In late 2014, The Hamilton Project released two economic analyses and interactives on the earnings of college graduates by major: one set that showed career earnings profiles and lifetime earnings and another that showed an undergraduate student loan repayment calculator.

Both were—and still are—very popular because they provide useful and actionable information to college students who are trying to make choices that will affect them for years. To remain useful, these data needed a refresh. We have updated the data in both interactives to use earnings from 2014-18 and we have also expanded the number of majors available from 80 to 98. The updated interactives can be accessed on The Hamilton Project website: career earnings profiles and lifetime earnings and undergraduate student loan repayment calculator).

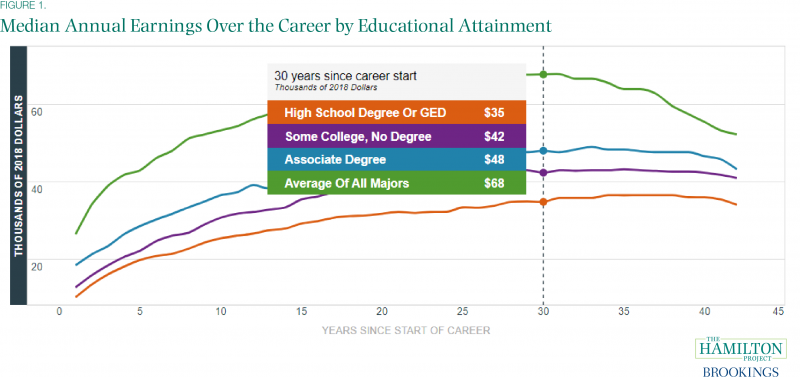

With just a few small differences, many conclusions from the initial economic analysis still hold. First, a college degree – in any major – is important for advancing one’s earnings potential (see figure 1).

- The earnings profile of bachelor’s degree graduates (with no additional education) is uniformly above that of associate degree graduates. The typical, or median, bachelor’s degree graduate earns about $68,000 (in 2018 dollars) at career peak (which occurs at year 30) and the typical associate degree graduate earns $49,000 at career peak (at year 33). In turn, the median earnings for associate degree graduates is uniformly above that of high school graduates.

- Median earnings of bachelor’s degree graduates are higher than median earnings of high school graduates for all 98 majors studied. This is true at career entry and mid-career. It is also true with two exceptions—early childhood education as well as visual and performing arts—at end of career.

- Median earnings of bachelor’s degree graduates are at least as high as median earnings for associate degree holders—again, throughout the career—for the vast majority of majors; the exceptions are certain arts-related majors in early career; education majors and human-services majors in mid-career; and all three of these groups of majors in late career.

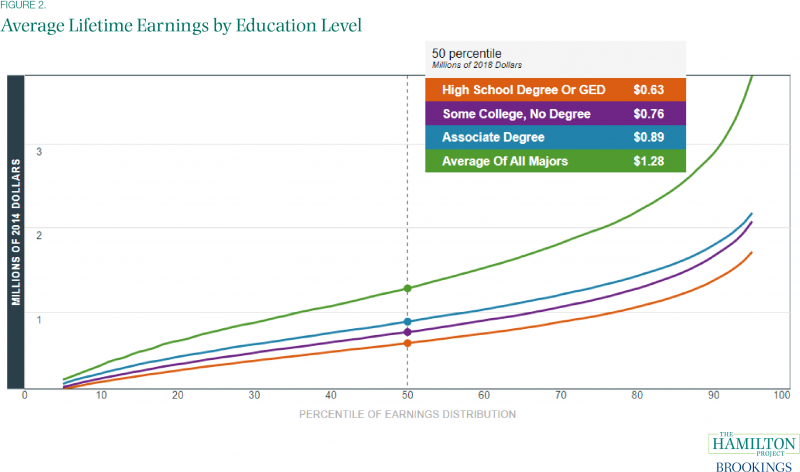

Figure 2 below shows the distribution of cumulative earnings[i] over the entire career, with the green line marking the distribution for bachelor’s degree graduates (averaged for all majors), and the blue, purple, and orange lines showing the respective distributions for workers with an associate’s degree, some college without a degree, and only a high school diploma (or GED).

Median career earnings for a bachelor’s degree holder are $1.28 million in 2018 dollars. This marks a gain of between 1 and 2 percent, after accounting for inflation, from our 2014 analysis. At the median, career earnings for a bachelor’s degree graduate are more than twice as high as for someone with only a high school diploma or GED, roughly 70 percent higher than for someone with some college but no degree, and more than 45 percent higher than for someone with an associate degree. These relationships do not hold for all workers: some workers without a bachelor’s degree have higher career earnings than some workers with a bachelor’s degree, including some workers with bachelor’s degrees in the highest-earning majors.

Median career earnings for a bachelor’s degree holder are $1.28 million in 2018 dollars. This marks a gain of between 1 and 2 percent, after accounting for inflation, from our 2014 analysis. At the median, career earnings for a bachelor’s degree graduate are more than twice as high as for someone with only a high school diploma or GED, roughly 70 percent higher than for someone with some college but no degree, and more than 45 percent higher than for someone with an associate degree. These relationships do not hold for all workers: some workers without a bachelor’s degree have higher career earnings than some workers with a bachelor’s degree, including some workers with bachelor’s degrees in the highest-earning majors.

Second, lifetime earnings vary significantly by major.

