In 2023, The Hamilton Project brought together leading experts in economic policy to highlight some of the nation’s most pressing economic issues. This year, the team’s publications ranged from tax policy and the federal deficit to contraception access for low-income, uninsured Americans. The figures below provide a snapshot of the research THP produced throughout the year.

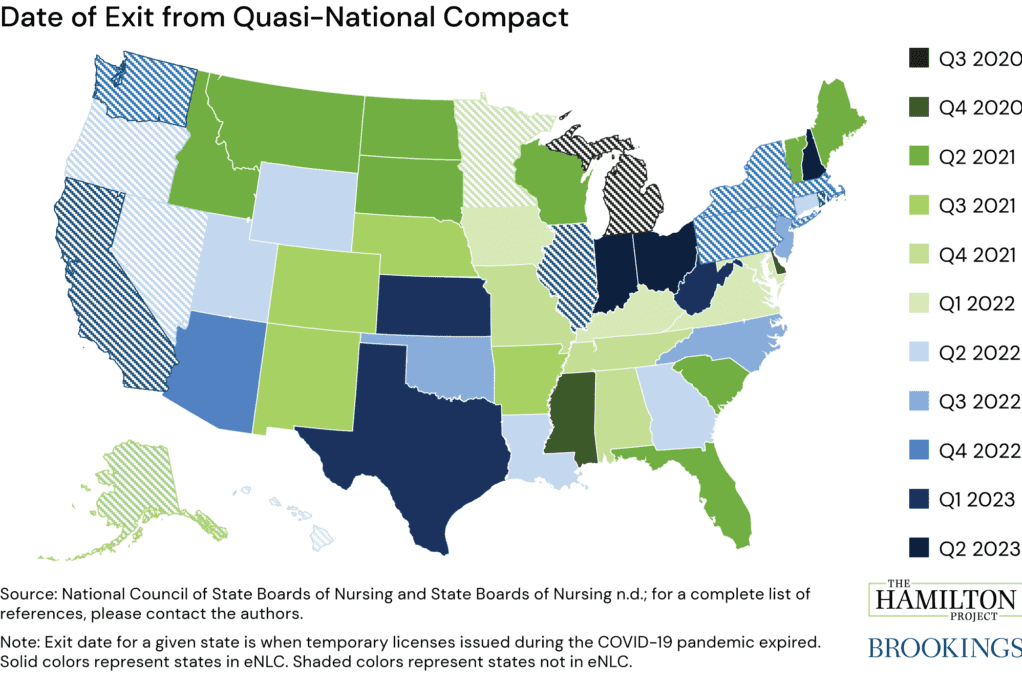

January: Expiration of state of emergency classifications stand to impact recent changes in the health care workforce.

Starting off 2023, The Hamilton Project investigated potential solutions to major issues with the ways in which the health care workforce withstands shock. In 2020, all states declared a state of emergency and implemented an emergency licensing waiver for health care professionals to address critical needs and shortages in the health care workforce. With this waiver, a quasi-national compact (or agreement) was formed where nurses could effectively practice anywhere without applying for an additional license or paying additional fees, regardless of whether a state previously recognized multi-state licenses. This resulted in an estimated 35 percent growth of travel nursing in 2020 relative to 2019 and an additional 40 percent growth in 2021. For those willing to travel, wages skyrocketed to an average of $154 an hour. States began rescinding emergency authorizations — and thus exiting the quasi-national compact — as early as April 2021, and most states allowed their temporary emergency authorizations to expire by September 2022. states allowed their temporary emergency authorizations to expire by September 2022.

