The US economy is entering its ninth month of recession. The latest data on Gross Domestic Product show a substantial rebound in spending in the third quarter of the year, as self-quarantining eased, and businesses reopened following the initial pandemic-induced reductions in economic activity. However, the level of economic activity remains well-below pre-pandemic levels, and in September the aggregate unemployment rate stood at 7.9 percent, 4.4 percentage points above its February level. Moreover, recent data suggest that the pace of consumer spending and job growth have tapered off, in part due to the waning boost from fiscal policy.

As fall turns into winter, and with cases increasing across the country, the risk is that the COVID-19 pandemic and an insufficient policy response lead to a further slowing of the economy and possibly another contraction. That raises the likelihood that some of the damage to the economy, which largely started out as a temporary response to the pandemic, will become structural, making the recovery even more difficult and protracted.

In this analysis, we find evidence of structural damage in the monthly employment data. Early in the pandemic, most workers who lost jobs were laid off temporarily, as businesses expected to reopen and recall their workers. However, as time has passed, an increasing share of unemployed workers have no expectation of being recalled: the fraction of the unemployed on temporary layoff has declined from about 80 percent in April to about 40 percent in September, while the fraction of the unemployed whose previous jobs have been permanently eliminated has increased from 10 percent to about 40 percent.

The shift in the composition of the unemployed from temporarily to permanently laid off has likely occurred for several reasons. First, for some workers who were initially temporarily unemployed, their employers decided to permanently downsize or close in response to weak activity. Second, as the recession has persisted, firms that did not initially lay off workers have likely started to restructure or close in response to what they perceive will be a prolonged period of reduced demand or even structural changes to the economy (for instance more telework or less business travel). We expect that those firms permanently laid off workers without offering any expectation of recall. Finally, in the face of poor labor market prospects or challenges brought on by the pandemic – particularly for the caregivers of young children – some workers on layoff have decided to (or felt compelled to) drop out of the labor force altogether.

Compared to workers on temporary layoff, people whose previous jobs are permanently lost are much less likely to transition back into employment and more likely to transition out of the labor force. In particular, we find that within four months of being laid off in May or June, the probability of transitioning into employment for people whose previous jobs are permanently lost was a little over 40 percent. The probability for those on temporary layoff was roughly 65 percent. In addition, those who are out of the labor force are less likely to become employed again than those who are permanently unemployed—just 9 percent for all of those who were out of the labor force in June. Thus, the shift from temporary layoff to a greater share of people whose previous jobs are permanently lost suggests that the labor market will take longer to heal, all else equal.

