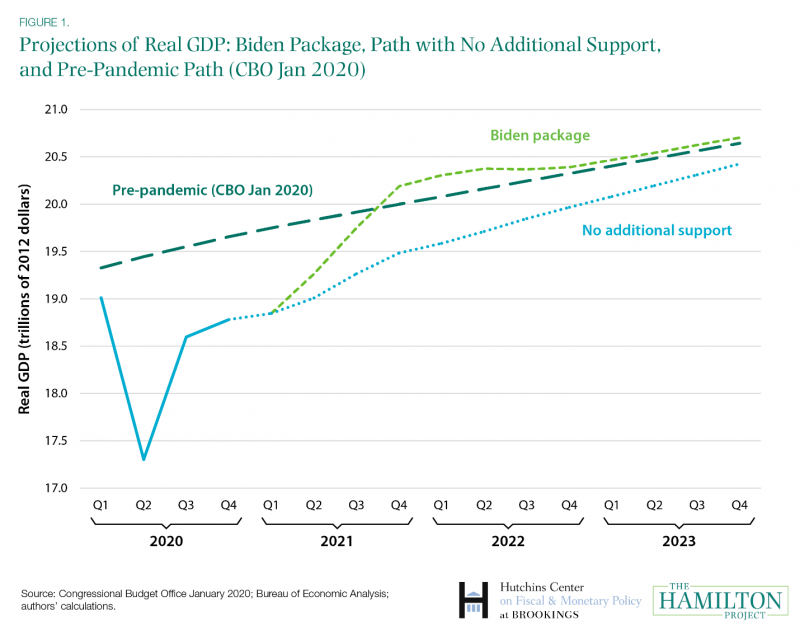

The Biden administration recently proposed an additional $1.9 trillion in federal spending to address the ongoing pandemic. We estimate that the package would boost economic activity, as measured by the level of real gross domestic product (GDP), by about 4 percent at the end of 2021 and 2 percent at the end of 2022, relative to a projection that assumes no additional fiscal support. We project that if the Biden package were enacted, GDP would reach the Congressional Budget Office’s (CBO) pre-pandemic GDP projection after the third quarter of 2021, exceeding it by 1 percent in the fourth quarter. In the middle of 2022, GDP would show a temporary and shallow decline and then grow at an annual rate of about 1.5 percent, coming close to the path projected just before the pandemic (see figure 1).

Without additional fiscal support, we project that real GDP would remain below the pre-pandemic level for the next several years. In the near term, without additional federal resources to contain the resurgence of the pandemic and distribute vaccines, the economy will face substantial headwinds. More broadly, millions of households will suffer as a result of waning fiscal support for the unemployed and households and businesses suffering financially. Indeed, Biden’s fiscal package should be judged primarily based on the extent to which it invests in COVID-19 containment and vaccination and provides needed relief to help households and businesses weather the pandemic.

Nonetheless, an analysis of how the fiscal package would affect the overall economy is instructive, although subject to a great deal of uncertainty. In all, with the $1.9 trillion package, we project that cumulative real GDP between 2020 and 2023 would end up close to its pre-pandemic projection; over the next two years households and businesses would make up some of the economic activity foregone during the pandemic. By late 2021, we would likely see the economy operating above its maximum sustainable level. That positive output gap would likely put upward pressure on inflation, which the Federal Reserve has said would be welcome. A risk worth noting is that the return of GDP back to its maximum sustainable level may create a difficult economic period after 2021. While our estimates show a “soft landing,” with a temporary and shallow decline in GDP after the fourth quarter of 2021, the slowdown could be more abrupt and painful than our projections suggest.

Analysis of the Biden Administration Fiscal Package

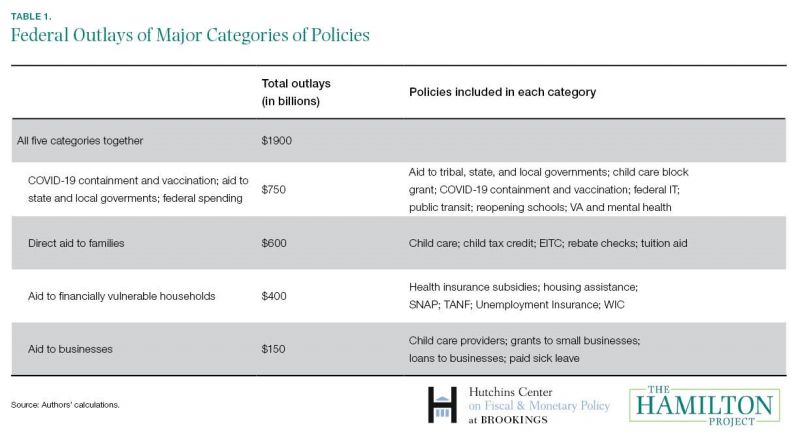

We divide the $1.9 trillion package into four categories based on who is receiving the money and how likely they are to spend it. (See Table 1 for a more detailed breakdown.)