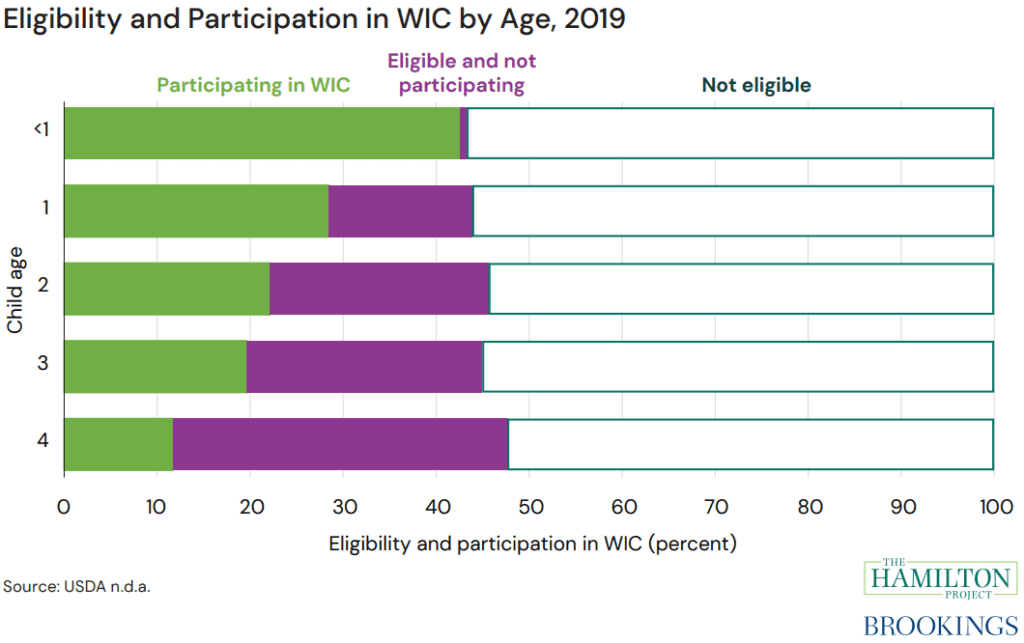

February: Food assistance participation drops off for children over the age of one despite stable eligibility.

The Hamilton Project explored gaps in child nutrition assistance. The figure above shows the large gaps between eligibility and participation in the federal supplemental nutrition program for women, infants and children, known as WIC. Between infancy and the age of four the share of children eligible for WIC is similar. However, participation among those eligible declines significantly starting at the age of one. By age four, only a quarter of eligible children participate in WIC, in comparison to 98 percent of infants. The report emphasizes the large gaps between eligibility and participation for children in these programs and argues that federal coordination and support to states for successful program delivery is an essential component of reducing child hunger.

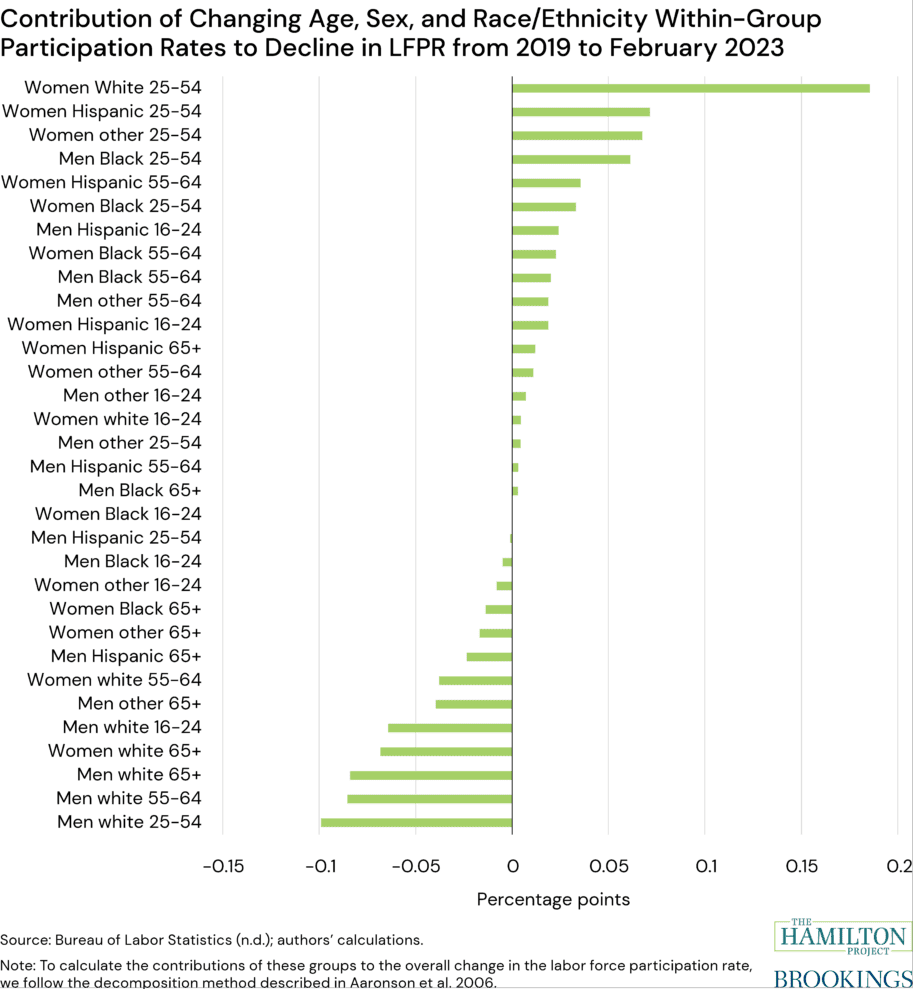

March: Prime-age women drive the recovery of post-pandemic labor force participation.

