It is commonly supposed that economic change affects the size of a household’s overall pie without much altering the pie’s composition: consumers may have more or less to spend in a given year, but spending patterns remain relatively constant. Evidence suggests that this is far from the truth. Understanding shifting spending patterns, including how much money remains in households’ budgets after purchasing basic needs, is an important aspect of understanding economic security. A guiding principle of The Hamilton Project is that economic security and economic growth are mutually reinforcing, as economic security enables Americans to make investments in their future.

Economic progress occurs unevenly, diffusely, and at times unpredictably: whole categories of spending diminish or grow as technology and preferences shift. For instance, as the relative price of clothing has plummeted, the share of spending going to clothing has declined; at the same time, health care has become more expensive and it has increased as a share of total spending. This economic analysis describes shifts in consumer spending patterns over the last 30 years, and how the experiences of low-income households have differed from higher-income households. We show that low-income households today spend a higher share of their budgets on basic needs—defined as the major budget components of housing, food, transportation, health care, and clothing—than they did three decades ago.

Differences in Expenditures on Basic Needs by Income

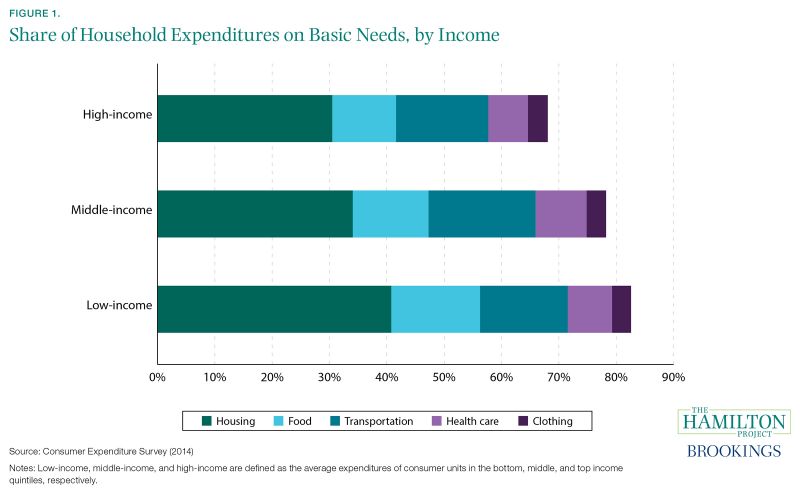

It is a well-known economic fact that low-income households spend a higher share of their budgets on basic needs, and that a smaller share of spending goes toward basic needs as a household’s income rises. This—along with a number of other interesting observations—is borne out in our analysis of data from the Consumer Expenditure Survey (CES), collected by the U.S. Census Bureau, which provides annual estimates of household expenditures from a representative sample of households. For the purposes of this analysis, low-income households are defined as those in the bottom income quintile, which aligns roughly with the percentage of the population (20.4%) that lives below 130 percent of the federal poverty level. Social programs like the Supplemental Nutrition Assistance Program (SNAP) and the Free/Reduced-Price School Lunch Program count households with incomes up to 130 percent of the federal poverty level as eligible, making this an important income threshold. Middle-income households are those in the middle income quintile, with incomes between the 40th and 60th percentile of the income distribution, while high-income households are those at or above the 80th percentile.

Figure 1 shows spending on basic needs for low-, middle- and high-income households.1 While middle-income households spent 78 percent of their budgets on these categories of basic needs in 2014, low-income households spent 82 percent. High-income households spent only two-thirds of their budgets on basic needs. Figure 1 also shows the share of spending that goes toward each category. For low-income households, a larger share of expenditures goes to housing and food (which includes food both at home and away from home) compared to middle- and high-income households. Housing takes up 41 percent of spending and the next 30 percent of expenditures are about evenly split between food and transportation, again for low-income households. For a middle-income household, about one-third of spending is devoted to housing. The next largest categories are transportation and then food, which comprise 19 and 13 percent, respectively. High-income households spend a smaller share of their budget on each basic need.

Note that categories omitted from the “basic needs” group still contain some essential spending, and should not necessarily be interpreted as wholly luxuries. The omitted categories include spending on personal insurance, pensions, and education. The omitted categories also include personal care and entertainment, among other expenditures.

This figure masks the real-life tradeoffs that low-income households must make between spending on different basic needs. Because almost all of household spending is on these five categories, pressure from one category or another based on need and circumstance could produce dilemmas. For example, a survey of food-insecure food bank clients—a particular population defined by their lack of resources to pay for sufficient food—found that two-thirds of these households surveyed report having to choose between buying food and paying for medicine and health care. With limited savings and a larger share of their budgets devoted to expenditures in these categories, low-income households are less able to absorb increased spending on any one category while maintaining expenditures on other basic needs.

