Foreword

Alexander Hamilton, for whom our project is named, was appointed Secretary of the Treasury at age 34 by President George Washington. He carried with him into office what biographer Ron Chernow called “a panoramic vision of a diversified economy that would provide opportunity for people from all walks of life.”

The American War of Independence against Great Britain left us with crushing debts. On assuming office, devising our nation’s first tax system was among Hamilton’s most urgent and difficult assignments. This tax system funded the government and paid off the states’ Revolutionary War debts, which in turn gave our young, vulnerable nation a chance to prosper.

Thanks to Hamilton’s foresight and political courage, America’s course toward bankruptcy was reversed, we established our creditworthiness, and a strong and successful nation was built. When Hamilton left his post five years later, interest rates in the United States were as low as any in the world.

This book is about taxes. It poses a simple question: Given that the United States needs more revenue, how should we raise it? The answers come from some of our nation’s foremost tax policy scholars and experts. The Hamilton Project commissioned them to come forward with proposals to address our government’s pressing need for revenue under the economic conditions that prevail today.

The ideas in the chapters that follow focus on the central and most enduring questions about raising taxes—who pays them, what effects do they have on the economy, and how much revenue can they raise—questions that have animated our political discourse across three centuries. While every effort to raise taxes provokes opposition, principled and otherwise, our current economic circumstances demand we take up those questions again.

There are a number of reasons to consider sources for more revenue. First, we have immense fiscal imbalances in the United States. In June, the Congressional Budget Office reported that “large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 78 percent of gross domestic product in 2019 to 144 percent by 2049.” Even in today’s low interest rate environment, unsound fiscal conditions will at some unpredictable moment in the future constrain the ability of policymakers to address national challenges if the debt grows continuously and today’s mix of revenues and spending remains unchanged.

Second, these imbalances are driven not by ambitious new spending programs but by previous health care and pension commitments as well as declines in federal revenues. As contributing author William Gale of the Brookings Institution writes, “much of the projected increase in spending is due to rising net interest payments—burdens created by deficits from previous years” (p. 198). To be clear, savings in government programs can be derived from thoughtful reforms, and federal budgets must reflect the necessity of stabilizing our fiscal position in the years and decades to come.

The yawning gap between spending and income is due in large part to reduced tax collections. As Larry Summers, former Secretary of the Treasury, and Jason Furman, former chairman of the President’s Council of Economic Advisors, wrote earlier this year, “the federal government [in 2018] took in revenue equivalent to just 16 percent of GDP, the lowest level in half a century, except for a few brief periods in the aftermath of recessions. Without the Bush and Trump tax cuts (and the interest payments on the debt that went with them), last year’s federal budget would have come close to balancing.”

Third, we cannot get back on track to restore long-term economic growth, address growing economic inequality, provide affordable health care coverage, combat climate change, and much more without restoring the nation’s tax base. Simply put, we need additional revenues to pay for investments that will make our economy grow and enable more Americans to share in that growth.

Fourth, most of these new revenues must come from those best able to pay, especially since tax cuts benefiting the highest earners account for so much of the declining share of taxes paid at the federal level. Since the late 1960s, the share of federal revenue paid by working Americans in the form of payroll taxes has increased from just over 20 percent to 35 percent. Yet corporate tax collections have plummeted from more than 25 percent to less than 10 percent of revenues, and the top rate paid by wealthy filers has fallen from 70 percent during Lyndon Johnson’s presidency to 37 percent today. And over the last two decades, Congress has hollowed out the estate tax to such an extent that only 0.2 percent of estates pay any tax at all.

This has consequences beyond the bottom line. The tax system does far too little to address the concentration of income at the highest levels or fund investments that enhance economic and social mobility for workers and their families.

In short, to stabilize our fiscal trajectory, whether to make our revenue system more progressive and growth-friendly or to fund new priorities, there is an urgent need to reconsider our current tax system.

In the chapters that follow, we present our contributors’ new proposals for a value-added tax, a financial transactions tax, wealth and inheritance taxes, fixing the broken corporate and international tax systems, and giving the Internal Revenue Service the resources it needs to ensure that tax laws, both old and new, are better enforced and administered and to remove loopholes and unnecessary deductions and shelters.

Overall, these proposals are carefully designed and built on the best available evidence and analysis. Each was subject to peer review, independently and in conferences, where we invited authorities in tax policy, economists, and others to exchange their views with the authors. We are grateful to all for contributing their expertise and making each proposal better.