In “Who’s Missing from the Post-Pandemic Labor Force?” The Hamilton Project examined the post-pandemic labor force landscape and found that although propensity to work has recovered, it has not been uniform. The report finds that a large portion of negative contributions to overall labor force participation rate (four out of five) are due to reduced participation among white men, especially prime-age white men (ages 25-54). This contrasts with contributions of prime-age women of any race, who make up four of the six most positive contributions, along with Black prime-age men and Hispanic women ages 55-64.

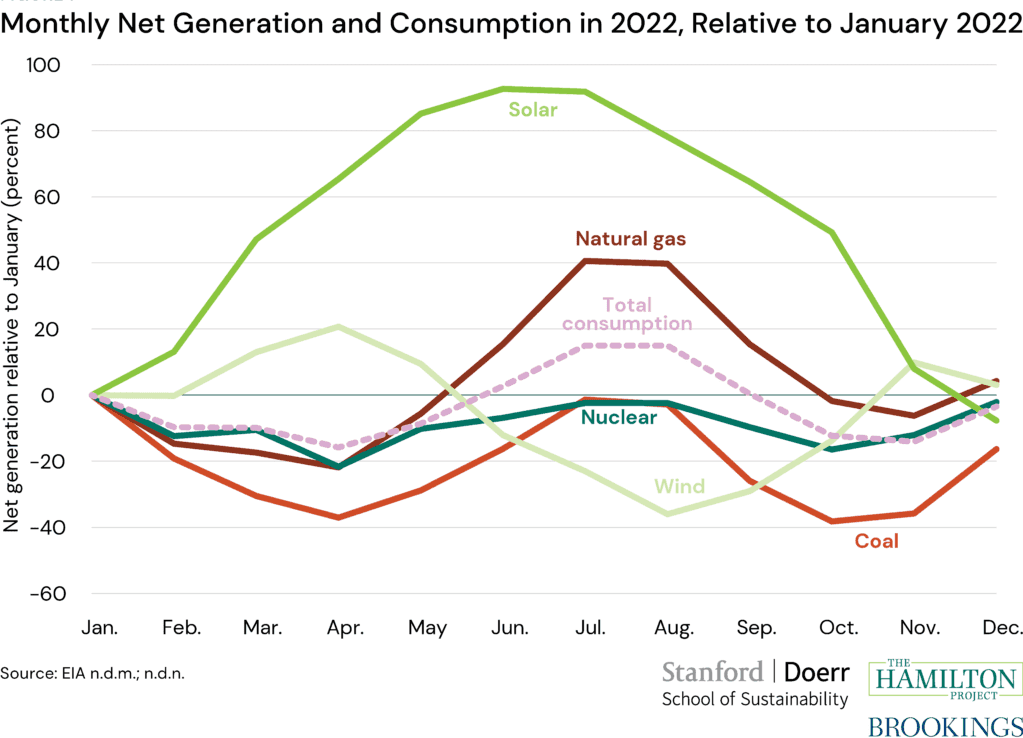

April: Seasonal variation in energy consumption is predicted to grow as more renewables enter the market.

In April, The Hamilton Project and the Stanford Doerr School of Sustainability published a set of ten economic facts on key energy system characteristics that will be consequential to the clean energy transition in the near term and merit policymaker attention. The great challenge of the next decade of U.S. climate policymaking will be for lawmakers and regulators to remove existing barriers to clean energy infrastructure deployment, the authors argue. Such challenges include the increase in seasonal variation in energy generation as renewables comprise a larger part of the electricity makeup. This variation, as demonstrated in the figure, can create issues for states and others preparing their electricity grids to meet peak demand. However, there are solutions as well, including: dispatchable zero-carbon energy sources, more efficient storage of energy from solar production, and better transmission connections between regions with diverse portfolios of renewable sources whose production is uncorrelated.

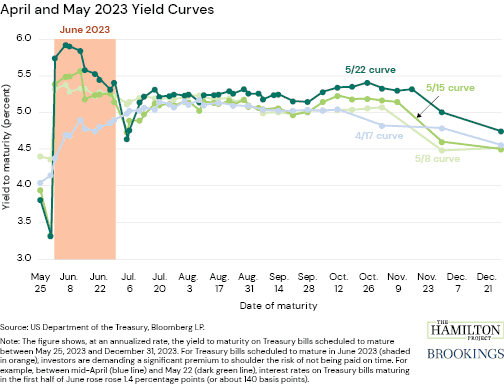

May: Confidence in U.S. Treasury markets fell as debt ceiling crisis neared, more than in prior debt crises.

