Publications

The Hamilton Project produces and commissions policy proposals and analyses to promote broad-based economic growth by embracing a significant role for well-designed government policies and public investment.

Posts

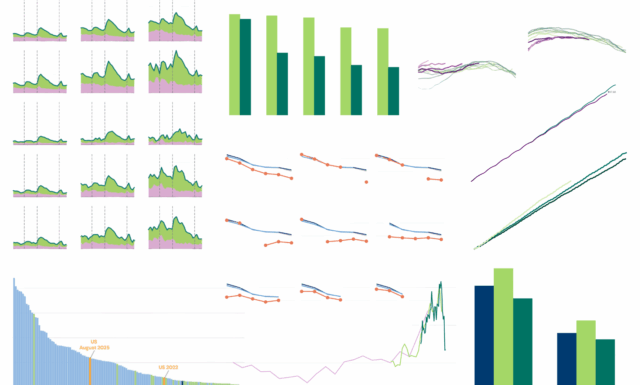

The Hamilton Project: 2025 in figures

These nine data visualizations illustrate The Hamilton Project's work in 2025 on key economic policy challenges and developments.

Read More

Posts

Learning curves: Post-COVID learning trajectories differ by the grade a student was in when the pandemic hit

Education

Policy Proposals

Artificial intelligence and algorithmic exclusion

Technology & Innovation

Posts

Event recap—Addressing threats to the SNAP program

Economic Security & Inequality

Social Insurance

Explore All Publications

Papers

December 1, 2007

A hand up: A strategy to reward work, expand opportunity, and reduce poverty

This paper offers a strategy to reduce poverty and strengthen growth across the income spectrum by helping people find jobs, investing in human capital, and cr…

Policy Proposals

December 1, 2007

New Hope: Fulfilling America’s promise to “make work pay”

The New Hope program was designed to assist workers by providing work supports including access to quality child care and health insurance. This paper evaluate…

Policy Proposals

December 1, 2007

Employment-based tax credits for low-skilled workers

This paper proposes increasing the return to work for low-income families through the expansion the earned income tax credit for low-income childless taxpayers…

Policy Proposals

December 1, 2007

Better workers for better jobs: Improving worker advancement in the low-wage labor market

This paper proposes a new federal funding stream to identify, expand, and replicate the most successful state and local initiatives designed to spur the advanc…

Policy Proposals

October 30, 2007

An equitable tax reform to address global climate change

This paper describes a carbon tax swap that is revenue and distributionally neutral. The tax swap levies a tax on greenhouse gas emissions with revenue being u…

Policy Proposals

October 30, 2007

A US cap-and-trade system to address global climate change

This paper lays out the arguments for using cap-and-trade to address climate change and proposes a system that includes an upstream cap on CO2, a gradual downw…

Papers

October 1, 2007

An economic strategy to address climate change and promote energy security

This paper presents a strategy for addressing climate change and promoting energy security that includes pricing carbon and oil, investing in basic research on…

Papers

July 2, 2007

Universal, effective, and affordable health insurance: An economic imperative

This paper examines the interrelated problems of uninsurance and expensive or ineffective care in the American healthcare system. Universal insurance would eli…