As a result of the COVID-19 pandemic, the U.S. labor market has deteriorated from a position of relative strength into an extraordinarily weak condition in just a matter of weeks. Yet even in times of relative strength, millions of Americans struggle in the labor market, and although it is still early in the current downturn, there are already clear signs that many of those same workers are struggling all the more today. While many higher-wage workers have been able to work remotely, low-wage workers have experienced much more disruption in their economic lives: they have seen their hours cut, endured layoffs, or borne an increased risk of infection at essential worksites.

One particularly at-risk group of workers consists of those in alternative work arrangements, or “nontraditional workers”. This category of workers is significant—accounting for over 15 million workers or 10 percent of the U.S. workforce—including independent contractors, on-call workers, workers from temporary help agencies, and workers provided by contract firms. What these workers have in common is that they are in some way removed from the employer that ultimately purchases their services, whether because they are self-employed, employed by an intermediary, or employed only on an as-needed basis.

In a new Hamilton Project economic analysis released titled “The Labor Market Experiences of Workers in Alternative Work Arrangements”, we explore the economic outcomes of this group of workers and show how they differ from traditional workers, concluding with a discussion of policy options for improving their labor market experience. In this blog post we focus on two important labor market disadvantages observed for nontraditional workers: more volatile hours and less health insurance coverage.

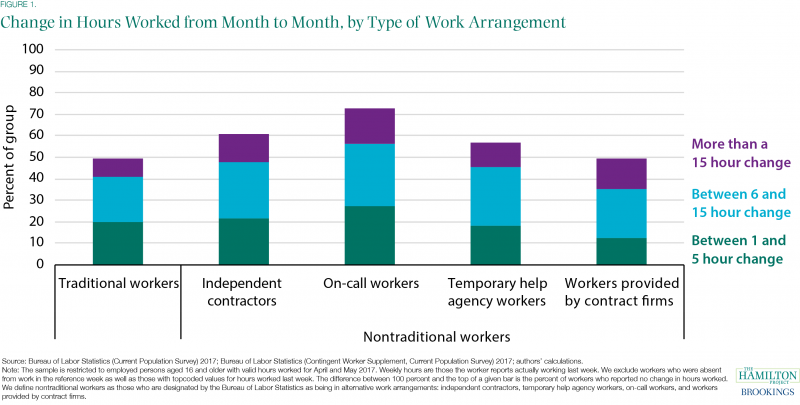

As shown in figure 1, many workers—traditional and nontraditional alike—experience some degree of change in their hours worked in a given week. Nearly 50 percent of traditional workers report that their weekly hours change at least slightly in a two-month span. However, nontraditional workers tend to experience larger and more frequent swings. For example, over 70 percent of on-call workers see their hours change month to month and 27 percent of on-call workers report a change greater than 10 hours. This contrasts with the 13 percent of traditional workers whose hours change by more than 10 hours month to month.

Certainly there exist workers for whom hours flexibility is valuable, and this preference may result in month-to-month hours volatility. But for many workers, volatile hours yield irregular and unpredictable earnings. As described in previous Hamilton Project analysis, volatility in weekly hours can also threaten workers’ eligibility for important safety net benefits like TANF and SNAP by causing them to fail to meet mandated hours requirements. For on-call workers in particular, irregular scheduling can mean being called into work when they are not scheduled or even traveling to work for a scheduled shift only to be sent home without pay. In addition to its economic consequences, instability in work schedules has been shown to contribute to psychological distress, poor sleep quality, and unhappiness for hourly workers in the service sector.

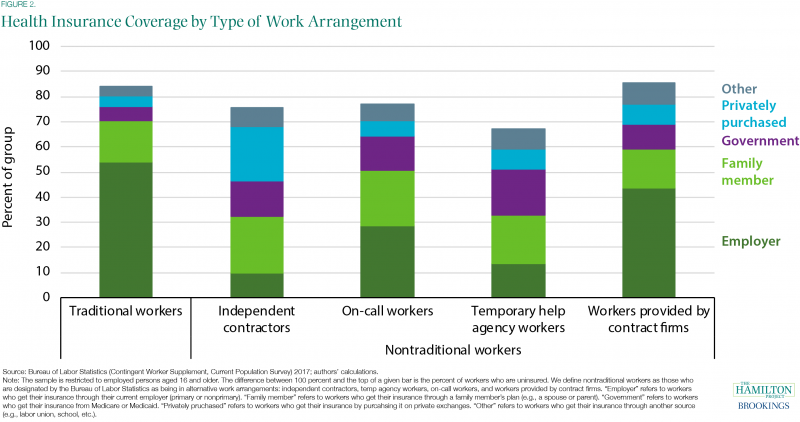

Another striking difference between traditional and nontraditional workers is in nonwage compensation—one of the most important components of which is health insurance. Health insurance constitutes about one quarter (26 percent) of nonwage compensation, as measured by the cost to employers. It is commonly secured through employment, with about 50 percent of all workers getting their health insurance through an employer-sponsored plan (authors’ calculations). And it can have substantial effects on job search and labor market outcomes.

Nontraditional workers are considerably less likely than traditional workers to participate in employer-provided health insurance. Furthermore when counting all forms of health insurance, most categories of nontraditional workers are less likely to have insurance at all, as shown in figure 2. Whereas 84 percent of traditional employees have health insurance, only 75 percent of independent contractors, 77 percent of on-call workers, and 67 percent of workers at a temporary help agency have health insurance.

The gaps are even larger when focusing on employer-sponsored coverage. Among traditional workers, 54.2 percent receive health insurance from their employer (dark green bar). By contrast, only 43.5 percent of workers provided by contract firms and 28.6 percent of on-call workers get coverage from an employer or a spouse, and 9.7 percent of independent contractors and 13.4 percent of workers at temporary help agencies get health insurance from those sources (figure 2).

Health insurance is arguably the most important fringe benefit a worker gets from their employer. The fact that workers in alternative work arrangements tend to (1) be covered at lower rates than traditional employees and (2) receive their insurance from government sources rather than employer-provided plans and spouses is suggestive of the precarious nature of their employment.

Despite these differences, it should be noted that the traditional work relationship is not the ideal arrangement in every circumstance. Some workers in alternative arrangements report satisfaction with the arrangement: 79 percent of independent contractors prefer that status to a traditional job; however, only 44 percent of on-call workers and 39 percent of temp workers prefer their current status to a traditional job. And alternative arrangements can in principle be more efficient ways to organize work, eliminating unnecessary costs. But the labor market gaps highlighted in this analysis suggest that alternative work arrangements (and the public policies that govern them) deserve careful scrutiny.

As discussed above, many nontraditional workers live already precarious economic existences that are now thrown into disarray by the ongoing pandemic. A better understanding of their labor market experiences can support the development of public policy that improves worker outcomes. Some policy options for doing so include expanding labor protections to nontraditional workers, addressing worker misclassification, and providing access to crucial benefits (e.g., health insurance, retirement plans, etc.) through mechanisms like portable benefits.