In May, The Hamilton Project examined the effects of debt ceiling brinksmanship and investors’ responses to the possibility of Treasury not being able to pay their obligations on time. Investors demanded the remarkable premium of 1.4 percentage points, about 140 basis points, to shoulder the risk of late payments for Treasury bills that were scheduled to mature in June, the earliest time at which Treasury could run short of resources. Between April and May alone, interest rates on Treasury bills maturing in June rose from 4.4 percent to 5.7 percent, an incredibly significant increase. This premium on Treasury bills was significantly larger and rose significantly earlier than during the last-minute debt ceiling negotiations in 2011 and 2013. The increase in interest rates represented a cost to taxpayers and a lack of confidence among investors. represented a cost to taxpayers and a lack of confidence among investors.

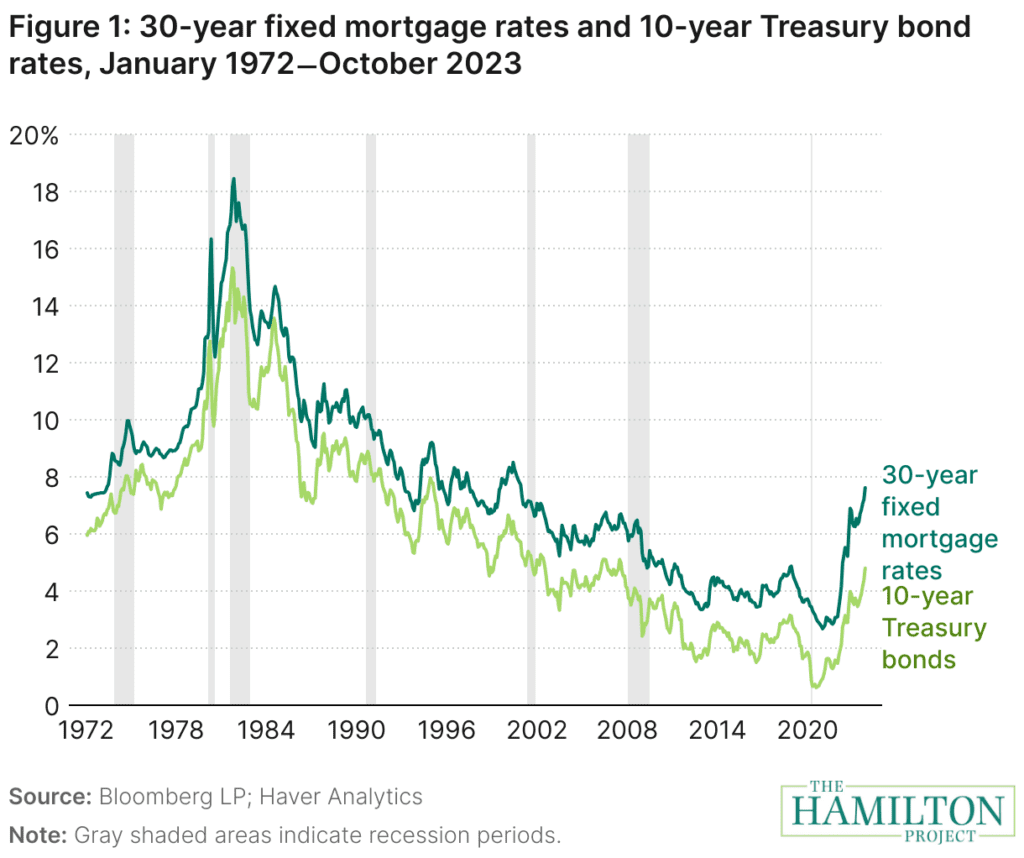

June: As long as Treasury bonds remain elevated, high mortgage rates are here to stay.

THP published a piece on nationally rising mortgage rates (updated in late November to include data through October 2023, as reflected in this figure). Although mortgage rates have been increasing over the past few years, in line with rates on Treasury securities, the unusually large increases since early 2022 point to additional, more temporary factors. The figure included demonstrates trends in mortgage rates compared to 10-year Treasury bond rates. While over the past 40 years the downward trend in mortgage rates has been in line with that of rates on 10-year Treasury bonds, the recent increase in the spread between these rates largely reflects an increase in prepayment risk and a duration adjustment, among other factors. The report concludes that while there are several conditions that have the potential to reduce mortgage rates, as long as Treasury bonds remain elevated, mortgage rates will stay high.