Transitions from Unemployment, March to September 2020

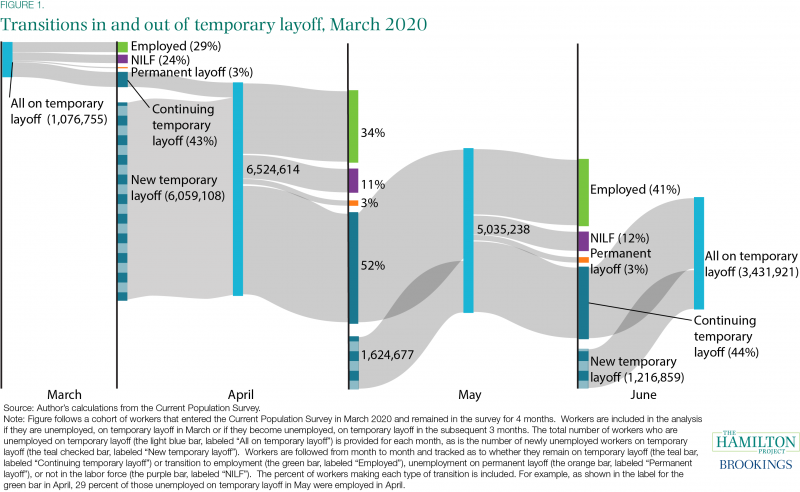

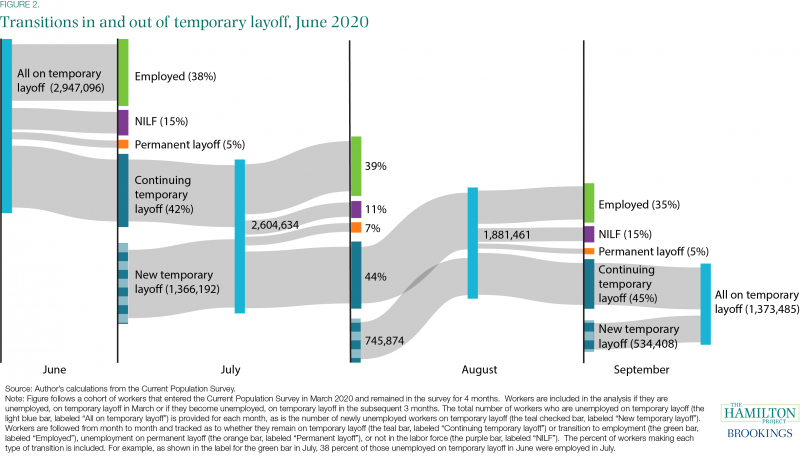

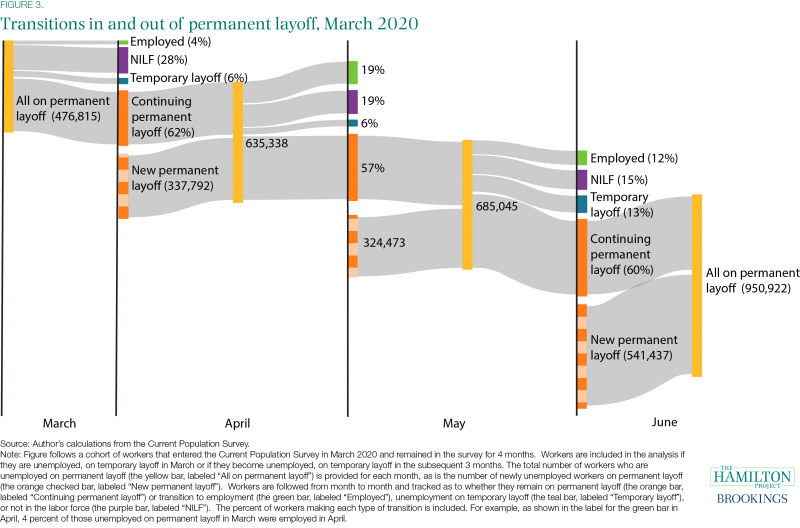

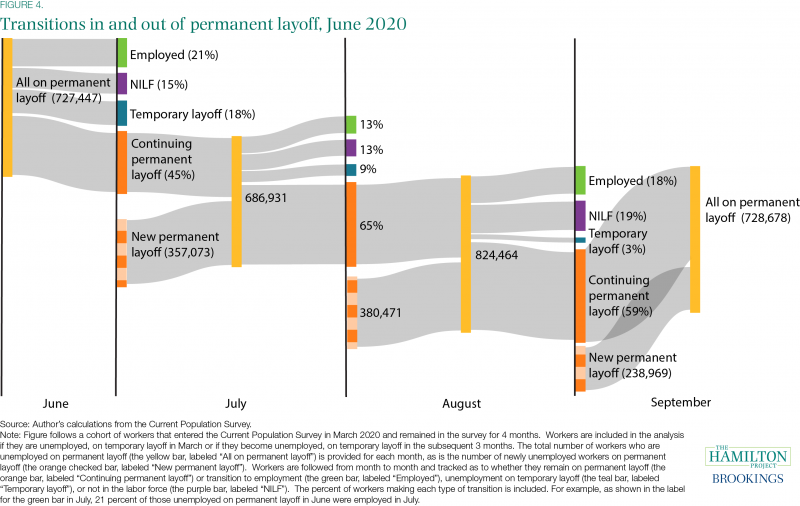

To understand the evolution of the unemployed population, we describe data from the Current Population Survey that follows one cohort of roughly 15,000 workers from March to June and another cohort of around 14,000 workers from June to September; those cohorts represent 68 million and 63 million workers, respectively. (Our conclusions also reflect an examination of cohorts observed from April to July and from May to August, which are not described in detail here.) Over these four-month time periods, we track the employment status transitions that each worker makes between being employed, unemployed on temporary layoff, unemployed on permanent layoff, and not in the labor force, which comprises those who are neither employed nor unemployed (meaning actively looking for employment). Because we are most interested in tracking what happens to those who have experienced unemployment during this recession, we condition our analysis on those who started a four-month period as unemployed, whether temporary (figures 1 and 2) or permanent (figures 3 and 4).

Transitions from Temporary Layoff

About 1 million workers from the March-June cohort were on temporary layoff in March, at the start of the recession (figure 1, the first teal bar all the way to the left).[1] Then in April, the ranks of the temporarily laid off in that first cohort swelled, as nearly 500,000 workers who had been temporarily laid off in March remained in that state (43 percent—the April blue bar), and they were joined by over 6 million additional workers who lost their jobs in temporary layoffs that month (the blue checked bar). From April to May, the decline in the number of workers who entered temporarily layoff that month was larger than the increase in the number of workers remaining on temporary layoff since April. As can be seen by observing the second cohort shown in figure 2, the stock of those who are temporarily laid off continued to fall throughout the summer as fewer people were laid off.

Many of those who were temporarily laid off early in the pandemic were reemployed. Of the temporarily laid off in March, nearly 30 percent became employed again in April, despite the dire economic conditions. The probability of finding employment rose in later months: of the temporarily laid off in May, more than 40 percent became employed again in June. Overall, of the workers who were temporarily unemployed in March, 54 percent transitioned into employment by June. Workers in the second, June, cohort on temporary layoff were even more likely to find employment within four months: of the workers who were temporarily unemployed in June, 66 percent transitioned into employment by September.

