In his first State of the Union address, President Trump highlighted the significant growth and progress of the U.S. economy during the last year. As a former Member of the Obama White House Council of Economic Advisers, I share the President’s enthusiasm for the nation’s continued economic growth, supported in part by the economic policies created during the last decade. In the past year, we have seen a continuation of positive trends, including the low unemployment rate and closing of the “jobs gap” in July of 2017. Both are cause for celebration, particularly when contrasted with the aftermath of the Great Recession that was the backdrop for President Obama’s first State of the Union address in 2010.

While a number of economic indicators are encouraging, many Americans have not benefited from this progress.

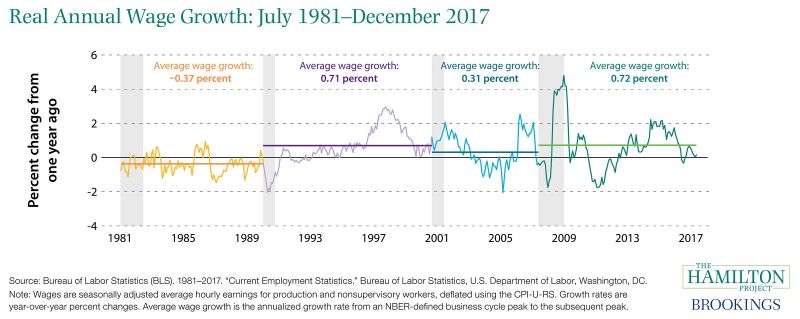

Wage growth has remained weak for many American workers in recent decades. After adjusting for inflation, U.S. wages were only 10 percent higher in 2017 than they were in 1973, with annual real wage growth just below 0.2 percent. As my Hamilton Project colleagues and I found in a September 2017 report, the wage growth that has occurred has been unequal, primarily benefiting those at the top of the income distribution. Between 1979 and 2016, wages grew significantly in the top two income quintiles, yet real wages fell slightly over the same period in the bottom quintile.

Furthermore, more and more Americans continue to drop out of the labor force altogether. At the end of 2017, nearly one-fifth of 25—54 year-old adults were not in the labor force. As illustrated in a recent Hamilton Project economic analysis, men have been leaving the labor force at a steady rate for decades. Although women entering the labor force masked this trend throughout the latter half of the twentieth century, they too have started leaving the labor force at similar rates since 1999. Given that the labor force participation rate is an indicator of household living standards and economic vitality, this trend is one that many economists find troubling.

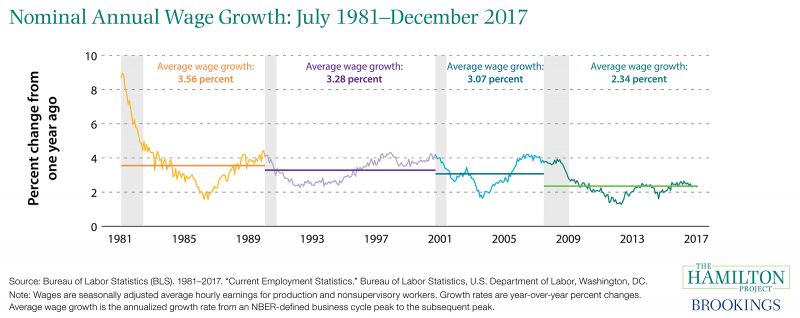

Finally, nominal wage growth—the visible boost in paychecks—has been weak during this business cycle. By contrast with previous decades, nominal wage growth has not increased as much as anticipated given the cyclical lows in unemployment reached; instead, it has stayed around 2.5 percent or less. However, it is important to note that because of low inflation, the current business cycle has seen slightly better real wage gains than in recent decades (see figure below); yet the roughly 0.7 percent per year gains since the beginning of the Great Recession are far too weak to make up for decades of stagnation.

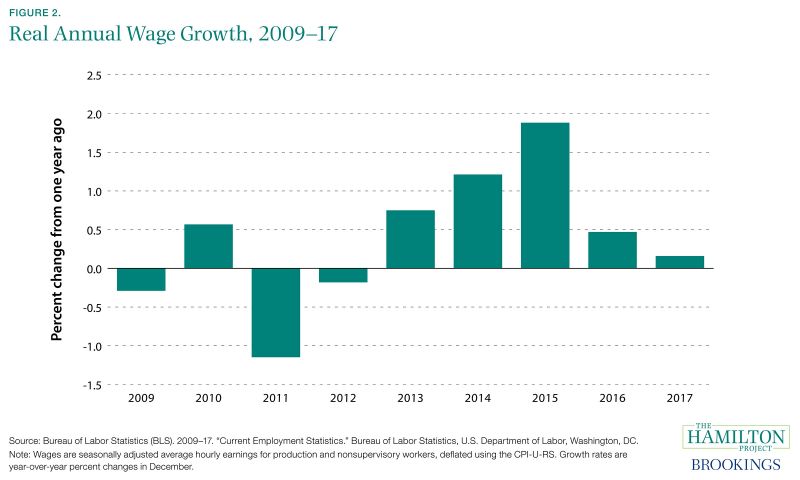

Given the slowdown in nominal wage growth in 2017, real average hourly earnings have grown this year at their slowest pace since 2012 (see the figure below), and are well below the average for this business cycle.

Stagnant wage growth for the typical worker and increasing numbers of Americans dropping out of the workforce has not occurred in a vacuum. A number of factors have contributed, including: declines in labor institutions such as unions, globalization and technological change, and decreased dynamism in the business community and labor markets.

These are complex economic challenges that require a continued commitment to identifying constructive, fiscally responsible solutions in the years ahead. Policies that merit serious and substantive consideration by policymakers and regulators include: reforming labor market institutions, limiting employer collusion, reforming non-compete policies, expanding wage transparency, encouraging worker mobility, improving and expanding technical education, and lifting labor demand through macroeconomic policy. In response, The Hamilton Project will soon release a new book of policy proposals aimed at helping the average American worker get a raise.

It is always encouraging to witness, and celebrate, periods of strong economic growth. However, we must also remember that when growth is broadly shared, the economy—and the country—stand to make the greatest gains.