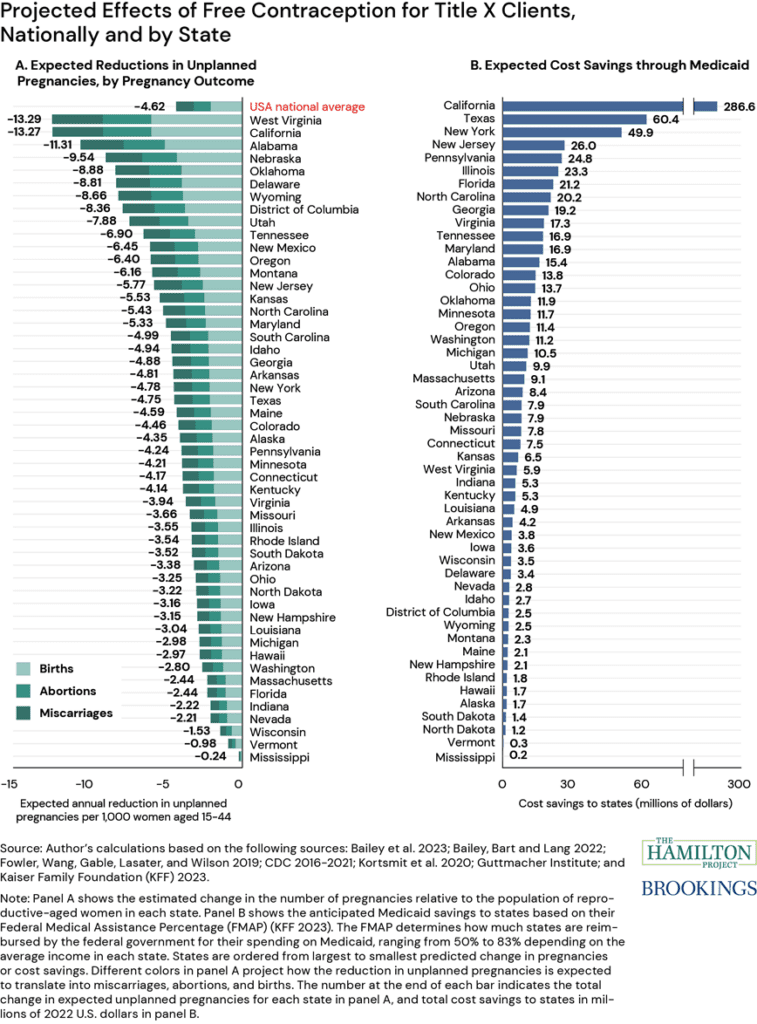

July: Projected effects of expanded contraception access include reduction in instances of unplanned pregnancies and cost saving through Medicaid.

Access to contraception is fundamental to reproductive autonomy and economic mobility, but today in the U.S., the cost of contraception severely limits access for those without health insurance. In her Hamilton Project policy proposal, Martha Bailey proposes two changes to Title X to increase the affordability of contraception for low-income, uninsured Americans: 1. make contraceptives free for low-income clients and 2. increase congressional appropriations for the Title X program to fund this change in guidelines. If implemented, states would see different effects as a result of the policy due largely to differences in their number of Title X clients. Later in the year, THP continued the theme of American health care with two October publications: one proposal discusses a sweeping reform of our health care system and the second suggests solutions to challenges faced by low-income Medicare beneficiaries.

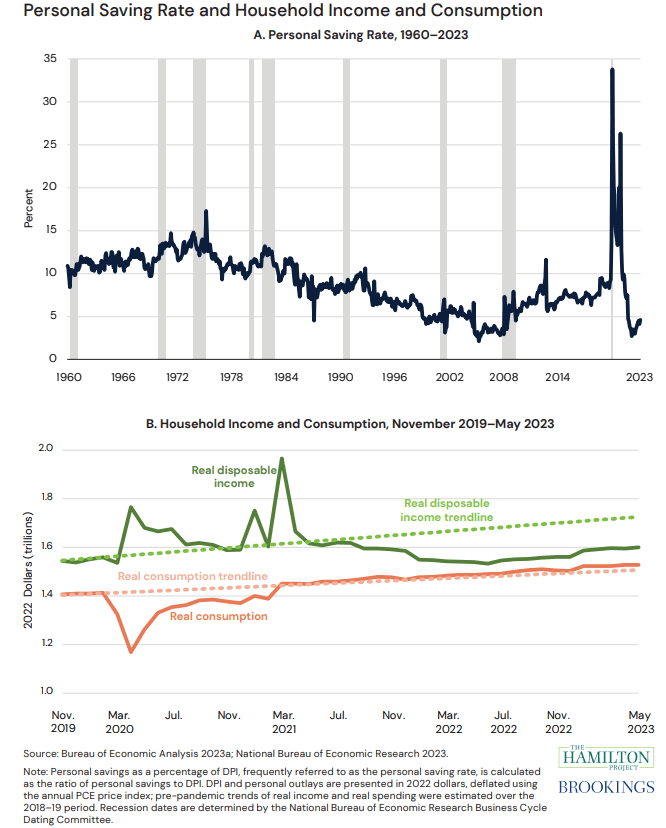

August: Sharp gains in household balance sheets during the pandemic have reversed in 2023.