- COVID-19 containment and vaccination, aid to state and local governments, and increased federal spending ($750 billion): this category includes both the direct $350 billion in state and local aid, as well as money for vaccination, testing and tracing, and reopening schools;

- Direct aid to families ($600 billion): this category includes the $1400 per person rebate checks and the child tax credit expansion;

- Aid to financially vulnerable households ($400 billion): this category includes the additional $400 per week in unemployment benefits and the extension of the pandemic unemployment programs; and

- Aid to businesses ($150 billion): this category includes loans and grants to small businesses and paid sick leave.

When recipients of federal aid increase their purchases of goods and services, businesses gear up production and hire more workers than they otherwise would, increasing production and GDP and putting upward pressure on prices. In turn, newly hired workers also increase their spending, which also leads to increases in production and GDP and a further upward pressure on prices. The resulting increase in real (inflation-adjusted) GDP for each initial dollar of spending is referred to as the fiscal multiplier.

The impact on GDP of an additional dollar of federal aid—whether to people, businesses, or state and local governments—depends on how quickly the federal aid is disbursed, how much and how quickly each received dollar is spent (known as the marginal propensity to consume, or MPC), and how large the multiplier is. During a pandemic, the MPCs and the fiscal multiplier, in turn, depend on the extent to which people practice social distancing. Under the assumption that the additional support for COVID-19 containment and vaccination in the package is enacted mitigates the need for social distancing, our expectation is that social distancing attenuates over the next three quarters; by October 2021, it is no longer a factor. In addition, MPCs and the fiscal multiplier are held down to the degree that higher prices dampen demand by recipients of aid, new workers, and businesses.

As discussed in the technical appendix, we choose MPCs based on the literature, attenuating them somewhat to account for the effects of social distancing over the next few quarters. We also attenuate the MPCs to account for recipients’ responses to temporary increases in prices that would result from the increase in scarcity of goods and services and because the saving rate has increased sharply during the pandemic, making households less likely to be liquidity constrained.

We use the range of multipliers the Congressional Budget Office (CBO) uses when monetary policy is very accommodating to calculate the effects of increased demand on GDP. At the lower end, the multiplier results in an increase in real GDP of $0.50 for every dollar of increase in aggregate demand. At the higher end, the multiplier results in an increase in real GDP of $2.50 for every dollar of increase in aggregate demand. Our estimated results of the $1.9 trillion package reflect a weighted average of those multipliers, with 60 percent weight on the low multiplier and 40 percent weight on the high multiplier. That stems from our judgment that supply constraints will lead more downward pressure on real economic activity from inflation than is typical when the economy responds to fiscal stimulus during periods of very accommodating monetary policy.

Baseline Projection for GDP including December 2020 Package

Under the assumption that no additional fiscal support is enacted, we project that real GDP would grow 4 percent from the fourth quarter of 2020 to the fourth quarter of 2021 and 2.5 percent in 2022. That is within the range of projections by economic forecasters. That projection reflects the many factors buffeting the economy. For example, on the one hand, real GDP growth in the near term is boosted by the recent fiscal support package enacted by Congress at the end of 2020, totaling roughly $900 billion. On the other hand, real GDP growth is restrained by a resurgence in COVID-19 cases and variants in recent weeks.

