The Hamilton Project seeks to advance America’s promise of opportunity, prosperity, and growth.

To this end, The Hamilton Project puts forward innovative, rigorous, and evidence-based proposals and analyses to introduce new and effective policy options into the national debate. In our policy proposals, experts in their field identify solutions to the most pressing policy challenges, from immigration to health care to climate change.

Below you will find a selection of The Hamilton Project’s work. Explore all publications from The Hamilton Project at hamiltonproject.org/publications.

Climate

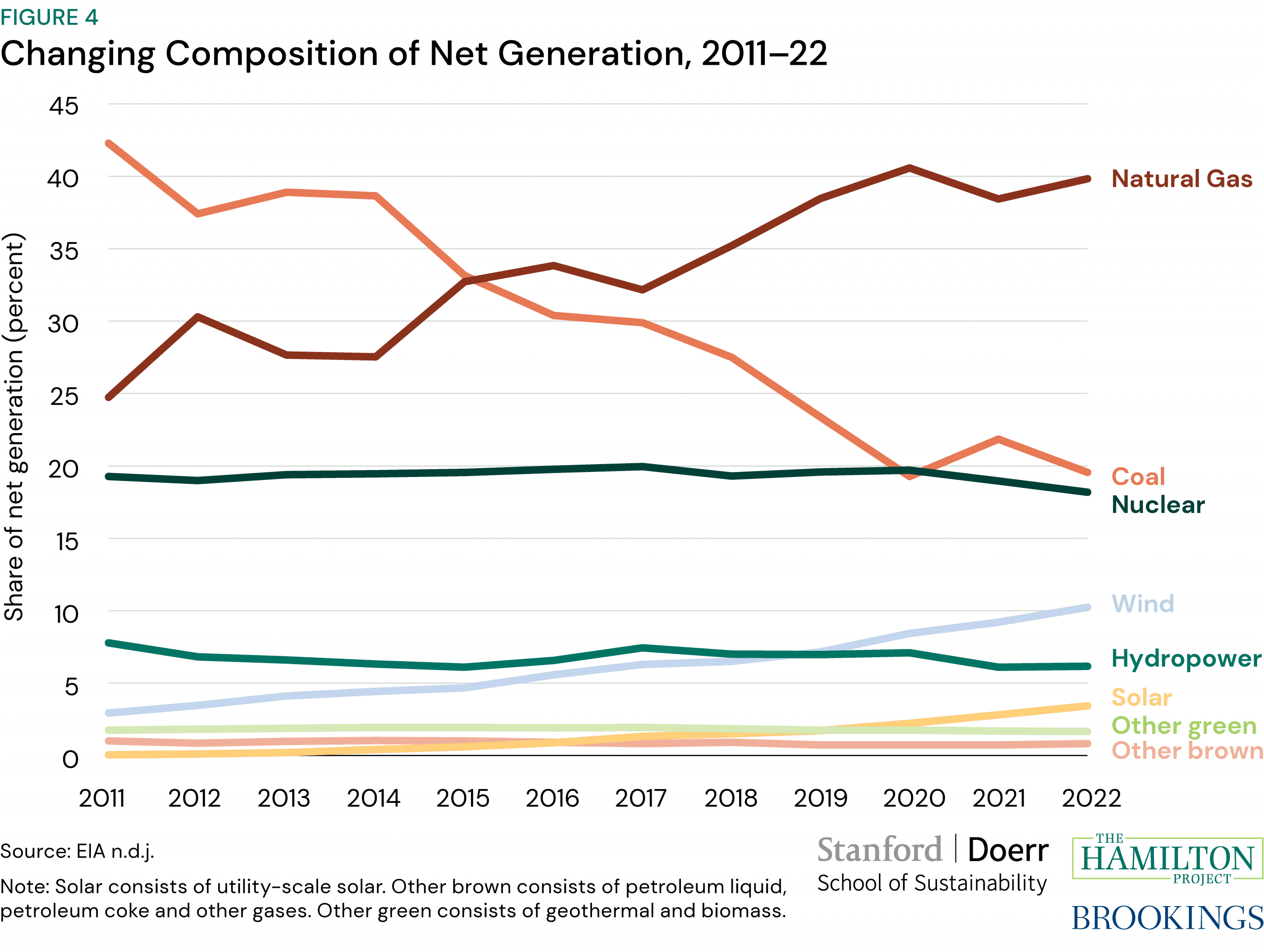

A sustainable economy requires policies that combat climate change, mitigate its effects, and promote research and new technologies. Furthermore, the tax code, where much of U.S. climate policy is implemented, will likely be the subject of intense policy debate in 2025. To inform that debate, it is important to explore how choices for tax policy can have significant effects on the speed of decarbonization in the United States. The Hamilton Project has commissioned policy proposals from leading experts on climate-related policy.

Climate tax policy reform options in 2025

Kimberly A. Clausing, UCLA School of Law

Neil Mehrotra, Federal Reserve Bank of Minneapolis

James H. Stock, Harvard University

Catherine Wolfram, MIT Sloan School of Management

Problem

Because much of U.S. climate policy currently operates through the tax code, efforts to achieve net zero carbon emissions by 2030 could hinge on the decisions made when many Tax Cuts and Jobs Act (TCJA) provisions expire in 2025. This paper assesses climate policies that the U.S. federal government may consider in 2025 and evaluates emissions reductions, abatement costs, fiscal impacts, and household energy expenditures across a range of policy scenarios.

Proposal

First, the emissions reductions of the Inflation Reduction Act (IRA) are significantly augmented under scenarios that add a modest carbon fee or, to a lesser extent, that implement a clean electricity standard in the power sector. Second, net fiscal costs can be substantially reduced in scenarios that include a carbon fee. Third, expanding the IRA tax credits yields modest additional emissions reductions with higher fiscal costs. Finally, although none of the policy combinations across these scenarios achieve the U.S. target of a 50-52 percent economy-wide emissions reduction by 2030 from 2005 levels, the carbon fee and clean electricity standard scenarios achieve these levels between 2030 and 2035.