The Hamilton Project examined recent fluctuations in household finances. In 2020, household wealth grew substantially because of reduced spending during the COVID-19 pandemic, increased income support from government transfers, and increases in asset values. The figure plots personal savings rates, which spiked to historic levels in 2020 and 2021. However, in early 2023 these savings were diminished, largely due to stock market losses and low saving rates coupled with weak income growth. To maintain relatively healthy balance sheets, such households will likely need to moderate their spending.

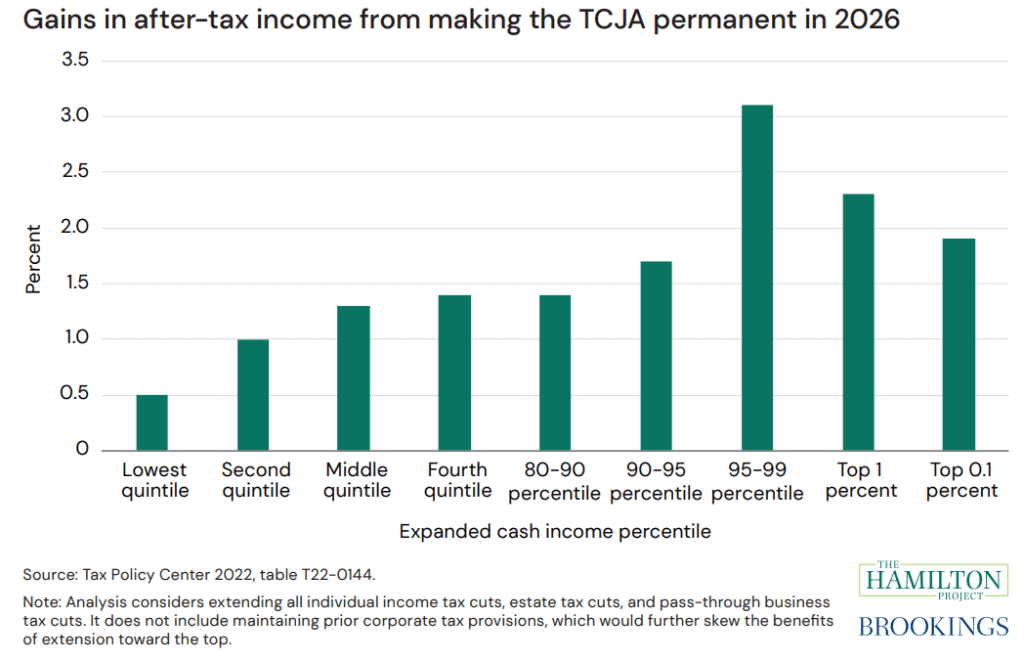

September: If extended past 2025, TCJA tax cuts would provide taxpayers at the top of the income distribution with significantly larger income gains than those at the bottom.

The Tax Cuts and Jobs Act (TCJA) was the focus of a THP September policy proposal. The expiration of key TCJA provisions at the end of 2025 could create a window of opportunity for sweeping tax reform in the U.S., according to authors Kimberly Clausing and Natasha Sarin. Estimates from the Tax Policy Center demonstrate the regressive impacts of extending the individual, pass-through business, and estate tax cuts in the TCJA. Extension of these temporary provisions in 2026 would provide taxpayers at the top of the income distribution with significantly larger after-tax gains than those at the middle and bottom of the distribution. In the first four income quintiles, after-tax income would increase by $100, $450, $990, and $1,870 on average, respectively. Income gains would average $7,730 for the top quintile and $48,690 for the top 1 percent.