Changes Over Time in Expenditures

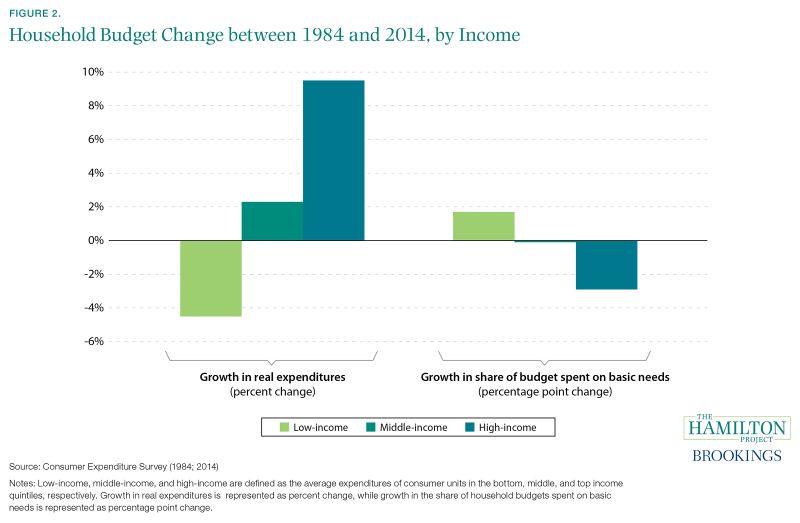

After adjusting for changing price levels, middle- and high-income households had higher expenditures in 2014 than in 1984. As shown in Figure 2, over this time period middle-income households’ spending increased by just over 2 percent, from about $44,400 to $45,400 (in inflation-adjusted 2014 dollars). On the other hand, low-income households saw their spending decline by 4.5 percent, from about $24,800 to $23,700.

Alongside this decline in real spending, low-income households have come to spend a larger share on basic needs. During this period, low-income households increased the share of their spending devoted to basic needs by almost two percentage points, while the share of spending on basic needs declined slightly for middle-income households and fell by about three percentage points for high-income households.

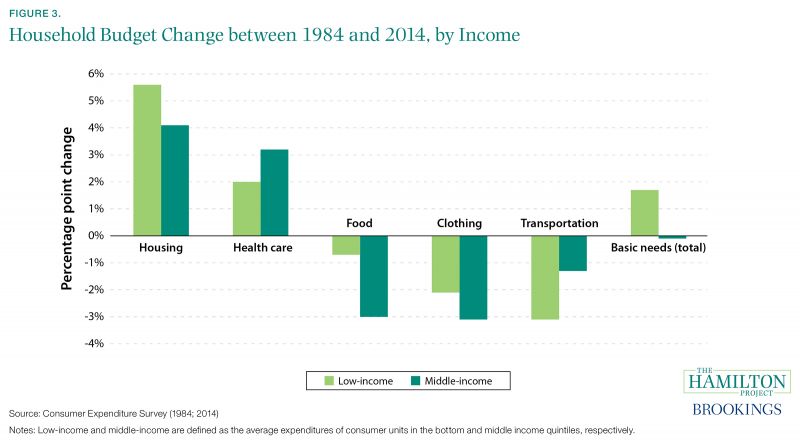

Breaking out spending on basic needs across its components, Figure 3 shows how the shares of spending on different categories have changed between 1984 and 2014, depicted separately for middle- and low-income households. Both middle- and low-income households allocate more of their spending to housing and health care than they previously did. Among low-income households, the share devoted to housing increased by 5.6 percentage points. At the same time, households spend less of their budgets on clothing, food, and transportation than they once did. Both middle- and low-income households reduced the share of their spending devoted to clothing and transportation. While middle-income households decreased their spending share on food by 3 percentage points, the decline was much smaller—only 0.7 percentage points—for low-income households.

Note that expenditures reflect both the price of goods and the amount of the good that is consumed. For this reason, it is also useful to consider how price levels have changed over time to help us distinguish between cases in which the item’s budget share has declined along with falling relative prices (e.g., apparel and transportation) and those in which the item’s budget share has declined while prices did not (e.g., food). Relative to changes in overall prices, the price of health care has nearly doubled over this period. Prices of food and housing have basically tracked inflation, while the relative prices of transportation and clothing have declined. Much of this spending now goes to housing, where low-income households increased the share of their spending by more than five percentage points.

