Editor’s note: This analysis was updated here in November 2023.

The recent increase in mortgage rates, which has made buying a house or borrowing against home equity more expensive, in part reflects a broad increase in rates on long-term U.S. Treasury securities. But the increase in 30-year fixed mortgage rates over the past year has been unusually large relative to rates on long-term Treasury securities, which may suggest that mortgage rates are being pushed up by temporary factors. In particular, as the path of future interest rates becomes more certain, mortgage rates could fall by roughly half a percentage point.

Why have mortgage rates risen by so much more than yields on 10-year Treasury bonds? We find that much of the increase in this spread can be attributed to two factors: interest rates on Treasury bonds with maturities less than 10 years are higher than rates on 10-year Treasury bonds and mortgage prepayment risk has increased. Higher interest rates on shorter term bonds matter because mortgages are generally held for fewer than 10 years. Prepayment risk is higher than in recent decades largely because of uncertainty around future interest rates. Both these factors are likely to continue to push up mortgage rates over the next few quarters.

Factors Contributing to the Spread between Mortgage and 10-Year Treasury Bond Rates

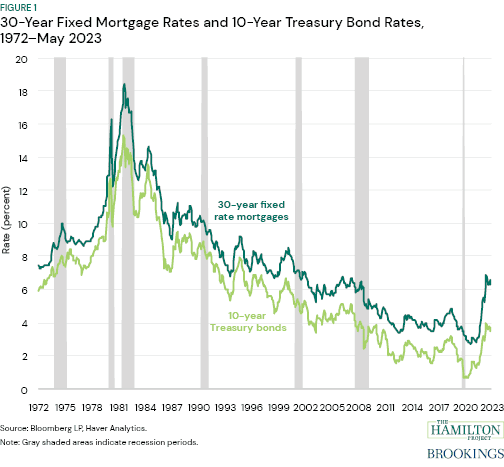

Mortgage rates reflect the cost of using a mortgage to buy a home or tap home equity and thus affect the price of real estate and housing wealth. To the degree that the Federal Reserve’s tightening of monetary policy pushes up mortgage rates, this channel is an important way in which tighter monetary policy slows the economy and dampens inflation. As shown in figure 1, there has been a long downward trend in mortgage rates (dark green) over the past forty years in line with the rate of 10-year Treasury bonds (light green). However, the spread between mortgage rates and Treasury bond rates fluctuates for various reasons, including changes in credit conditions and interest rate uncertainty.

Mortgage rates generally track the rate on 10-year Treasury bonds because both instruments are long term and because mortgages have relatively stable risk. Nonetheless, to compensate investors for the higher risk of mortgages, rates for fixed mortgages have historically been, on average, one to two percentage points higher than Treasury yields. As rates on 10-year Treasury bonds have risen since mid-2020, mortgage rates have risen as well. But, over the past year, mortgage rates have risen by a surprisingly large amount relative to the 10-year Treasury rates, putting more restraint on borrowing conditions and the housing market.

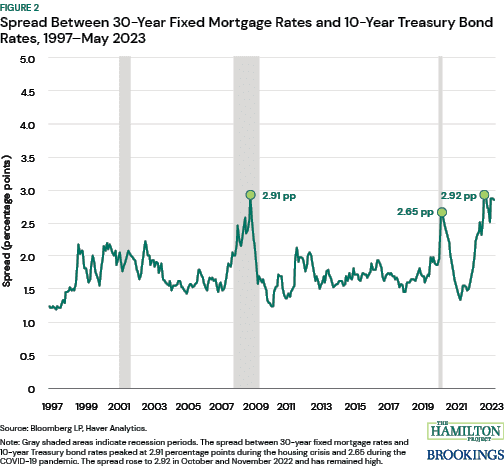

Figure 2 shows the spread between 30-year fixed mortgage rates and 10-year Treasury rates from 1997 through May 2023. The peak spread during the housing crisis was 2.9 percentage points, reflecting a sharp tightening of credit conditions and significant disruptions in the financial markets that fund mortgages. The spread rose again during the COVID-19 pandemic, peaking in 2020 at 2.7 percentage points, reflecting shorter-lived disruptions in financial markets and concerns among lenders and investors in mortgage assets. Recently, the difference between 30-year fixed mortgage rates and 10-year Treasury rates has widened to an unusual degree. Since October 2022, the spread has hovered near the levels last seen during the housing crisis.

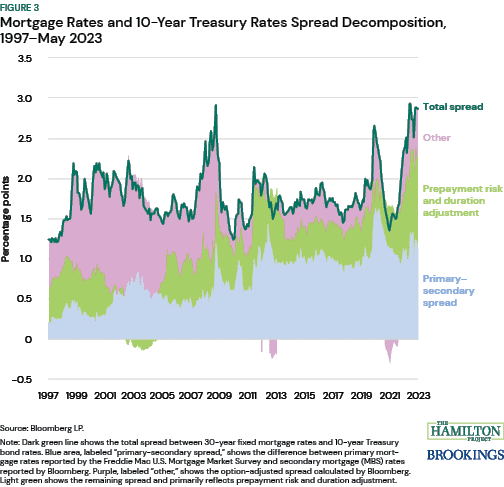

To explain why the spread between 30-year fixed mortgage rates and 10-year Treasury rates is so large, figure 3 parses it into three components:

- The spread between the rate charged to borrowers and the yield on mortgage-backed securities (MBS), referred to as the primary-secondary spread, which is generally stable when the costs of mortgage issuance are stable (blue).