- For the median bachelor’s degree graduate, cumulative lifetime earnings for workers across majors range from $770,000 (early childhood education) to $2.28 million (aerospace engineering). This is a slightly larger range than in the original analysis, driven by gains in aerospace engineering.

- It is still true that majors that emphasize quantitative reasoning tend to have graduates with the highest lifetime earnings. The five highest-earning majors (at the median) are all in engineering fields: aerospace, followed by energy and extraction, chemical and biological, computer, and electrical.

- Majors that train students to work with children or provide counseling services tend to have graduates with the lowest earnings. The five lowest-earning majors (at the median) are communication disorders sciences and services, visual and performing arts, human services and community organization, studio arts and early childhood education.

- Earnings can also vary tremendously within major. Consider, for example, those with a bachelor’s degree who majored in economics. Such graduates at the 10th percentile of career earnings take in $490,000, at the median, $1.74 million, and at the 90th percentile, $5.09 million. That is, the top tenth of economics graduates earn more than ten times over their career what the bottom tenth earns.

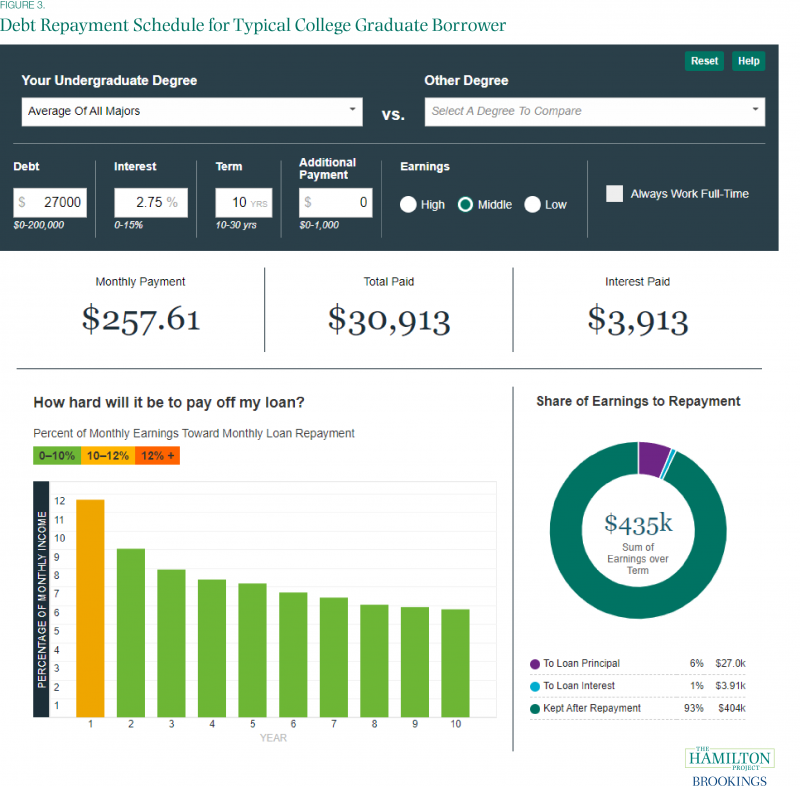

Third, it can still be a challenge in early career to service the typical $27,000 in debt among new bachelor’s degree graduates who borrowed for their education, although there has been some improvement since the original analysis. You can find this interactive here.

- For a typical college graduate who borrowed, the standard 10-year repayment plan at today’s interest rates imply a monthly payment of $258. In the first year of the career, this amounts to 12.7 percent of earnings——but by year 10, the monthly payment is only 6.3 percent of earnings.

- In the original analysis, the respective shares were 14.1 percent and 6.5 percent. The recent declines are due to increases in early career earnings, slower growth in the typical amount borrowed, and lower interest rates.

- Some majors carry greater risk than others in terms of likely difficulty in making loan payments. Graduates in drama and theater arts, for example, can expect to pay over 10 percent of earnings for the first six years in a standard repayment plan (including more than 20 percent in the first year), whereas computer science graduates will typically pay less than 8 percent of earnings in each year of repayment.

- Graduates who earn less than the typical amount within their major are also at elevated risk of having trouble under a standard repayment plan. Computer science graduates with earnings at the 25th percentile (with one-quarter earning less and three-quarters earning more) can expect to pay more than 10 percent of earnings in their first two years of repayment; drama and theater arts graduates can expect to pay more than 10 percent of earnings in every year of repayment.

Income-driven repayment plans may make sense for a large number of college graduates who borrowed, especially if the amount borrowed was greater than typical or if earnings are lower than expected in early career—particularly during recessions that make finding a good job match harder.

Conclusion

For many years, The Hamilton Project has produced data interactives that help young people make decisions regarding their education and careers. Today we have provided an update to Major Decisions, which helps undergraduates learn about career earnings profiles and lifetime earnings and how this relates to student loan repayment.

Putting Your Major to Work links college majors to careers and shows the most common jobs, employment rates, and earnings by major and occupation. In Where Work Pays: Occupations and Earnings across the United States, people can see how typical earnings in occupations vary across the United States, and how these earnings are affected by cost of living and tax differences in different places. These data interactives and accompanying research provide useful information at critical junctures and illuminate the implications of human capital investments that last a lifetime.

Endnotes

[i] All cumulative earnings are calculated using a 3 percent annual discount rate. This converts earnings into a “present value,” the amount that if invested today at a 3 percent annual rate of return would yield the same total value as lifetime earnings.