Tax policy is enormously complex. There are economic differences between—and disparate impacts from—taxes on capital, consumption, and labor. Straightforward computational questions can lead to contentious debates. What should be unobjectionable policy goals—for example, raising revenues in the least costly and most progressive and efficient ways—can be difficult to realize in practice. We hope this book evokes an informed debate and prepares policymakers to act.

Beyond substance, higher hurdles lie in wait. In every budget and tax debate in which we’ve participated, some policymakers argue that tax increases will cost jobs and impede economic growth. Others argue that their hands are tied by pledges not to raise taxes signed as they campaigned for elected office. Critics of President Bill Clinton’s economic program warned that raising the top rate would wreck the economy and prevent any deficit reduction from taking place. In fact, the opposite happened: economic growth was strong and surpassed expectations while large deficits turned into large surpluses. This can happen again.

This volume is about more than raising revenues and stabilizing our fiscal position. It is about preserving our market-based economy and providing for a strong and effective government that promotes not only growth but widespread economic well-being and reduced inequality for all Americans. In the coming debate over our nation’s future, this is the narrative we hope policymakers and the broader public will choose to embrace, so that we may succeed in our time as Americans did in Hamilton’s time, at the dawn of our national life.

[a] Chernow, Ron. 2006, April. Presentation at the Hamilton Project at the Brookings Institution, Washington, DC.

[b] Congressional Budget Office (CBO). 2019. The 2019 Long-Term Budget Outlook. Congressional Budget Office, Washington, DC.

[c] Furman, Jason and Lawrence H. Summers. 2019, January 28. “Who’s Afraid of Budget Deficits? How Washington Should End Its Debt Obsession,” Larry Summers (blog).

[d] Office of Management and Budget (OMB). 2019. “Table 2.1 Receipts by Source: 1934–2024.” Historical Tables, Office of Management and Budget, Washington, DC.

[e] Urban-Brookings Tax Policy Center (TPC). 2018. “Historical Highest Marginal Income Tax Rates.” Tax Policy Center, Washington, DC.

[f] Huang, Chye-Ching and Chloe Cho. 2017. “Ten Facts You Should Know About the Estate Tax.” Center on Budget and Policy Priorities, Washington, DC.

Introduction

by Emily Moss, Ryan Nunn, and Jay Shambaugh

Taxation is an enduring focus of economic policy debates. Substantial reforms and changes in tax rates happen every decade: as policymakers propose new ideas, they tend to match them with new revenues or a revised tax code. This volume contributes to that vital discussion with policy options for raising revenue in efficient and equitable ways.

In this volume we present a series of policy options, authored by leading tax experts and backed by rigorous analysis, to increase federal revenue in ways that are both efficient and equitable. The policies include better tax enforcement, improved corporate taxation, increased taxation of wealth and inheritances, and taxes on financial and other transactions. Some options represent alternatives to each other; these provide informed choices for policymakers tasked with raising federal revenue. But the proposals share the goal of efficiently raising more revenue in a way that increases the burden on high earners while largely shielding low earners.

There are many reasons to raise more tax revenue. For example, the latest budget forecasts suggest that a persistent gap between federal revenue and federal spending will grow over time and thus generate a persistently increasing debt-to-GDP ratio. Even policymakers comfortable with current debt levels may wish to phase in additional revenue over time to stabilize or slow the increase in debt.

Another reason to raise more tax revenue is the anticipated need for increases in federal spending across a range of programs and investments, including retirement and health care, infrastructure, R&D, innovation, and education. As federal discretionary spending has shrunk relative to the size of the economy in recent decades, investments in a wide range of programs have suffered.

New economic challenges may also necessitate more tax revenue. For example, our response to climate change—both through mitigation and adaptation—will require increased spending in some areas. Another example is health care, where several policymakers have called for a greater federal role, which would require additional spending. Thus, even those comfortable with the current fiscal picture may have an interest in raising more revenue to fund new priorities.

Finally, putting revenue needs aside, the current tax system could be updated to make it more progressive and efficient. High levels of wealth and income inequality suggest policy options that would raise revenue in ways that increase the progressivity of the tax code. This update might require raising revenue from new sources or in new ways. We also focus on reforms that would both support economic growth and raise revenue with minimal distortions.