Governing the grid for the future: The case for a Federal Grid Planning Authority

Shelley Welton, University of Pennsylvania

Problem

The U.S. electricity grid is nearing crisis mode, plagued by a suite of challenges including lengthy delays in interconnecting new resources, insufficient regional and interregional transmission expansion, and increasing reliability concerns. These problems should be understood centrally as a challenge of governance: For-profit companies have too large a role in the long-term, systemic planning of the electricity grid, causing U.S. consumers to dramatically overspend on grid projects that serve incumbents’ interests but do not efficiently or effectively accomplish public goals for the system.

Proposal

Shelley Welton proposes the creation of a new Federal Grid Planning Authority to develop grid expansion plans in the national interest, accompanied by changes to grid oversight to enable more scrutiny of proposed utility projects that do not align with national and regional plans. The proposal also explores systemic, structural reforms that the Federal Energy Regulatory Commission (FERC) and U.S. Department of Energy (DOE) could undertake in the absence of legislation to address the governance challenges impeding the creation of a cost-effective and forward-looking transmission grid.

Climate change and utility wildfire risk: A proposal for a federal backstop

Michael Wara, Stanford University

Michael Mastrandrea, Stanford University

Eric Macomber, Stanford University

Problem

Recent catastrophic wildfires have made it clear that much of the Western United States is exposed to material wildfire risk. Climate change, a legacy of landscape management oriented at fire suppression, and increased development of housing in vulnerable areas have all contributed to large increases in loss of life, structure loss, ecological impacts, and smoke-related health impacts from catastrophic wildfires. Utility-ignited wildfires are a unique and outsized contributor to this problem, leading to some of the most destructive wildfires with losses that are large enough to significantly affect the financial health of electric utilities in a growing number of states. Utility-ignited wildfires also threaten the affordability of electricity rates, the implementation of state and federal clean energy policies, and the overall health of the housing market. Despite this, many utilities exposed to wildfire-related liability have not created or implemented plans to mitigate the chance that their electric infrastructure ignites a wildfire.