However, even as an increasing number of workers on temporary layoff were finding employment, there was also a slight uptick in the proportion experiencing either permanent job loss or leaving the labor force altogether. For example, the probability of transitioning from temporary layoff to permanent layoff in a given month (the orange bars) rose from about 3 percent between March and June to 5 percent between July and September. The probability of transitioning from temporary layoff to out of the labor force in a given month (the purple bars) also rose, from 12 percent between March and June to 15 percent in September. It is also worth pointing out that while the probability of transitioning from temporary layoff to permanent layoff is relatively low, the large numbers of those on temporary layoff and the nature of permanent layoff means that such transitions have swelled the ranks of those on permanent layoff. We find that, since April, typically more than 40 percent of those reporting they are on permanent layoff were previously on temporary layoff.

Transitions from Unemployment when Previous Job Permanently Lost

As noted, there has been a slight uptick in the probability that an unemployed worker transitions from temporary layoff to permanent layoff between March and September. At the same time, as figures 3 and 4 show, the flow of people moving straight from employment into permanent unemployment (the orange checked bars) has remained fairly steady, excepting a burst of permanent layoffs in June. However, with temporary layoffs declining in recent months, a greater share of the job losses have been permanent.

The rise in permanent unemployment is problematic because workers on permanent layoff are less connected to the workforce than those on temporary layoff. On average, less than a fifth of those on permanent layoff in one month were employed in the next month (the green bars). Indeed, less than one half of those on permanent layoff in June were employed within four months. In addition, each month, a larger fraction of those on permanent layoff in comparison to those on temporary layoff leave the labor force (the purple bars). Moreover, for the second cohort, we saw a jump in the fraction of those on permanent layoff in one month who left the labor force in the next month rose from 13 percent in August to 19 percent in September; that jump likely reflects, in part, the challenges faced by parents with young children starting school remotely.