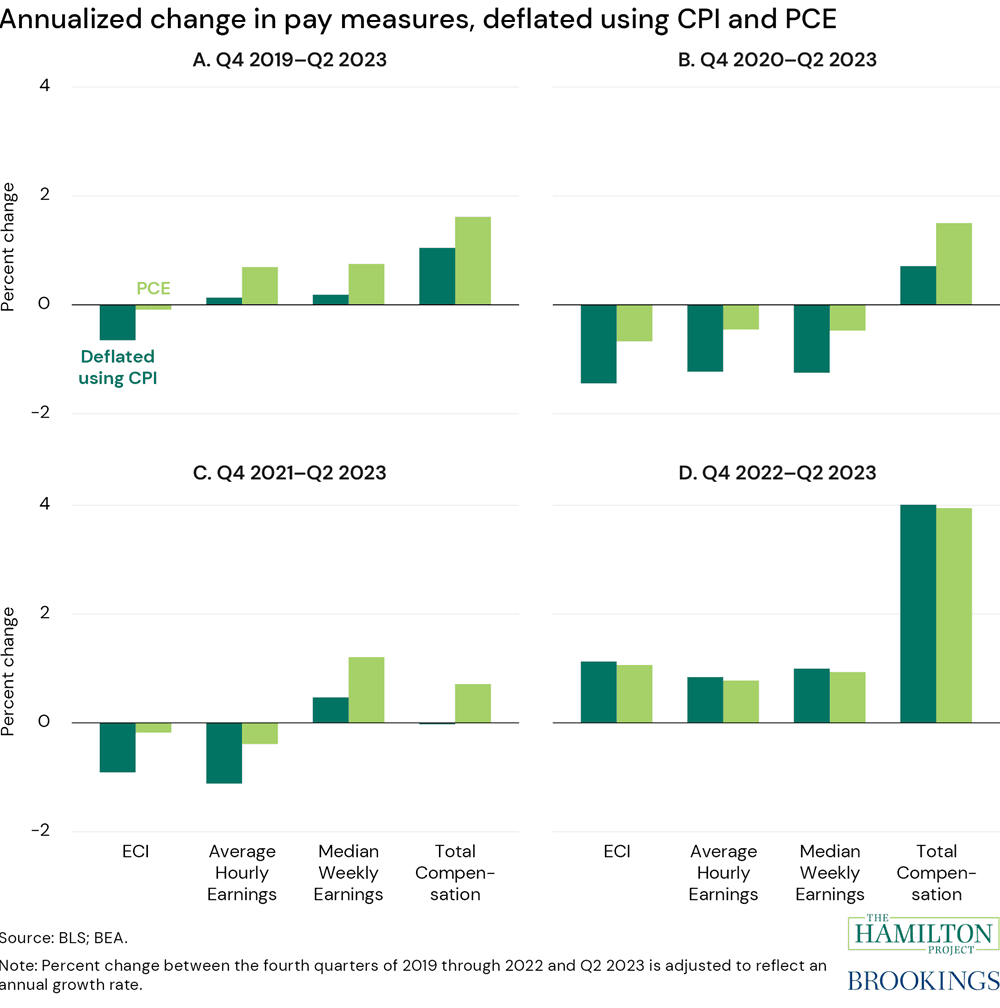

October: Analysis of real wage growth points to reason for both optimism and pessimism.

The story of recent real wage growth for workers can vary depending on the measure used for analysis. In October, THP set out to find clarity in this conversation by examining wage growth using four different measures: Employment Cost Index (ECI), average hourly earnings, median weekly earnings, and total compensation. The measures were then calculated using both the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index, various reference periods, and different pay measures. This figure demonstrates how these complexities affect conclusions about the state of today’s labor market. Overall, all four measures of pay have increased since the end of 2022. Additionally, three of the four measures have increased since 2019. Those same three pay measures, adjusted for inflation with PCE, are recently showing gains that are above the levels predicted by historical trends. These changes show some reason for optimism regarding wage growth. However, pay gains are overall weaker when adjusted for CPI; this garners less support for optimism as CPI reflects the prices most noticeable to consumers in their day-to-day lives. The piece concludes

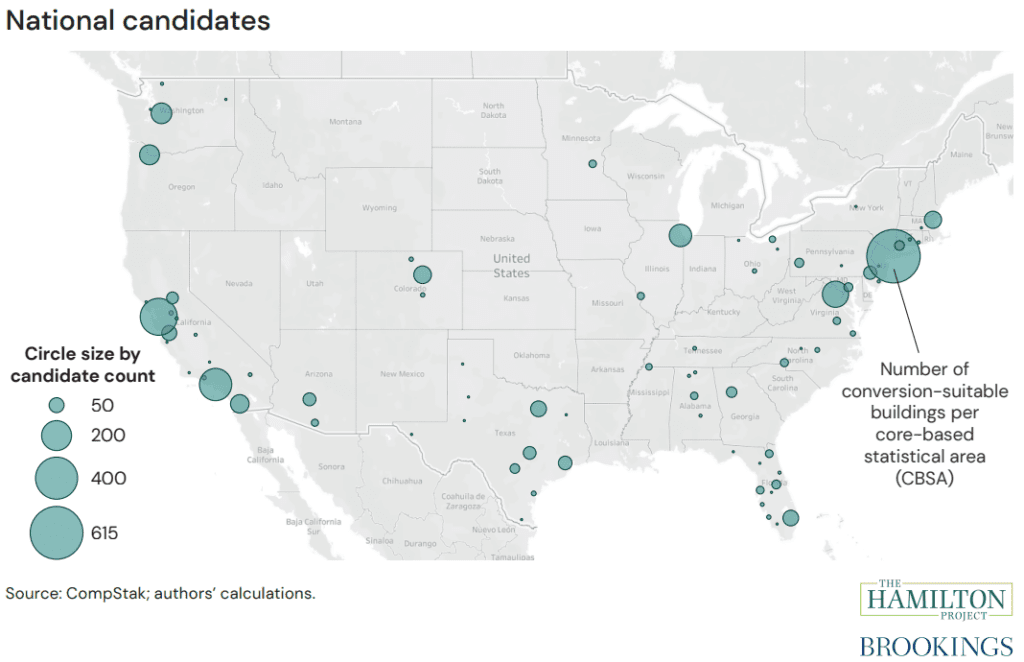

November: Location, building age, class, size, and other features are essential to determining a building’s eligibility for conversion.

