Publications

The Hamilton Project produces and commissions policy proposals and analyses to promote broad-based economic growth by embracing a significant role for well-designed government policies and public investment.

Posts

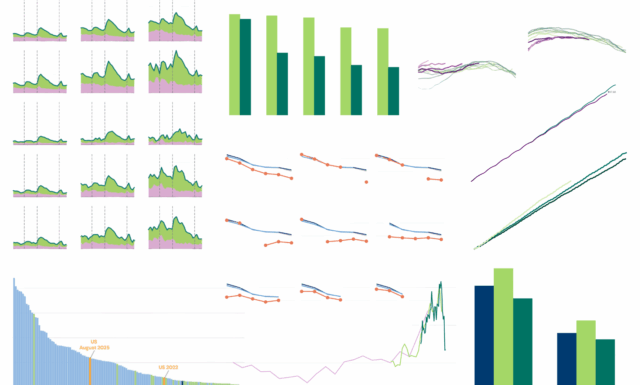

The Hamilton Project: 2025 in figures

These nine data visualizations illustrate The Hamilton Project's work in 2025 on key economic policy challenges and developments.

Read More

Posts

Learning curves: Post-COVID learning trajectories differ by the grade a student was in when the pandemic hit

Education

Policy Proposals

Artificial intelligence and algorithmic exclusion

Technology & Innovation

Posts

Event recap—Addressing threats to the SNAP program

Economic Security & Inequality

Social Insurance

Explore All Publications

Papers

October 27, 2022

A closer look at a hot labor market

This analysis uses JOLTS data to determine the degree to which firms that are looking to hire a significant number of workers can or cannot expand employment.

Policy Proposals

September 28, 2022

Building the analytic capacity to support critical technology strategy

To build the intellectual foundations, data, and analytics needed to inform national technology strategy, Erica R.H. Fuchs proposes the creation of a national …

Policy Proposals

September 28, 2022

An industrial policy for good jobs

A modern approach to industrial policy must target "good-jobs externalities" and include the service sector, Dani Rodrik argues. He proposes two specific initi…

Economic Facts

September 28, 2022

Nine facts about the service sector in the United States

Nine factors about the service sector illustrate recent trends in spending, employment, and inflation as the country continues to rebalance.

Posts

September 8, 2022

A COVID-19 labor force legacy: The drop in dual-worker families

Katherine Lim and Ryan Nunn examine why some prime-aged workers are not participating in the labor force.

Papers

September 1, 2022

Tracking the robust recovery in the business sector since 2020

Defying expectations, the business sector appears to have weathered the COVID pandemic and found a renewed gear of dynamism in the process. This analysis looks…

Posts

August 26, 2022

Food security shouldn’t take a summer vacation

Pandemic EBT has the potential to be a powerful tool to fight food hardship among children when schools close for summer. But to realize its potential, states …

Posts

August 4, 2022

Can a hot but smaller labor market keep making gains in participation?

An analysis of the size and composition of the labor force identifies both populations and policies that could contribute to gains in labor force participation.