Recent reports indicate that the Trump Administration proposes to make substantial cuts to non-defense discretionary spending. Because the government statistical agencies are funded through these appropriations, those who value their important work are concerned. Already, government statistical agencies find their budgets insufficient to exploit new opportunities and provide the best possible statistical information to America’s businesses, families, and policy makers. In addition to potential budgetary threats, the political discussion of federal statistics such as the unemployment rate has raised concerns about the role of statistical agencies and the products they provide.

Mindful of these concerns, The Hamilton Project, in partnership with scholars from the American Enterprise Institute, highlights the importance of federal statistical agencies in a forthcoming paper, “In Order That They Might Rest Their Arguments on Facts”: The Vital Role of Government-Collected Data. Specifically, the paper explores the many benefits of government data for businesses, policy makers, and families. The usefulness of federal statistical agencies to the private sector is often overlooked, and the U.S. Census Bureau’s American Community Survey (ACS) in particular provides valuable local data for businesses.

Although the ACS is an indispensable source of government-collected data, it has faced continual budget threats. The House of Representatives has voted to either cut the survey entirely or make it voluntary with substantial reductions in funding. While the ACS continues to operate for now, funding constraints have forced the Census Bureau to drop its 3-year ACS estimates, which are valuable for providing timely updates with large sample sizes.

Given the wide-ranging benefits of detailed government data for businesses, the ACS is a particularly indispensable tool upon which many firms rely. For example, many businesses require workers with specific skills and need to know where those workers are located. The ACS is an important tool for identifying potential firm locations because it is a large, nationwide survey of relevant demographic, social, economic, and housing data. It provides fine-grained, local-level data with an annual sample of more than 2 million geographically dispersed housing units, using cost-effective questionnaires, phone calls, and follow-ups to maximize the response rate.

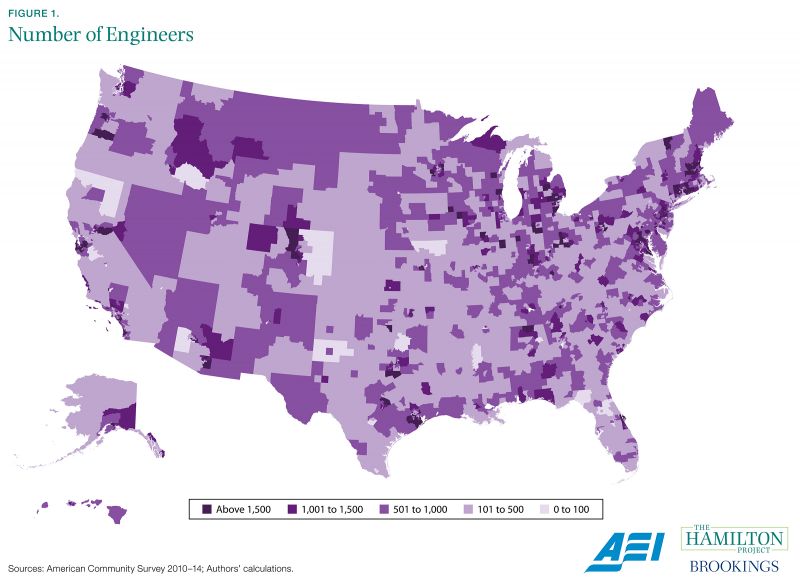

Figure 1 highlights the usefulness of the ACS for generating local estimates of specific types of workers that a business may want to hire—in this case, engineers. The usefulness of this analysis is not limited to businesses seeking engineers: firms looking for other types of skilled or unskilled labor can make similar calculations using ACS data and then decide where to locate their business accordingly.

The ACS reveals that engineers are plentiful in the northeast corridor from Washington, DC, to Boston, as well as in central California, Denver, and the Chicago area. Investigation of more-detailed subpopulations, like the number of graduates with chemical engineering majors, is also possible with this survey. Businesses and workers can even observe typical workers’ salaries in a given location and occupation, further improving their analysis.

Private businesses also make extensive use of the ACS in determining when and where to open or expand stores, distribution centers, and warehouses. A retailer selling a product must understand and address a particular market: Target and Kroger, in particular, have reported that they use ACS data to appropriately tailor their product mixes and advertising across locations. And several companies are in the business of analyzing ACS data for other companies: Acxiom, an Arkansas-based marketing firm with more than $1 billion in revenue, creates market indices and other products that depend heavily on data from the ACS.

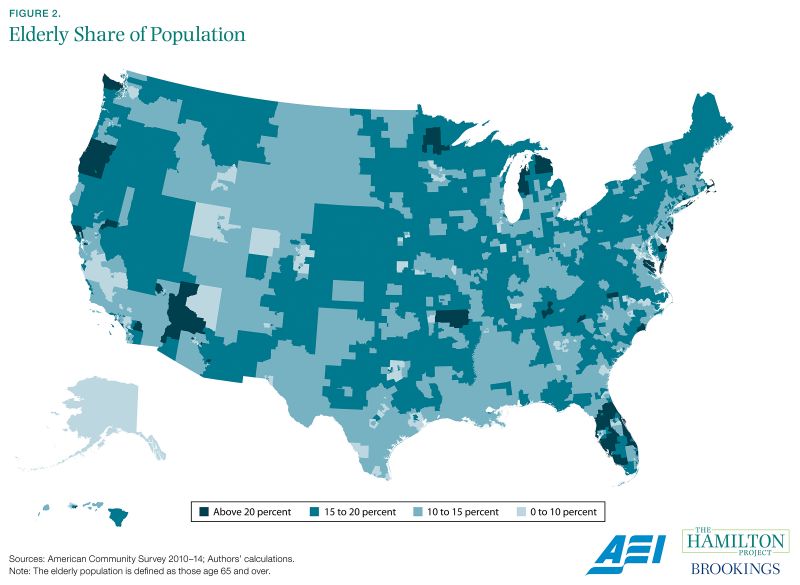

Figure 2 shows how this could work through a particular example: it maps the share of the elderly in each local population.1 As with many other groups, the elderly are not evenly distributed across the United States, but cluster in certain areas. Florida, Arizona, and parts of the eastern seaboard all have relatively high elderly representation in their populations.

Beneficiaries of this information include firms that offer services to the elderly, as well as local and state policy makers who must respond to the age-related needs of their constituents. Federal data collection like the ACS allows both government agencies and private sector leaders to make well-informed decisions. To learn more about the vital role of government-collected data and the statistical agencies, join The Hamilton Project and the American Enterprise Institute for a discussion on March 2 (event information and registration available here).

1 The unit of analysis for Figures 1 and 2 is Public Use Microdata Area (PUMA), which are statistical geographic areas defined for the ACS.