Publications

The Hamilton Project produces and commissions policy proposals and analyses to promote broad-based economic growth by embracing a significant role for well-designed government policies and public investment.

Posts

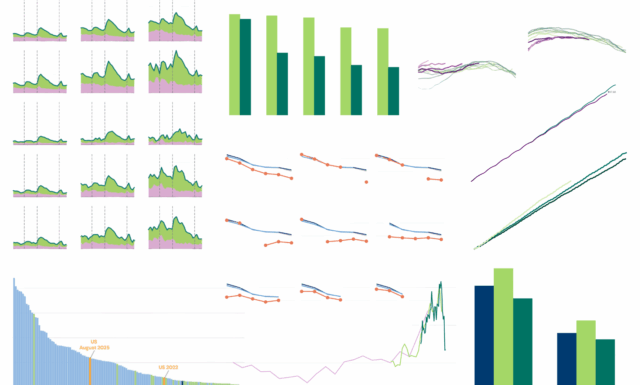

The Hamilton Project: 2025 in figures

These nine data visualizations illustrate The Hamilton Project's work in 2025 on key economic policy challenges and developments.

Read More

Posts

Learning curves: Post-COVID learning trajectories differ by the grade a student was in when the pandemic hit

Education

Policy Proposals

Artificial intelligence and algorithmic exclusion

Technology & Innovation

Posts

Event recap—Addressing threats to the SNAP program

Economic Security & Inequality

Social Insurance

Explore All Publications

Posts

March 12, 2020

How to bolster UI in response to COVID-19

Ryan Nunn argues that in the wake of the COVID-19 pandemic, the UI system requires a number of reforms to support families and the broader economy.

Policy Proposals

March 10, 2020

What to do about health care markets? Policies to make health care markets work

Martin Gaynor of Carnegie Mellon University describes the substantial consolidation that has occurred in health-care markets, showing that it is has generally …

Policy Proposals

March 10, 2020

Reducing administrative costs in US health care

U.S. health-care spending on administrative costs far exceeds the amount necessary to deliver effective health care. David Cutler proposes several reforms to r…

Policy Proposals

March 10, 2020

A proposal to cap provider prices and price growth in the commercial health care market

The United States spends a larger share of its GDP on health care than any other advanced economy. This high private sector health-care spending in the United …

Economic Facts

March 10, 2020

A dozen facts about the economics of the US health care system

A well-functioning health-care sector supports well-being and is a prerequisite for a well-functioning economy. Unfortunately, the problems with U.S. health ca…

Posts

March 9, 2020

Food security is economic security is economic stimulus

Lauren Bauer and Diane Whitmore Schanzenbach detail policy responses tailored to the COVID-19 pandemic to support food security, particularly for households wi…

Posts

March 2, 2020

What should a fiscal response to a COVID-19 outbreak look like?

Hamilton Project Director Jay Shambaugh comments on the COVID-19 virus and how economic policies with automatic triggers can alleviate the financial burden of …

Posts

February 26, 2020

Examining the Black-white wealth gap

A close examination of wealth in the U.S. finds evidence of staggering racial disparities.