Proposal

This paper proposes the creation of a voluntary multistate and federal safety program, with participation incentivized by the creation of a federal Utility Wildfire Fund, an insurance-like backstop mechanism. Access to the fund is conditioned on compliance with minimum safety standards. This approach is modeled on California’s approach to utility wildfire mitigation.

Principles for public investment in climate-responsible energy innovation

Catherine Hausman, University of Michigan

Problem

The United States has fallen behind in energy innovation, according to measures on inputs (the portion of GDP spent on energy R&D) and outputs (clean energy patenting). There continues to be a need to support technological advancements in new ways of producing and consuming energy to enable economic growth, enhance energy security, and combat climate change.

Proposal

The proposal offers rationale for substantially increasing federal spending on clean energy research and development (R&D), along with four foundational pillars for energy innovation policy to leverage effective investment:

- Spend triple the federal support for energy R&D;

- Prioritize clean energy, with a secondary focus on energy security;

- Allow for risk-taking in project selection, and expect (and learn from) some project failures; and,

- Draw on the expertise of the U.S. Department of Energy, the Advanced Research Projects Agency-Energy, and the national laboratories.

Promoting innovation for low-carbon technologies

David Popp, Syracuse University

Problem

Despite progress made over the past decade, further innovation is necessary to achieve deep decarbonization of the U.S. economy. Meeting climate policy goals currently under consideration will not be possible without further technological improvement. Unfortunately, market failures affect all stages of clean energy technology development, meaning that market forces alone will not lead to optimal allocation of resources.

Proposal

Supporting clean energy innovation requires a portfolio of policy tools that will increase the potential market for innovation (the demand side) and address market failures that hinder innovation (the supply side). These policies include phasing in spending increases for clean energy research, emphasizing high-risk, high-reward opportunities that are unlikely to receive private sector support, and enhancing opportunities for technology transfer through DOE laboratories.

Market-based clean performance standards as building blocks for carbon pricing

Carolyn Fischer, Resources for the Future

Problem

Because industrial sectors contribute a large fraction of total greenhouse gas emissions in the United States, addressing their emissions is an essential element of combating climate change. However, emissions reduction is costly for industrial firms with energy-intensive production processes; requiring significant investment in low-carbon manufacturing technologies can disadvantage domestic firms relative to their unregulated, international competitors.

Proposal

Carolyn Fischer makes the case for using market-based tradable performance standards to reduce industrial carbon emissions. The proposal would set carbon emissions benchmarks tailored to energy-intensive industrial production processes against which a firm’s emissions would be evaluated. Firms with emissions in excess of their benchmark would be required to pay; firms that reduce emissions below their benchmark would receive tradable credits, which can be sold to other firms facing higher abatement costs.

Protecting urban places and populations from rising climate risk

Matthew E. Kahn, University of Southern California

Problem

Climate change has already produced a range of risks that confront Americans cities; even under optimistic projections for carbon dioxide (CO2) emissions mitigation, these risks will continue to increase. Climate-related challenges will put stress on existing infrastructure, requiring urban areas in particular to adapt. Public officials must make key choices in infrastructure investments to help build climate change resilience.

Proposal

Matthew E. Kahn suggests three complementary policies for enhancing urban resilience to new climate risk.

- Improving and investing in key infrastructure resilience.

- Protecting the urban poor, who are the most vulnerable to climate change risks.

- Reducing the cost of adaptation through better-functioning markets, and to allow prices of natural resources, energy, and coastal insurance to reflect true conditions.

From “Ten economic facts about electricity and the clean energy transition.”