We begin with a chapter by Emily Moss, Ryan Nunn, and Jay Shambaugh of The Hamilton Project that examines how the federal government currently raises revenue and the effects that taxes have on the U.S. economy, as well as the considerations that motivate tax policy design. It documents the low level of federal revenue by both historical and international standards as well as the shift from reliance on corporate and excise taxes to payroll taxes, which are more regressive. The chapter also examines the distribution of wealth and income in the United States and implications for progressivity of taxation.

The first chapter of policy proposals, by Lily Batchelder of New York University, argues for the replacement of existing wealth transfer taxes with a comprehensive inheritance tax. The following chapter, written by Greg Leiserson of the Washington Center for Equitable Growth, is itself a menu of ambitious options for taxing wealth and capital income. The next two chapters find progressive and efficient opportunities to raise revenue by taxing transactions. Antonio Weiss of the Harvard Kennedy School and Laura Kawano of the University of Michigan propose a new financial transactions tax that would raise significant revenue. William Gale of the Brookings Institution proposes a value-added tax (VAT) that would improve on similar taxes used in many other advanced economies and that, when paired with a uniform rebate to households, can implement the VAT in a progressive way.

The following two chapters address the corporate and international tax systems. Kimberly Clausing of Reed College proposes short-run reforms as well as a comprehensive reform to the taxation of multinationals—sales-based formulary apportionment—that raise revenue while reducing the incentive to move production outside the United States. Jason Furman of the Harvard Kennedy School proposes to reorient corporate tax policy in ways that raise additional revenue and increase economic growth.

The final chapter, authored by Natasha Sarin of the University of Pennsylvania, Lawrence Summers of Harvard University, and Joe Kupferberg of Harvard University and the University of Pennsylvania, proposes a more robust approach to tax enforcement and compliance, pairing this reform with complementary base-broadening measures.

There are of course more options to raise revenue than could be included in a single volume. In particular, we exclude proposals for what are known as Pigouvian taxes (see the next chapter for discussion), which address negative spillovers and aim to discourage particular activities. For example, a tax on carbon could raise revenue while mitigating emissions and slowing climate change.

Another progressive revenue-raising option, not included in this volume, is a proposal simply to raise marginal tax rates on high earners. This could be done by raising the top marginal rates or by creating a new tax bracket at a higher income level. Because these policies involve less fundamental reforms to tax policy, we do not dedicate a chapter to either of them in this volume.

Because it would not be advisable for policymakers to implement all these proposals simultaneously, the volume does not include a comprehensive revenue score. For example, a financial transactions tax may be designed differently depending on how a VAT is constructed. New wealth taxes may be less desirable if sufficient reforms are made to taxing the intergenerational transfer of wealth.

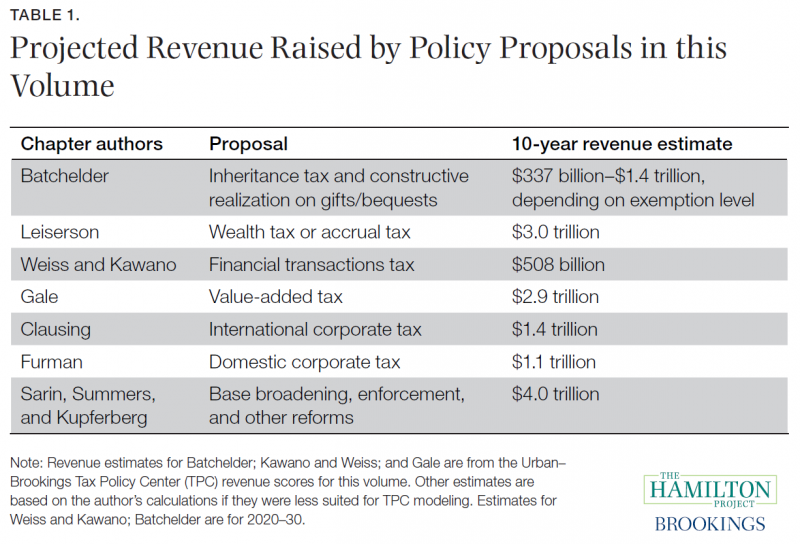

However, we do include expected revenue increases for several of the individual proposals, as illustrated in table 1 below; some of these proposals could be combined to generate larger sums of revenue. In addition, the proposals provide estimates of their distributional impacts. It is important to remember that any of these proposals would likely be implemented as part of a broader tax package, and it is the impact of the overall package on progressivity that is most important. In particular, a proposal that generates some tax burden for lower earners can be offset by other changes (e.g., increases in refundable credits or reductions in regressive taxes).