One part of the solution to the housing crisis in the U.S. is conversion of vacant office buildings to green affordable housing, as Arpit Gupta, Candy Martinez, and Stijn Van Nieuwerburgh observe in their November proposal. For a building to be eligible for conversion it must meet certain criteria: location, building age, building class, building size, distance from the city core, the state of current tenant agreements, and energy efficiency. After eliminating infeasible candidates using these criteria, the proposal finds about 9 percent of office buildings physically suitable for conversion. The proposal explains how federal and local funds can be used to subsidize conversions that are not otherwise financially viable, particularly conversions that reduce greenhouse gas emissions and create affordable housing. Coinciding with the proposal, THP published an interactive financial calculator to help policymakers and developers evaluate conversion candidates in their municipalities and determine whether and how large a subsidy is required to make the conversion feasible.

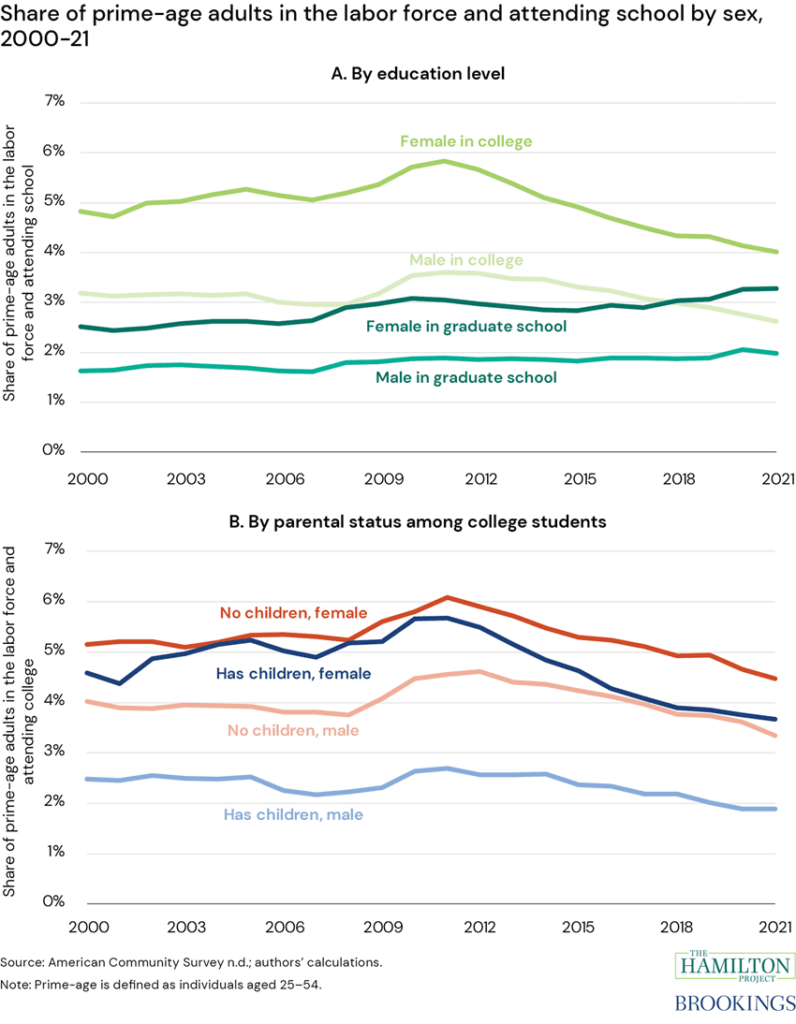

December: Women, regardless of parental status, outpace men in simultaneous labor force participation and postsecondary education enrollment.

To wrap up the year, The Hamilton Project took a look at the composition of nontraditional students who also work. The analysis tracks nontraditional student enrollment from 2000 to 2021 by parental status and sex, education level and sex, and occupation and industry. Since 2000, women have outnumbered men in the share of those who are both enrolled in postsecondary education and work, regardless of parental status. Interestingly, although prime-age women without children are more likely than women with children to both work and enroll in school, the share of women with children who are working students still exceeds the rate for men without children. As shown in the second panel of this figure, the pattern exists for those enrolled in college; however, the same trend exists for those enrolled in graduate school (not shown).

To stay up to date on all of The Hamilton Project’s new research in the upcoming year, sign up for our newsletter here.