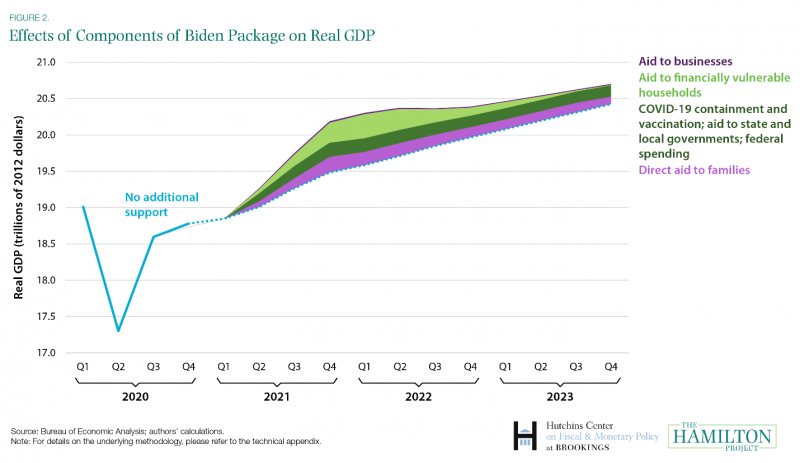

The Economic Effects of the Biden Package

Figure 2 shows the breakdown of the effects on GDP by our four categories of aid layered over our baseline projection of real GDP with no additional support. The largest effect stems from the roughly $750 billion for COVID-19 containment and vaccination, aid to state and local governments, and increased federal spending (the dark green region), because of both the magnitude of the federal outlays and our assessment that the MPCs out of this aid are relatively large. The smallest effect stems from the roughly $150 billion for business aid (the dark purple region), because the outlays are relatively small and the effect on GDP per dollar of outlay is relatively modest. As a result of the expected path of federal outlays and the estimated effects of those outlays, the largest boost to GDP is projected to occur in the fourth quarter of 2021.

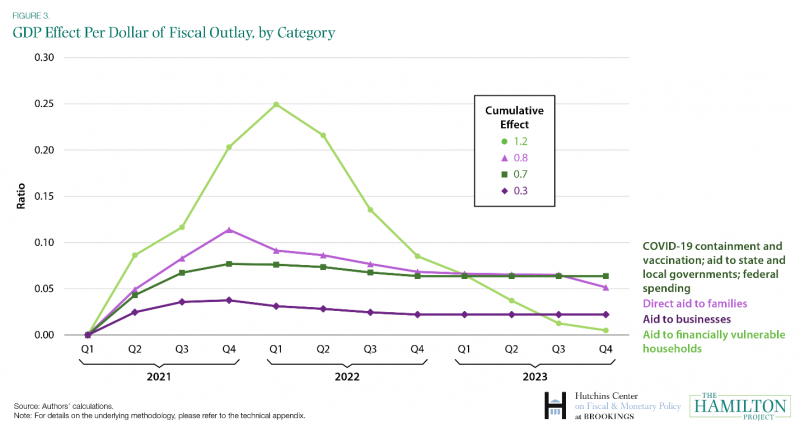

The estimated effects per dollar of total fiscal outlay for each of the four categories are shown in figure 3. Aid to financially vulnerable households (shown by the light green line) has the largest effect on GDP—boosting it by almost than 10 cents per dollar of aid in the second quarter of 2021, with a peak effect of about 25 cents in the first quarter of 2022. The GDP effect changes over time for several reasons. First, for this category of aid, federal outlays are assumed to be disbursed over a few quarters. Second, we expect that households will spread their spending out over two years, partly in response to an expected temporary increase in prices, with three-quarters of the response in the first year and the remainder in the second. And third, the fiscal multipliers take time to increase production and GDP. From 2021 to 2023, aid to financially vulnerable households is estimated to boost cumulative GDP by about $1.20 (as shown in the inset box).

Aid to businesses (shown by the dark purple line) has the smallest effect on GDP. From 2021 to 2023, aid to businesses is estimated to boost GDP by about 30 cents for each dollar of total fiscal outlay in this category.

The other two categories, COVID containment, aid to state and local governments, and federal spending as well as direct aid to families, have similar effects on GDP, peaking at about 10 cents per dollar of fiscal outlays by the end of 2021, and having cumulative impacts of 70 cents and 80 cents per dollar, respectively, over the 2021 to 2023 period.

Figure 1 (shown above in the introduction) compares the projection of real GDP assuming the $1.9 trillion package is enacted (green dashed line) to a projection of real GDP under CBO’s pre-pandemic January 2020 economic projection (teal dashed line), and under our baseline GDP trajectory that takes current law as given (blue dotted line). With the $1.9 trillion package, we project that real GDP would grow robustly in 2021, contract slightly in the middle of 2022, and then grow modestly in 2023.

Without additional fiscal support, our projection follows the consensus forecast real GDP would remain below the pre-pandemic level for some time. In part, that outcome is a result of the waning fiscal support for distressed people and households under current law. For example, expanded unemployment insurance benefits are set to expire for new recipients in March 2021, long before the labor market is expected to have recovered. In all, cumulative GDP through 2023 without additional fiscal support is about 3 percent below its pre-pandemic projected path. But with the $1.9 trillion package, real GDP reaches its pre-pandemic level by the fourth quarter of 2021, and then exceeds it over the next two years – as households and businesses make up some of the economic activity foregone during the pandemic. Still, cumulative GDP through 2023 remains about 1 percent below its pre-pandemic projected path.

