Updated with an expanded edition on August 16, 2022

Abstract

A longstanding narrative holds that social programs targeted by income fare poorly politically and tend to be cut or eliminated over time, while universal programs (available to people at all income levels) do far better. The experience of recent decades casts doubt on this narrative. Between 1979 and 2019, mandatory programs (entitlements and other programs funded outside the appropriations process) that are targeted—which includes programs like Medicaid, SNAP and the EITC—grew at an average annual rate more than 40 percent faster than the three main universal mandatory programs (Social Security, Medicare, and Unemployment Insurance). In both categories, some programs were expanded while others were cut. The variation in how programs within each of the two categories fared exceeds the variation between the categories. Differences in the share of people eligible for a program who actually receive its benefits also are greater among programs within each of the categories than between the categories.

Multiple factors affect a program’s political strength, including whether (for a targeted program) it serves only the poor or also people significantly above the poverty line and often a sizable share of the middle class; whether a program is tied to work; whether it provides straight cash to people who aren’t employed or elderly or disabled or whether it provides benefits in-kind or through the tax code; whether it’s fully federally financed; and whether it has strong federal eligibility, benefits, and access standards.

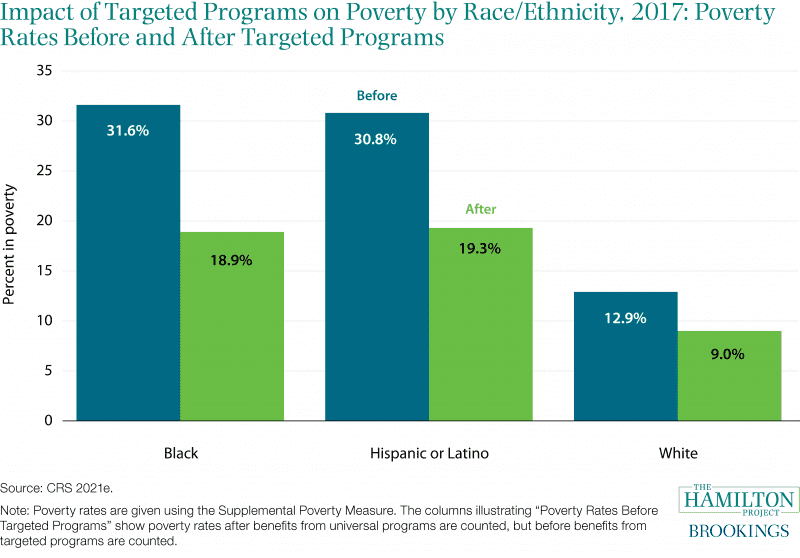

Growth in both targeted and universal programs has lowered poverty rates markedly. In 1970, under the Supplemental Poverty Measure, government benefits and taxes kept out of poverty 9 percent of those who would otherwise be poor; by 2017, they kept out 47 percent. Social Security keeps many more people 65 and over out of poverty than all other programs combined. Targeted programs keep out of poverty twice as many people under 65 as Social Security and UI combined and also reduce racial disparities in poverty, though those disparities remain wide.