- A combination of an adjustment for mortgage duration and prepayment risk (light green). The duration adjustment reflects that mortgages are generally held for fewer than 10 years and are more closely related to rates on a 7-year rather than a 10-year Treasury security. Prepayment risk reflects the probability that a future drop in rates induces borrowers to exercise their option to refinance.

- The remaining spread, which reflects changes in demand for mortgage-related assets after adjusting for prepayment risk (purple).

Given estimates of 1 and 3, we are able to estimate 2 by subtraction.

Factors Driving Higher Mortgages Rates

Using this framework, we find that the biggest reason that the mortgage spread to the 10-year Treasury rate is higher relative to other periods is due to the duration adjustment and prepayment risk. Since mortgages are typically held for fewer than 10 years, they have a shorter duration than 10-year Treasuries. Since early 2022, and for the first time since 2000, the rate on 7-year Treasury securities is higher than the rate on 10-year Treasury securities. In particular, from 2015 through 2019, the 10-year rate exceeded the 7-year rate by about 0.15 percentage point on average. Instead, year-to-date, the 7-year rate has exceeded the 10-year rate by about 0.10 percentage point, on average. As a result, the duration adjustment explains roughly a quarter of a percentage point of the unusually large spread shown in figure 3.

In addition, prepayment risk is higher now than in previous years. Borrowers with mortgages are affected differently if interest rates rise or fall. If rates rise, mortgage holders can simply choose to keep their mortgages at the previously issued rate. Instead, if rates fall, mortgage holders can prepay and refinance their mortgages at lower rates. That means that if there is a wider range of uncertainty around the future of interest rates—even if that range is symmetrical—there is a higher probability that current mortgage holders will find it advantageous to refinance in the future. As it happens, measures of interest rate uncertainty (such as the MOVE index, or Merrill Lynch Option Volatility Estimate Index) are currently higher than before the pandemic. Moreover, when rates are very low as they were in early 2020, there is only so much lower they can go, and thus borrowers and lenders alike see a smaller likelihood of a new mortgage being refinanced to a lower rate in the future. Instead, when mortgage rates are higher, as they are now, there are more possible future outcomes where rates fall and mortgages are refinanced. In other words, mortgage lenders want to protect against the possibility that mortgages issued recently will be refinanced to lower rates. As a result, lenders charge a premium.

To get a sense of how much this factor is pushing up mortgage rates to an unusual degree, it is useful to compare the estimated contributions of the duration adjustment and prepayment risk now versus the late 1990s, which was before the housing bubble, the housing crisis, the slow recovery from the 2008 recession, and the COVID-19 pandemic. In the late 1990s, 10-year Treasury rates were moderately higher than today but, like today, the 7-year rate was higher than the 10-year rate. At that time, the estimated contribution of the duration adjustment and prepayment risk to the mortgage rates spread was roughly a half percentage point lower than today.

While the largest factors driving high mortgage rates are the duration adjustment and prepayment risk, another reason mortgage rates have been unusually high is because of a slightly elevated primary-secondary spread. Lenders often finance mortgages by selling claims to MBS, which are pools of mortgage loans that are guaranteed by government-sponsored enterprises. The spread between the primary mortgage rate to borrowers and the secondary rate on MBS reflects the costs of issuing mortgages. For example, originators have to bear interest rate risk between the time an interest rate on a mortgage is set and when it is closed. The primary-secondary spread jumped by 0.3 percentage points toward the end of 2022, but has retraced most of the runup since then.

Finally, the component after accounting for those factors is also somewhat elevated relative to before the pandemic. This component, referred to as the option-adjusted spread (and “other” in figure 3) is likely elevated due to reduced demand in the MBS market. In recent years, the Fed has reduced its holdings of MBS. In addition, private investors in MBS have readjusted portfolios in response to an increase in interest rates. This was particularly true when long-term Treasury rates jumped in the fourth quarter of 2022; demand for MBS has remained cool since then. In addition, holders of MBS may be more pessimistic about prepayment risk than empirical models reflect, which could be the case if investors think that future mortgage rates are more likely to be a little lower relative to current rates rather than a little higher.

Conclusions

Higher mortgage rates are probably here to stay for a while, but a reduction in uncertainty could meaningfully bring down mortgage rates. If interest rate uncertainty returns to more normal levels and prepayment risk fell back to levels seen in the late 1990s, rates could fall – perhaps by half a percentage point. Nonetheless, one factor keeping rates higher that is likely to persist for the next several quarters is dampened demand for MBS as the market for mortgage financing continues to recalibrate to restrictive monetary policy and higher interest rates.

Until the economy slows to a more sustainable pace, uncertainty will remain. How will a slowdown affect house prices? How much will it reduce the income of borrowers? Will financial markets remain stable? Until such questions are resolved, unusually high mortgage rates will probably continue to cool the housing market and dampen borrowing against housing equity.

—

Acknowledgments: The authors are grateful to Lauren Bauer, Laurie Goodman, Aaron Klein, David Wessel, and Paul Willen for their insightful comments. The authors also thank Alex Conner and Isabel Leigh for their research support.