In the last few months, inflation has been a hotter topic than in recent memory. Google trends search intensity for the word “inflation” hit an all-time high (for the last 16 years since it was measured) and is roughly twice as high as it has been in normal weeks in the last five years.

A number of economists have suggested that recent fiscal policy stimulus will lead to over-heating and inflation, while others have argued just as vociferously it will not (see for example). This suggests that over the next few months, each inflation reading will draw increased scrutiny. There are a number of reasons to use caution when reading the data, though.

Bouncy Data in the Next Few Months

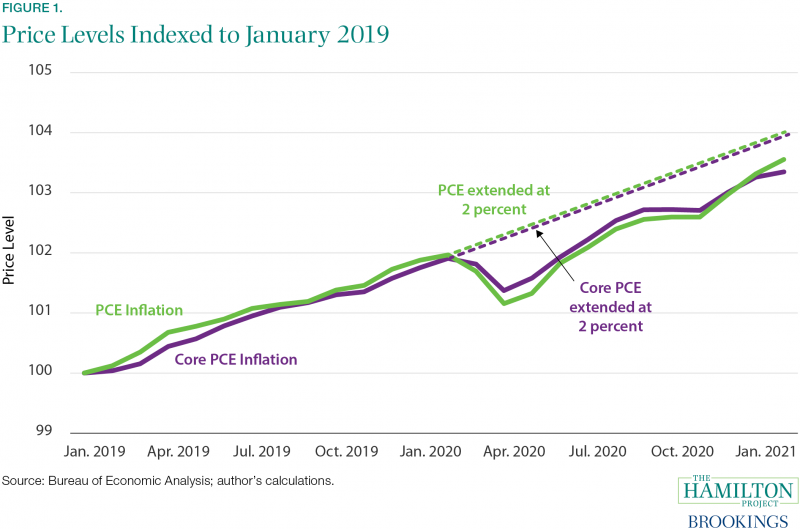

The COVID-19 pandemic cost hundreds of thousands of lives in the United States and unleashed a sharp recession. In addition to loss of employment and income, the shock caused the steepest three-month drop in the core personal consumption expenditures (PCE) price index since data exists in 1959 (the PCE is the preferred price index of the Federal Reserve and “core” means it excludes volatile food and energy prices). This dip is shown in the figure below which shows both headline (overall prices) and core prices over the last few years along with a line showing what the price level would have been had prices grown at 2 percent. This highlights that prices are still well below what a simple 2 percent trend would have generated.

The drop last year will soon be important once again because inflation is typically reported as the change in prices over a 12-month period. Monthly changes are often volatile, so focusing on a 12-month change can smooth those bounces. Since prices fell from February to March in 2020, the comparison or “base” month will fall when March 2021 data are reported. If we focus on the rebound in prices since then without appreciating that it was just partially returning prices to their prior level, it may seem like inflation is rising out of control. Even if prices remained perfectly flat over the next few months, it would look like inflation is rising as the 12-month-ago base comparison is actually going down.

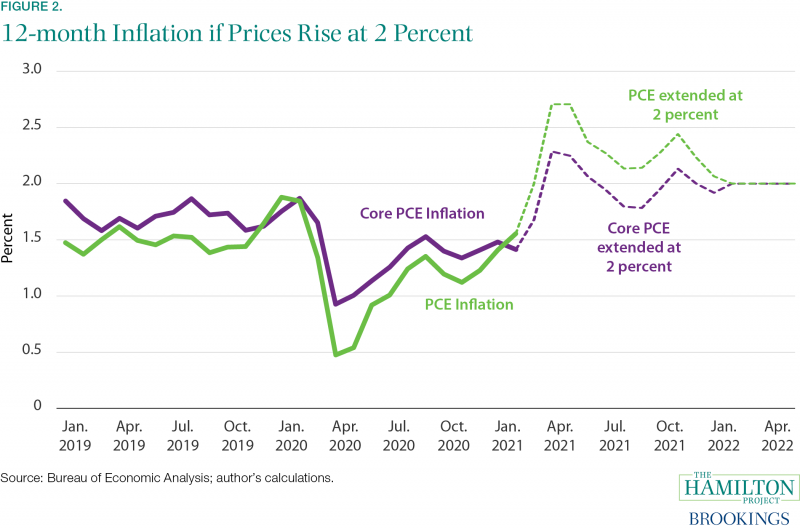

The next figure shows what inflation will be if PCE prices grow at exactly 2 percent over the next year. As the figure shows, due to the huge dip a year ago, it will seem like inflation is rising rapidly, even though prices are simply moving up at a 2 percent annual rate month after month. Once the unusual low of last spring’s prices are no longer the base period, 12-month inflation dips back down.

Headline (or overall) PCE inflation will rise from 1.6 percent over the twelve months ending in February to 2.7 percent by April even if prices just move along at a simple 2 percent rate. This will look like accelerating inflation but would not be due to faster price growth this spring, but rather because the 12-month window no longer includes the price drops from February to April 2020 but does include the bounceback after the price drop. The impact on core PCE inflation will be less severe, but it will still pick up from 1.4 percent in February to 2.3 percent in April. If 12-month inflation rises in the next few months, it may be just because of the odd moves in prices a year ago.