Housing and Health Care Absorb More of Household Budgets than in the Past

The share of low-income household budgets devoted to housing has increased by 5.5 percentage points over the past 30 years—from 35 percent in 1984 to nearly 41 percent in 2014. Housing expenditures include rent payments, mortgage interest, property taxes, and utilities.2 Creating particular difficulties for low-income households, expenditures on rented dwellings have increased faster than those for owned dwellings.3 Evidence shows that consumption patterns in low-income households are particularly sensitive to variation in housing expenses: adults in low-income households tend to decrease food consumption to offset rising utilities expenditures during the winter, while higher-income households increase expenditures on both utilities and food.

Health care – including out-of-pocket expenditures on health insurance, medical services, drugs, and medical supplies – constituted a relatively small fraction of households’ budgets in 1984. Thirty years later, expenditures have increased by a full 60 percent for the middle-income households and 28 percent for low-income households, though total health-care expenditures in both types of household remain lower than expenditures on housing, transportation, or food.

Clothing and Transportation Provide Savings Due to Declining Prices

While expenditures on housing and health care now take up a larger share of the budgets of both middle- and low-income households, clothing and transportation have declined as a share of household budgets. Transportation is a broad category including vehicle purchases, fuel, maintenance, vehicle insurance, and public transportation, but the changes in household expenditures are largely driven by declining expenditures on vehicle purchases. Prices for both clothing and transportation have declined relative to overall prices, with clothing in particular dropping over the last two decades. It is important to recognize that the CPI attempts to adjust for changes in quality, so the declining relative price index for transportation also reflects improvements in the longevity of vehicles. As these prices have fallen, households have allowed their expenditure shares in clothing and transportation to fall.

Middle-income, but not Low-income, Households Spend Less on Food

Middle-income households have reduced their food expenditure share by 3 percentage points, while the expenditure share for low-income households has changed little. Many staple foods, including fruits, vegetables, and bread, are cheaper today than three decades ago due to factors like advancements in agricultural productivity and liberalization of global agricultural trade, but the price of food generally has actually risen about as quickly as overall prices.

Box 1. American Spending on Food

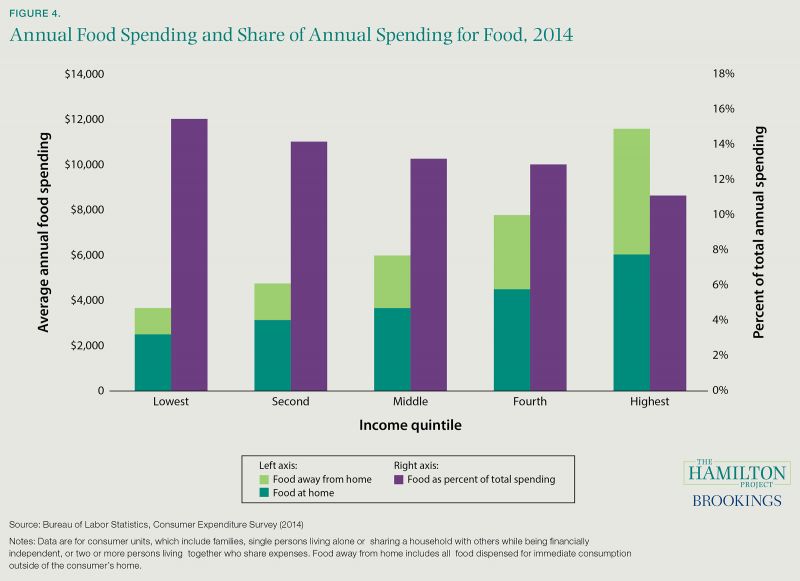

Low-income households spend much less on food overall than other households (green bars), but food spending takes up a higher share of their spending (purple bars). In 2014, households in the bottom quintile of incomes allocated an average of 15 percent of their total spending to food, while households in the top quintile spent on average 11 percent of their budgets on food.

The composition of food spending also differs widely across the income distribution, with lower-income households spending a lower share of their food budgets on food away from home than higher-income households do. Figure 4 shows that households in the top income quintile spend almost five times as much on food away from home as households in the bottom income quintile. Among the highest-income households, 48 percent of food spending goes to food away from home, while the lowest-income households spend 32 percent of their food budgets this way. Both restaurants and fast food establishments contribute to the higher share of food spending on food away from home; in fact, contrary to popular perception, children living below 130 percent of the federal poverty level consume the fewest calories from fast food of any income group.

