lowest-earning one is about $500,000; at the 90th percentile, this difference is over $3.5 million.

Figure 3: Lifetime Earnings Distributions, by College Major

Conclusion

As college students begin another year of classes, few of them have good knowledge of what their earnings for their chosen field of study are likely to be. The good news is that no matter what their major, they are likely to earn more over their careers than those with less education. College degrees may not be a guarantee of higher income, but they come closer than just about any other investment one can make.

Importantly, the higher earnings associated with obtaining a bachelor’s degree, even in low-earning fields in the humanities and education, stand up when accounting for the risks of unemployment and underemployment. The earnings presented here incorporate the weak labor market during and after the Great Recession and include all workers, not just those with full-time jobs. Even college graduates who begin their careers in a recession with a relatively low-earning major will still earn more over their lifetimes than individuals with just a high school diploma. To further explore career earnings by major, visit The Hamilton Project’s interactive analysis, where the user can choose different majors and education levels, and compare earnings.

All of this being said, future earnings should not be the only factor that students weigh when determining what it is they want to study. It is, however, a significant factor, particularly as student debt burdens grow larger. To further promote thinking around this issue, The Hamilton Project will soon be releasing the second and third parts of this series on major decisions and lifetime earnings. The second part will explore earnings growth over the career, and the third will include an interactive calculator that shows the share of earnings—for each of the 80 majors studied here—that are needed to repay student debt in early career. Our goal is to provide additional information that can help consumers—students and their families—make the best decisions regarding their higher-education investments.

The interactive feature allows users to choose whether they want to view earnings among all workers or only those working full-time and year-round. It also allows the choice of whether to include or exclude workers with advanced degrees.

All cumulative earnings are calculated using a 3 percent annual discount rate. This converts earnings into a “present value,” the amount that if invested today at a 3 percent annual rate of return would yield the same total value as lifetime earnings.