Publications

The Hamilton Project produces and commissions policy proposals and analyses to promote broad-based economic growth by embracing a significant role for well-designed government policies and public investment.

Posts

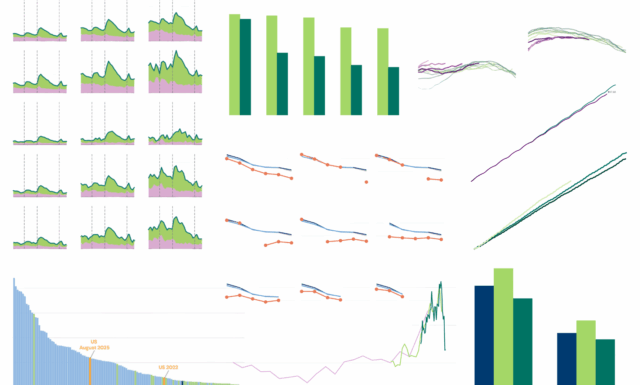

The Hamilton Project: 2025 in figures

These nine data visualizations illustrate The Hamilton Project's work in 2025 on key economic policy challenges and developments.

Read More

Posts

Learning curves: Post-COVID learning trajectories differ by the grade a student was in when the pandemic hit

Education

Policy Proposals

Artificial intelligence and algorithmic exclusion

Technology & Innovation

Posts

Event recap—Addressing threats to the SNAP program

Economic Security & Inequality

Social Insurance

Explore All Publications

Posts

December 17, 2025

The Hamilton Project: 2025 in figures

These nine data visualizations illustrate The Hamilton Project's work in 2025 on key economic policy challenges and developments.

Posts

December 8, 2025

Learning curves: Post-COVID learning trajectories differ by the grade a student was in when the pandemic hit

Lauren Bauer and Eileen Powell assess whether the effect of COVID-related disruptions differed depending on the grade a student was in during the 2019–20 schoo…

Policy Proposals

December 4, 2025

Artificial intelligence and algorithmic exclusion

In this proposal, Catherine Tucker makes the case for including algorithmic exclusion, defined as failure or harm arising from insufficient input data, in AI p…

Posts

November 7, 2025

Event recap—Addressing threats to the SNAP program

On October 30, The Hamilton Project hosted a webcast to highlight the importance of SNAP amid the ongoing government shutdown and in the wake of major cuts to …

Posts

November 4, 2025

Tariffs are a particularly bad way to raise revenue

In this explainer, Jay C. Shambaugh shows why tariffs are a particularly bad way to raise funds for the U.S. government.

Posts

October 8, 2025

SNAP cuts in the One Big Beautiful Bill Act will significantly impair recession response

Lauren Bauer and Diane Schanzenbach analyze how SNAP cuts in the One Big Beautiful Bill Act will affect the program’s response to recessions.

Posts

August 28, 2025

Tracking National Labor Relations Board actions through its administrative data

Olivia Howard, Lauren Bauer, Celine McNicholas, and Margaret Poydock use administrative data from the National Labor Relations Board (NLRB) to assess the numbe…

Economic Facts

July 1, 2025

Seven economic facts about prime-age labor force participation

This set of economic facts takes stock of the labor market through May 2025, paying particular attention to prime-age labor force participation.