Education

Increasing educational attainment for all is central to broad-based economic opportunity and competitiveness. The Hamilton Project has commissioned policy proposals from leading experts on education policy from early childhood through adult education and has produced topical analysis on critical issues including chronic absenteeism, K–12 and higher education enrollment changes, and career earnings by college major.

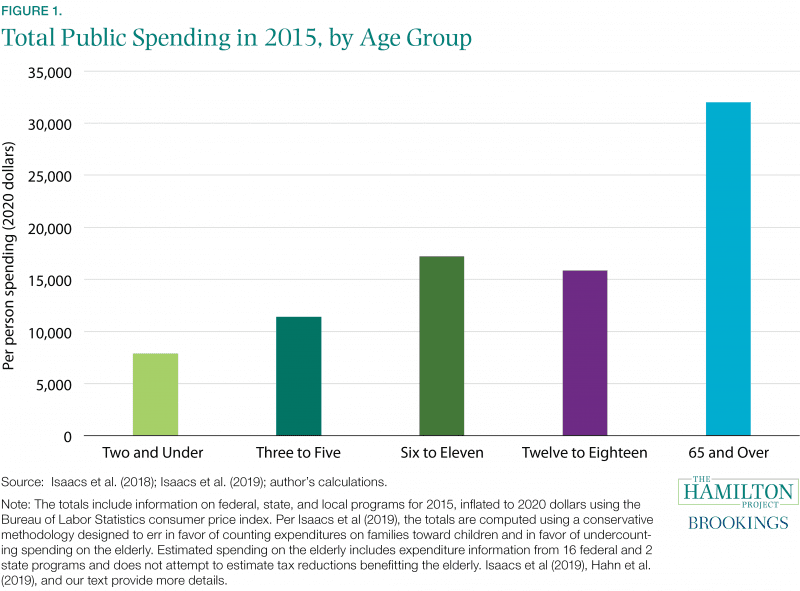

Increasing federal investment in children’s early care and education to raise quality, access, and affordability

Elizabeth Davis, University of Minnesota

Aaron Sojourner, W.E. Upjohn Institute for Employment Research

Problem

Children in the United States do not have equal or equitable opportunities, especially in the first five years of life. Research has shown that high-quality Early Childhood Care and Education (ECE) plays a critical role in children’s short- and long-run outcomes, yet the U.S. set of ECE policies and programs is underfunded and fragmented.

Proposal

Elizabeth Davis and Aaron Sojourner propose increasing federal funding for Early Childhood Care and Education (ECE) to ensure every American family and child has access to high-quality affordable childcare during the first five years of life.

- Establish automatic funding of ECE services to guarantee every child has access.

- Implement an income-based cap on the amount any family pays for early childhood care and education.

- Put in place policies to increase competition and provide additional resources, which would ensure care is of high quality and high value to the public.

Building tomorrow’s workforce today: Twin proposals for the future of learning, opportunity, and work

Richard Arum, University of California Irvine

Mitchell L. Stevens, Stanford University

Problem

Current federal government college funding programs do not encourage schools to be cost-efficient or to build toward the future needs of the U.S. workforce. There remains a need to expand and equalize postsecondary access, reduce the sector’s reliance on costly in-person instruction, and develop a cumulative science of adult learning.

Proposal

Richard Arum and Mitchell L. Stevens make the case for reforming the U.S. higher education system to encourage schools to be more cost-efficient and build towards the future needs of the U.S. workforce.

- Incentivize innovation in instructional delivery throughout the national higher education system;

- Issue Learning Opportunity Credits (LOCs) to promote worker training, bridging the divide between academia and the labor force; and

- Establish a network of government agencies and universities to coordinate best practices on adult learning in high-quality hybrid environments.

Building a more coherent and effective workforce development system in the United States

Harry J. Holzer, Georgetown University

Problem

The U.S. workforce development system generates weak outcomes in the aggregate, contributing to inequality and low upward mobility among poorer Americans. Both funding and institutional support for workforce development is limited and often insufficient.