In our assessment, the significant and temporary increase in GDP with the $1.9 trillion would largely be the result of an increase in average hours worked and employment relative to our baseline projection. At its peak, the increase in real GDP over CBO’s pre-pandemic projection would equal about 1 percent from the fourth quarter of 2021 to the second quarter of 2022. Our rough assessment is that the unemployment rate would temporarily dip to 3.2 percent, more than 1 percentage point below CBO’s estimate of the natural rate of employment in that period.

The Significant Uncertainty Surrounding this Analysis

The extent of uncertainty underlying our results is significant. First, the path of GDP with no additional fiscal support is hard to predict, as it depends critically on the pace of the vaccine roll-out and the response to the new more contagious COVID-19 variant. Second, the increase in demand in response to the package’s enactment is also highly uncertain. We have incorporated a fairly slow pace of spending out of the federal aid, reflecting the fact that households are flush with savings and state and local government budgets are in much better shape than anticipated last spring. But the pace of spend-out in such unusual circumstances is hard to predict, and it could be faster or slower than we expect.

In addition, we may be overestimating the fiscal multipliers. As we noted above, we have used the range of multipliers CBO uses in a weak economy, when monetary policy is very accommodating. Multipliers in those circumstances are higher because the Federal Reserve is not expected to react to the higher demand or increased inflationary pressures by raising interest rates on risk-free assets. Although the positive output gap we project would likely put upward pressure on inflation, pushing the rate toward and probably above the Federal Reserve’s 2 percent target, the Fed is unlikely to tighten monetary policy given their new flexible average inflation targeting framework. Indeed, the Fed has signaled that faster inflation and inflation temporarily above its 2 percent target would be welcome. Still, greater inflation and higher interest rates faced by private-sector borrowers could result in a larger reduction to fiscal multipliers than we have incorporated. Moreover, a greater share of the increase in demand by U.S. households and businesses could be met by imports than is typically the case, suggesting less of an increase in domestic production of goods and services.

In addition, our projection of a “soft landing” may be overly optimistic. Our GDP projection given enactment of the $1.9 trillion fiscal aid package shows an economy outpacing its pre-pandemic projected path in 2021 and 2022, and then smoothly coming back close to it in 2023. The economy was strong in early 2020 before the pandemic began, with unemployment at just 3.5 percent. At the time, CBO projected that GDP would be just slightly above its projection of potential—the maximum sustainable level of output—through the end of 2023. With enactment of the fiscal aid package, GDP would be projected to be even further above that projection of potential: by about 2 percent at the end of 2021, 1 percent at the end of 2022, and just a touch above at the end of 2023.

With GDP expected to exceed potential output over the course of 2021, we are uncertain whether the landing will be as soft as we project. For example, businesses may misinterpret a temporary increase in demand as a permanent one, leading to overinvestment in the near term and a somewhat sharp contraction in investment when the surge in demand abates. That outcome seems less likely if the surge in GDP is predominantly in sectors of the economy that were suppressed during the pandemic—such as dining, travel, entertainment, and medical services. However, the magnitude of the $1.9 trillion fiscal package may be so large that the increase in demand would be broad, increasing the chances of a somewhat more painful adjustment in economic activity.

Moreover, the effects of the COVID-19 recession may have reduced potential output, suggesting an even larger overshooting or, in other words, a larger positive projected gap between GDP and potential output if the package were enacted. For example, as a result of the pandemic and recession, the potential labor force may be smaller if workers have permanently left the labor force or immigration is reduced for some time. In addition, declines in investment in 2020 may have persistently reduced the size of the capital stock. Indeed, in July 2020, CBO lowered its estimate of potential GDP, alluding to some of those factors.

In our view, however, better containment of the pandemic and a stronger economy could to some degree reverse the factors that have dampened potential output. As a result, a comparison of the projected GDP path with enactment of the package and CBO’s projection of potential output in July 2020 would overstate the size of the positive output gap that would result. In our view, if the $1.9 trillion package were enacted in full, the path of potential output would be between CBO’s January 2020 and July 2020 estimates. That would imply that, with the enactment of the package, GDP would be a little over 2 percent above potential output at the end of 2021 and then above by a more modest 1 percent at the end of 2022.

For additional analysis and reporting of results, please see A Macroeconomic Analysis of a Senate Republican COVID Relief Package.

Acknowledgments: The authors thank Stephanie Aaronson, Lauren Bauer, Jason Furman, Kriston McIntosh, and David Wessel for valuable feedback. Mitchell Barnes and Stephanie Lu provided exceptional research assistance. Becca Portman provided graphic design and Sara Estep and Moriah Macklin provided superb research support.