The rise in permanent unemployment is problematic because workers on permanent layoff are less connected to the workforce than those on temporary layoff. On average, less than a fifth of those on permanent layoff in one month were employed in the next month (the green bars). Indeed, less than one half of those on permanent layoff in June were employed within four months. In addition, each month, a larger fraction of those on permanent layoff in comparison to those on temporary layoff leave the labor force (the purple bars). Moreover, for the second cohort, we saw a jump in the fraction of those on permanent layoff in one month who left the labor force in the next month rose from 13 percent in August to 19 percent in September; that jump likely reflects, in part, the challenges faced by parents with young children starting school remotely.

Conclusion

Overall, the labor market has clearly improved since the early summer, as indicated by the decline in the aggregate unemployment rate. However, an analysis of worker labor market transitions indicates that the problem that remains may be more difficult to resolve. A higher share of job loss is now accounted for by permanent layoffs, and, while small, a steady share of workers who started off being temporarily laid off have ended up on permanent lay off—and workers on permanent layoff are much less likely to become reemployed.

In addition, we see a large number of workers transitioning out of the labor market altogether. The permanently unemployed are particularly likely to leave the labor force, but there is also a small stream of workers on temporary layoff who depart as well. This trend is even more troubling—and a sign of structural damage to the economy that could take longer to heal, because workers who are out of the labor force, even those saying that want a job, have relatively low reemployment rates. For example, even in more normal job market conditions, only roughly 40 percent of those out of the labor force who say they want a job are back in the labor force within 12 months.

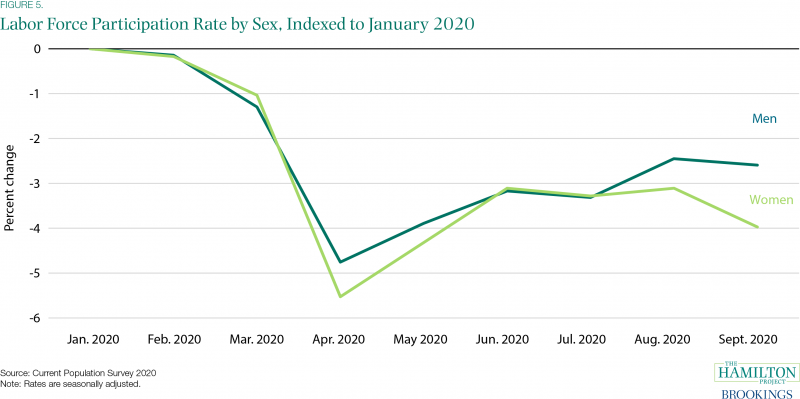

Generally speaking, since March women have borne more of the pain in the labor market than men. In that vein, while the labor force participation rates of both men and women remain well-below their pre-pandemic levels, recently women’s participation has particularly lagged over the past several months. In September, as shown in figure 5, the participation rate for men stood about 2.6 percentage points below its pre-pandemic level, whereas the participation rate for women was 4 percentage points lower. Much of the disparity has been attributed to women’s greater responsibility for caring for children, many of whom are participating in school virtually or are without options for childcare.

With the labor market already showing significant signs of more structural damage, the federal government should be taking action to prevent further deterioration. Additional aid to households and to state and local governments would boost demand and create new jobs. In addition, aid that enabled more childcare centers and schools to reopen in a safe manner would allow some parents with young children – particularly women – to return to the labor market.

Endnotes

[1] We classify workers as temporarily unemployed who identified themselves as being employed but not at work “for other reasons,” meaning not for a specified reason such as vacation, illness, child care, other family obligations, parental leave, labor dispute, or weather. That category spiked in the spring as workers who were probably temporarily unemployed but still affiliated with firms described themselves as employed but not at work “for other reasons.” For an explanation of why those workers were more accurately characterized as on temporarily on layoff, see https://www.hamiltonproject.org/blog/who_are_the_potentially_misclassified_in_the_employment_report.