Proposal

This paper proposes the following reforms:

- Reform the Higher Education Act to expand high-quality workforce training and other programs at postsecondary institutions for disadvantaged students.

- Discourage worker displacement and encourage effective work-based learning and retraining by subsidizing worker retraining through a tax on employers who permanently displace workers.

- Create more funded partnerships between community colleges, workforce training institutions, and states by establishing a permanent version of the Training Adjustment Assistance Community College and Career Training (TAACCCT) grant program.

Coming and going: Encouraging geographic mobility at college entry and exit to lift wages

Abigail Wozniak, University of Notre Dame

Problem

Geography is an important part of economic opportunity—but due to monetary and nonmonetary costs of migration, college attendance is less likely for those who live farther from postsecondary institutions. The college educated have also become increasingly concentrated in larger labor markets, while mobility across markets is falling.

Proposal

Abigail Wozniak suggests modifications to existing Federal Student Aid programs to reduce geographic barriers at college entrance and exit, including:

- Creating annual supplements to the Federal Pell Grant Program for students from counties without a degree-granting college institution.

- Allowing exiting college students to receive extended automatic deferments to Federal Student Loan (FSL) repayment if they are relocating to start their careers.

Health care

Economic security requires delivering higher-quality health care more efficiently and with less financial risk for families. The Hamilton Project has published substantial research on health care policy reform.

Increasing financial access to contraception for low-income Americans

Martha Bailey, University of California Los Angeles

Problem

Access to contraception is fundamental to reproductive autonomy and economic mobility for parents and their children. However, substantial upfront out-of-pocket costs for contraception severely limit access for those without health insurance.

Proposal

This proposal eliminates cost-sharing requirements for contraception for uninsured, low-income Americans through the Title X program, a national family planning program that offers subsidized, patient-centered reproductive health services for low-income individuals. Martha Bailey recommends two changes to Title X to make access to the contraception of choice more affordable:

- Make contraceptives free for low-income women through a change to the guidelines issued by the Department of Health and Human Services that defines the schedule of discounts; and,

- Increase congressional appropriations for the Title X program to fund this change in guidelines.

A proposal to cap provider prices and price growth in the commercial health care market

Michael E. Chernew, Harvard Medical School

Leemore S. Dafny, Harvard Business School and John F. Kennedy School of Government

Maximilian J. Pany, Harvard University

Problem

The United States spends a larger share of its GDP on health care than any other advanced economy. The high private sector health-care spending in the United States relative to that of other economies is driven largely by higher prices. However, there is scant evidence that high U.S. provider prices reflect better quality of care. Market forces have not yielded competitive commercial provider pricing, making policy intervention necessary.

Proposal

Although the United States will likely continue to rely on markets to allocate most health-care resources, market competition has not been sufficient to control commercial provider prices. Price regulations could be used to constrain commercial provider prices in an efficient manner. The authors outline a three-pronged approach that includes:

- Market- and service-specific price caps that apply directly to only the very top of the commercial price distribution;

- Service-, insurer-, and provider-specific price growth caps that constrain price inflation; and

- Flexible oversight by state or federal authorities to address potential evasion.

What to do about health care markets? Policies to make health care markets work

Martin Gaynor, Carnegie Mellon University

Problem

Health care markets have become much more consolidated over time. That consolidation has generally resulted in higher prices without gains in quality or other improvements. There are many health care markets where competition can be effective, but the right policies are needed to support that competition. In other markets, robust competition would be more difficult to achieve, necessitating a different policy approach.

Proposal

Martin Gaynor offers policy reforms to increase competition in health care and improve market functioning:

- Reduce or eliminate policies that encourage consolidation or that impede entry and competition.

- Strengthen antitrust enforcement so that federal and state antitrust enforcement agencies can act effectively to prevent and remove harms to competition.