The proposals in this volume constitute important steps toward the improvement of the U.S. tax system. Federal revenue can be increased substantially at the same time that the progressivity and efficiency of the tax code are improved. A more growth-friendly tax system that places less of its burden on taxpayers with limited means is a vital part of any project to promote broadly shared economic growth.

Chapter 1: The economics of federal tax policy

by Emily Moss, Ryan Nunn, and Jay Shambaugh

Abstract:

The federal government faces increasing revenue needs driven by the aging of the population and emerging challenges. But the United States collects less revenue than it typically has in the past and less revenue than other governments do today. In addition, how the government raises revenue—not just how much it raises—has critical implications for economic prosperity. This chapter provides a framework for assessing tax policies and understanding their implications for growth and economic inequality.

Chapter 2: Leveling the playing field between inherited income and income from work through an inheritance tax

by Lily Batchelder

Abstract:

Despite our founding vision as a land of opportunity, the United States ranks at or near the bottom among high-income countries in economic equality and intergenerational mobility.1 Our tax code plays a key role. Inherited income is taxed at less than one-seventh the average tax rate on income from work and savings. This chapter proposes a major step toward leveling the playing field by requiring wealthy heirs to pay income and payroll taxes on inheritances they receive above a large lifetime exemption. As part of this shift, the proposal would repeal the current estate and gift taxes and would tax accrued gains (beyond a threshold) on transferred assets at the time of transfer. It would also substantially reform the rules governing family-owned businesses, personal residences, and the timing and valuation of transfers through trusts and similar vehicles. The Urban-Brookings Tax Policy Center estimates the proposal would raise $340 billion over the next decade if the lifetime exemption were $2.5 million, and $917 billion if it were $1 million, relative to current law.

The proposal would almost exclusively burden the most affluent and most privileged heirs in society, while the additional revenues could be used to invest in those who are not as fortunate. As a result, the proposal would soften inequalities, strengthen mobility, and more equitably allocate taxes on inheritances among heirs. It would also enhance efficiency and growth by curtailing unproductive tax planning, increasing work among heirs, and reducing distortions to labor markets and capital allocation. Furthermore, the proposal is likely to increase public support for taxing inherited income. While the burdens of estate and inheritance taxes both largely fall on heirs, inheritance taxes are more self-evidently “silver spoon taxes” and appear to be more politically resilient as a result.

Chapter 3: Taxing wealth

by Greg Leiserson

Abstract:

The U.S. income tax does a poor job of taxing the income from wealth. This chapter details four approaches to reforming the taxation of wealth, each of which is calibrated to raise approximately $3 trillion over the next decade. Approach 1 is a 2 percent annual wealth tax above $25 million ($12.5 million for individual filers). Approach 2 is a 2 percent annual wealth tax with realization-based taxation of non-traded assets for taxpayers with more than $25 million ($12.5 million for individual filers). Approach 3 is accrual taxation of investment income at ordinary tax rates for taxpayers with more than $16.5 million in gross assets ($8.25 million for individual filers). And Approach 4 is accrual taxation at ordinary tax rates with realization-based taxation of non-traded assets for those with more than $16.5 million in gross assets ($8.25 million for individual filers). Under both the realization-based wealth tax and the realization-based accrual tax, the tax paid upon realization would be computed in a manner designed to eliminate the benefits of deferral. As a result, all four approaches would address the fundamental weakness of the existing income tax when it comes to taxing investment income: allowing taxpayers to defer paying tax on investment gains until assets are sold at no cost.

Chapter 4: A proposal to tax financial transactions

by Antonio Weiss and Laura Kawano

Abstract:

We propose a tax instrument that is not currently used to any significant degree by the United States: a financial transaction tax (FTT). An FTT—if carefully designed and implemented—would raise substantial revenues in a progressive manner. We propose an FTT of 10 basis points that would apply to trading in stocks, bonds, and derivatives. We do not believe an FTT at this level would hinder market functioning or impede price discovery, and in fact it would be less than the recent declines in transaction costs that have occurred in many markets. The Urban-Brookings Tax Policy Center estimates that the proposal would raise approximately $60 billion in annual revenue once it is fully phased in. Because the United States does not have recent experience with a nontrivial FTT, some aspects of its effects—including the precise amount of revenue that would be raised—remain uncertain. For this reason, we propose a staged implementation over four years, with the FTT starting at 2 basis points, to allow policymakers to monitor market functioning, address avoidance techniques that will undoubtedly arise, and, if necessary, more carefully calibrate the level of the tax.