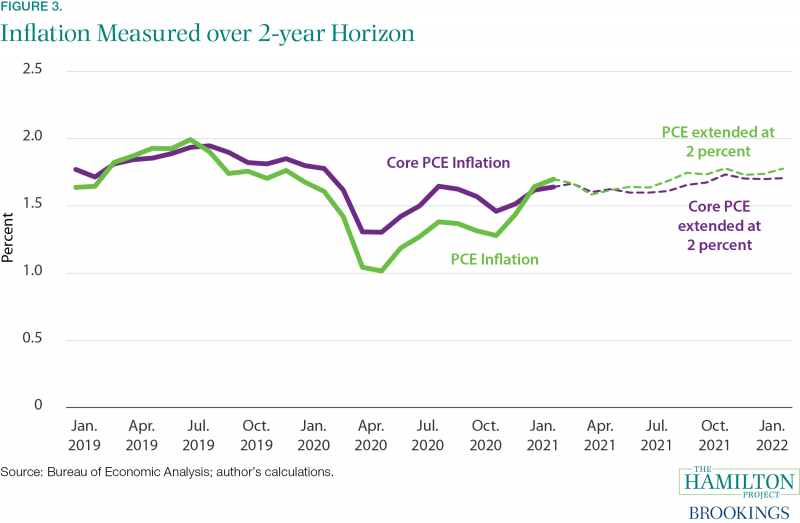

One could look past the bumps in 2020 by focusing instead on the annual rate of inflation over shorter horizons, but these are often quite noisy. Another choice would be to compare prices to their level two years ago. Doing so would highlight both the need for the Federal Reserve to make up for low inflation last year and prevent odd base year effects. The next figure shows inflation over the last two years.

Looking at inflation over a two-year horizon will not show an odd bump due to base-year effects. The period included in the calculation includes both the dip and the bounceback, so they cancel out. If prices grow at 2 percent for the next year, we will see two-year inflation below 2 percent because inflation was low in 2020 (just 1.4 percent core inflation and 1.2 percent headline inflation in the twelve months of 2020).

What inflation rate does the Federal Reserve want?

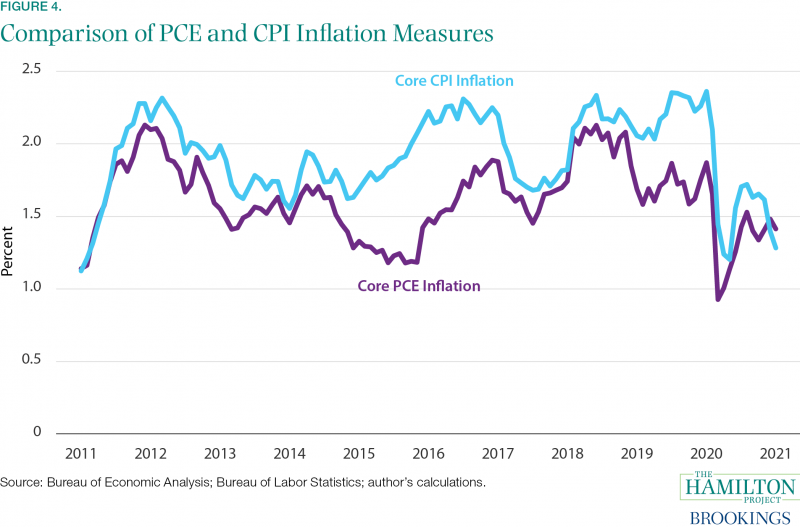

It is also important to remember the actual inflation target. The Federal Reserve targets an average of 2 percent inflation over the medium term for prices as measured by the personal consumption expenditures (PCE) price index. The Fed will normally focus on the “core” PCE price index (one that omits food and energy) to avoid wide fluctuations caused by swings up or down in commodity prices. The PCE price index, though, has typically tracked below the widely reported consumer price index (CPI). Over the last decade, core PCE inflation has been an average of 0.3 percentage points lower than core CPI inflation.

Over the last decade, core CPI inflation has occasionally gone above 2 percent, but core PCE inflation has tended to be below the 2 percent target (meaning average inflation has been below target over time). If CPI inflation gets over 2 percent, core PCE inflation may still be well below it.

Second, as the figure shows, inflation has been well below 2 percent for the last two years, especially since the global pandemic struck. This means if the Fed wants to have “average inflation over time” at 2 percent, it will need to make up for the lower inflation recently. This is also visible in the first figure as the price level remains below a 2 percent projected trend. The Federal Reserve recently released a new framework for monetary policy that promises to make up for periods of low inflation. The Federal Reserve is likely looking for inflation (measured by PCE) in the range of 2.5 percent for the next year to make up for the last low year. That is, PCE inflation at 2.5 percent (or CPI inflation at 2.8 percent) would not be a sign the Fed has let inflation climb too high. It would be a sign the Fed is trying to hit its target of an average of 2 percent over time.

Conclusion

Inflation will be in the news frequently over the next few months. Some prices will rise (as gasoline prices have done in the last six months), and others may fall. The best way to gauge inflation is always looking at a broad basket. There are reasons to think inflation will rise, most notably recent fiscal and monetary policy stimulus. There are more reasons to think it will not likely get out of control over the next year, including a still very large gap in employment (over 10 million fewer jobs than prior trend leaving extensive slack in the economy now), a lack of inflation in recent decades anchoring expectations, and a low responsiveness of prices to periods of strong employment growth (limiting price pressure once employment has recovered more). Given the competing narratives, there will be a temptation to overinterpret each data release.

Remembering which basket is the Fed’s target (PCE), avoiding swings up or down from volatile prices (by looking at core inflation), and avoiding odd base month effects (by looking over a longer horizon) will all help cut through the noise of what will certainly be a loudly discussed topic.

The author thanks Wendy Edelberg for helpful comments and Mitchell Barnes and the Hamilton Project team for great production assistance.