- Create an agency responsible for monitoring and overseeing healthcare markets and give that agency the authority to flexibly intervene when markets are not working.

Reducing administrative costs in US health care

David Cutler, Harvard University

Problem

Administrative costs account for one-quarter to one-third of total health care spending in the United States—far greater than the amount necessary to deliver effective health care. Excessive administrative burden results in higher costs for physicians, insurers, and patients alike.

Proposal

This proposal outlines reforms to the U.S. health care system aimed at reducing administrative costs that could save $50 billion annually.

- Establish a clearinghouse for bill submission.

- Simplify prior authorization.

- Harmonize quality reporting.

- Enhance data interoperability in the health care system.

From “What to do about health care markets? Policies to make health care markets work.”

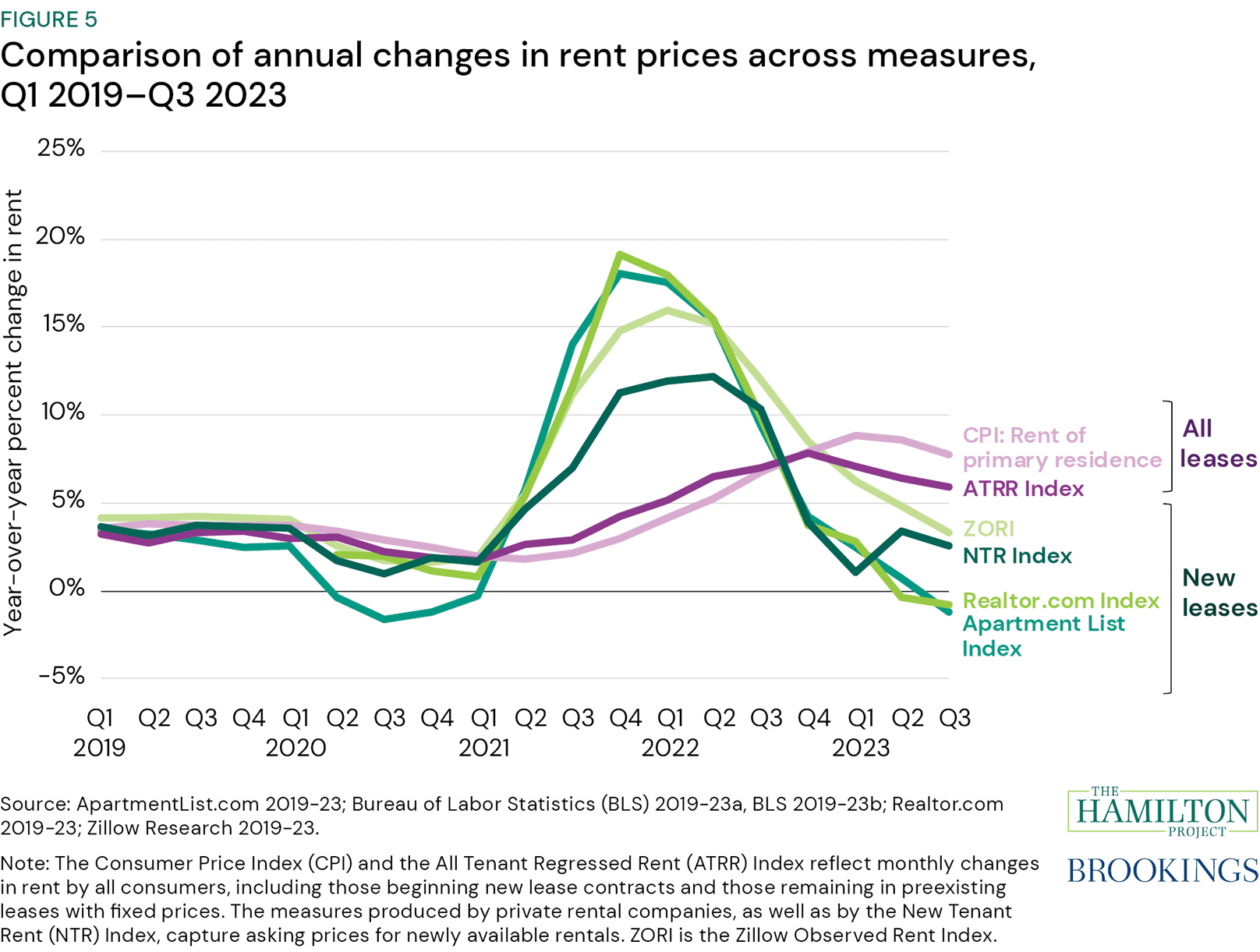

Housing

Increasing the supply of housing and prioritizing new investment in public projects while ensuring existing resources are used efficiently is essential for economic prosperity. The Hamilton Project has commissioned policy proposals from leading experts on housing policy, including a data interactive to determine the financial viability of brown office to green apartment conversions.

Single-family rentals: Trends and policy recommendations

Laurie S. Goodman, Urban Institute

Ingrid Gould Ellen, New York University

Problem

Large institutional investors remain a small overall share of all single-family rentals, but they are highly concentrated in particular geographic areas. The evidence on the behavior of these entities and their impact on markets is limited.

Proposal

- Adopt and enforce rental registries to create more transparency in ownership structures.

- Impose additional requirements by scale. Ensure that single-family homes owned by institutional investors are accessible to diverse renters by being required to (i) accept housing choice vouchers, (ii) accept rental security insurance in lieu of security deposits, (iii) provide renters with time flexibility in paying the security deposit or rent and disclose fees and fee increases transparently, and (iv) do more to enable tenants to build wealth (e.g., report rent payments to credit bureaus to allow renters to build credit), and (v) have a good cause for evicting a tenant.

- Expand First Look policies offered by government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac, and by the Federal Housing Administration (FHA).