Chapter 5: Raising revenue with a progressive value-added tax

by William Gale

Abstract:

To raise revenue in a progressive, efficient, and administrable manner, this chapter proposes a new national consumption tax: a broad-based credit-invoice value-added tax (VAT). The proposal comes with several qualifications: the VAT should complement, not substitute for, new direct taxes on the wealth or income of affluent households; to ensure the policy change is progressive, the VAT should be coupled with adjustments to government means-tested programs to account for price level changes, and with a universal basic income (UBI) program; to avoid having the VAT depress the economy, revenues should be used to raise aggregate demand in the short run and the Federal Reserve should accommodate the tax by allowing prices to rise. A 10 percent federal VAT that funded a UBI equal to 20 percent of the federal poverty line would be highly progressive (with net income rising among the bottom forty percent and not changing in the middle quintile) and would still raise more than 1 percent of GDP in net revenue. VATs are a proven success, existing in 168 countries. VATs have been proposed by both Democrats and Republicans in recent years. Concerns about small businesses, vulnerable populations, and the states can be easily addressed.

Chapter 6: Taxing multinational companies in the 21st century

by Kimberly Clausing

Abstract:

The corporate tax remains a nearly indispensable feature of the U.S. tax system, since 70 percent of U.S. equity income is untaxed at the individual level by the U.S. government. Yet taxing multinational companies presents policymakers with conflicting goals. Although lower tax rates and favorable regimes may attract multinational activity, such policies erode the corporate income tax as a revenue source. Unfortunately, the Tax Cuts and Jobs Act of 2017 did not resolve this policy dilemma. Despite big reductions in corporate tax revenue due to lower rates, the 2017 tax law does not adequately address profit shifting or offshoring incentives within the tax code, nor does it improve the competitiveness of United States–headquartered multinational companies. This chapter proposes a rebalancing of U.S. international tax policy priorities. Starting from current law, there are several simple changes that can raise corporate tax revenue and adequately address profit shifting and offshoring; these changes can be implemented almost immediately within the architecture of current law. In the medium run the United States should partner with other countries to pursue a formulary approach to the taxation of international corporate income. By dramatically curtailing the pressures of tax competition and profit shifting, such an approach allows policymakers to transcend the trade-off between a competitive tax system and adequate corporate tax revenues. There is widespread international recognition of these problems; the current Organisation for Economic Co-operation and Development/Group of 20 process can serve as a steppingstone toward a fundamental rethinking of how we tax multinational companies in the 21st century.

Chapter 7: How to increase growth while raising revenue: Reforming the corporate tax code

by Jason Furman

Abstract:

This chapter proposes reforms to business taxes that would address some of the challenges facing the current system. These challenges include historically low revenue collections, instability, distortions, failure to address positive spillovers from research and development, and failure to address the increased returns to corporations that derive from their monopoly power. The proposal would raise the corporate tax rate from 21 percent to 28 percent, require large pass-through businesses to file as C corporations, and close other loopholes. In addition, it would expand incentives for new investment by allowing businesses to expense all their investment costs and get a nearly 50 percent larger credit for their research and development spending. The proposal would raise the long run level of GDP by at least 5.8 percent, adding at least 0.2 percentage point to annual GDP growth over the next decade. The combination of tax increases and additional growth would raise $1.1 trillion over the next decade and 1.1 percent of GDP in steady-state. The middle quintile of the income distribution would see a 3.5 percent increase in its after-tax income after taking into account the uses of the money raised. The overall gain to society in the long run would be about a 5.0 percent increase in well-being.

Chapter 8: Tax reform for progressivity: A pragmatic approach

by Natasha Sarin, Lawrence Summers, and Joe Kupferberg

Abstract:

Trends in demographics, national security, economic inequality, and the public debt suggest an urgent need for progressive approaches to raising additional revenue. We propose a suite of tax reforms targeted at improving tax compliance, rationalizing the taxation of corporate profits earned domestically and abroad, eliminating preferential treatment of capital gains, and closing tax loopholes and shelters of which wealthy individuals disproportionately avail themselves. We estimate that these proposals have the potential to raise over $4 trillion in the coming decade. These proposals are comparable on the basis of both potential revenue raised and progressivity with newer and more radical proposals, like wealth taxation and mark-to-market reforms, that have been the focus of much recent attention. Importantly, our agenda is likely to enhance rather than reduce efficiency, is far less costly in terms of political capital, and hews more closely to basic notions of fairness than alternative approaches.