Budget Pressures Vary Across the Country

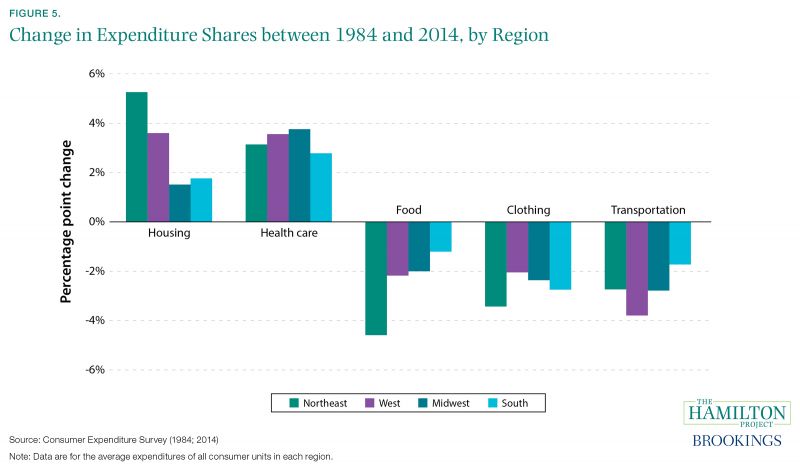

Changes in spending patterns are starkly different across regions of the country. Figure 5 shows changes in expenditure shares from 1984 to 2014 for the four main regions of the United States. Housing and health care have risen as a share of spending throughout the country, with the increase in housing expenditure more pronounced for the relatively expensive Northeast and coastal West. For food expenditures, the pattern is reversed, with the expenditure share for food in the Northeast declining by over 4 percentage points—over twice the decline seen in other regions. Across most categories of expenditure, households in the South have experienced the smallest changes.

While across the nation housing prices have grown apace with overall prices, there is substantial regional variation in house price inflation. Households in the Northeast and West have experienced rising housing prices relative to other goods, while the opposite is true for households in the Midwest and South.

Implications for the Social Safety Net

Consumption patterns have shifted over the last thirty years, with low- and middle-income households notably diverging along critical dimensions. Yet the design of some safety net programs has not been adjusted to reflect changing consumption norms and budgetary needs. In the case of SNAP, the largest federal nutrition assistance program, benefits are calculated based on food consumption patterns that no longer hold in the modern economy. The Hamilton Project has produced several proposals that aim to better target social safety net programs, including SNAP, to changing conditions.

First, a proposal by Hamilton Project Director Diane Schanzenbach discusses adjusting the SNAP benefit requirements to better incorporate evolving spending patterns and geographic differences in cost of living. SNAP is a good place to start, since research suggests that it help recipients not only purchase more food, but also avoid falling behind on payments for housing and forgoing needed medical care (see Fact 12 of the Hamilton Project’s Twelve Facts about Food Insecurity and SNAP). In addition, a recent Hamilton Project proposal by James Ziliak examines the adequacy of the existing SNAP formula given the increasingly unrealistic assumptions it implies for recipients’ time use and food preferences.

The Hamilton Project has also considered how to help low-income households struggling with rising rental costs. Federal housing assistance such as the Housing Choice Voucher program enables low-income households to spend only 30 percent of their income on housing, but it is not available to all applicants who are eligible; currently only one-quarter of the eligible population receives assistance. A Hamilton Project proposal by Edgar Olsen explains the importance of shifting from unit-based housing assistance such as housing projects to tenant-based vouchers and serving more low-income families.

Conclusion

While it is no surprise that low-income households allocate a greater share of their spending to basic needs than do high-income households, the composition of this spending and the changes that have occurred over time are less well-known. Low-income households have seen their real consumption fall over the last thirty years, while the fraction of their budget spent on basic needs has risen; for middle- and high-income households, consumption has risen and the share spent on basic needs has decreased. All three groups of households now spend more on housing and health care than they did previously, but the increase in spending on housing has been more pronounced for low-income households. These changes varied considerably by region: in the Northeast, the share of spending on housing grew more than in other regions, while the share of spending on food fell.

When changes in household spending composition are driven by shifting preferences and technology, policy makers should generally not attempt to interfere. What policy can aim to achieve is a basic level of economic security for all households. For instance, social safety net programs like SNAP and Medicaid help households to afford basic needs during times of economic hardship. As households’ preferences and economic environment change, policy should continue to support broad-based economic progress and security.

We thank Leslie McGranahan for helpful comments.

1 Note that food spending includes purchases made with SNAP benefits. Data on child care expenditures are not included, because they are not available except in the microdata.

2 Housing expenditures exclude payments on mortgage principal.

3 Calculated using Consumer Expenditure Survey data over the 1984-2014 period.