Converting brown offices to green apartments

Arpit Gupta, New York University Stern School of Business

Candy Martinez, Columbia University School of Business

Stijn Van Nieuwerburgh, Columbia University School of Business

Problem

This proposal aims to address three related challenges:

- The housing affordability and supply crisis: There is a severe housing crisis in the United States.

- Office revenues and oversupply: While there is an undersupply of residential properties, there is an oversupply of office space.

- The effects of conversion on rental housing and GHG emissions: Demolishing buildings and constructing new ones produces more carbon emissions than conversion.

Proposal

The authors suggest policies to stimulate conversion of brown class A–/B/C offices to green apartments. A key aspect of the proposal is to highlight the relevance and availability of federal climate resources funded under the Inflation Reduction Act that can be used to make more conversions, including those with affordable housing requirements, financially viable.

From “Ten economic facts about rental housing.”

Immigration

Increasing immigration to the United States is worthwhile: Immigrants boost economic activity, promote innovation, and improve the productivity of American workers. But the immigration system is broken, and the immediate costs of welcoming immigrants are unevenly shared. The Hamilton Project has commissioned policy proposals from leading experts on immigration policy that address reforms to increase immigration and separately provide mechanisms for helping state and local governments bear some of immigration’s costs.

New immigration estimates help make sense of the pace of employment

Wendy Edelberg, The Hamilton Project, Brookings

Tara Watson, Center for Economic Security and Opportunity, Brookings

Congressional Budget Office (CBO) estimates released in January 2024 suggest much higher rates of recent immigration than previously projected. Using these new estimates, Edelberg and Watson calculate that the labor market in 2023 could have sustainably accommodated employment growth of 160,000 to 230,000, or about twice as much as previous estimates. The increased immigration numbers help to explain the United States’ surprising economy recovery post-pandemic and point to immigration’s long-term economic benefits.

A more equitable distribution of the positive fiscal benefits of immigration

Wendy Edelberg, The Hamilton Project, Brookings

Tara Watson, Center for Economic Security and Opportunity, Brookings

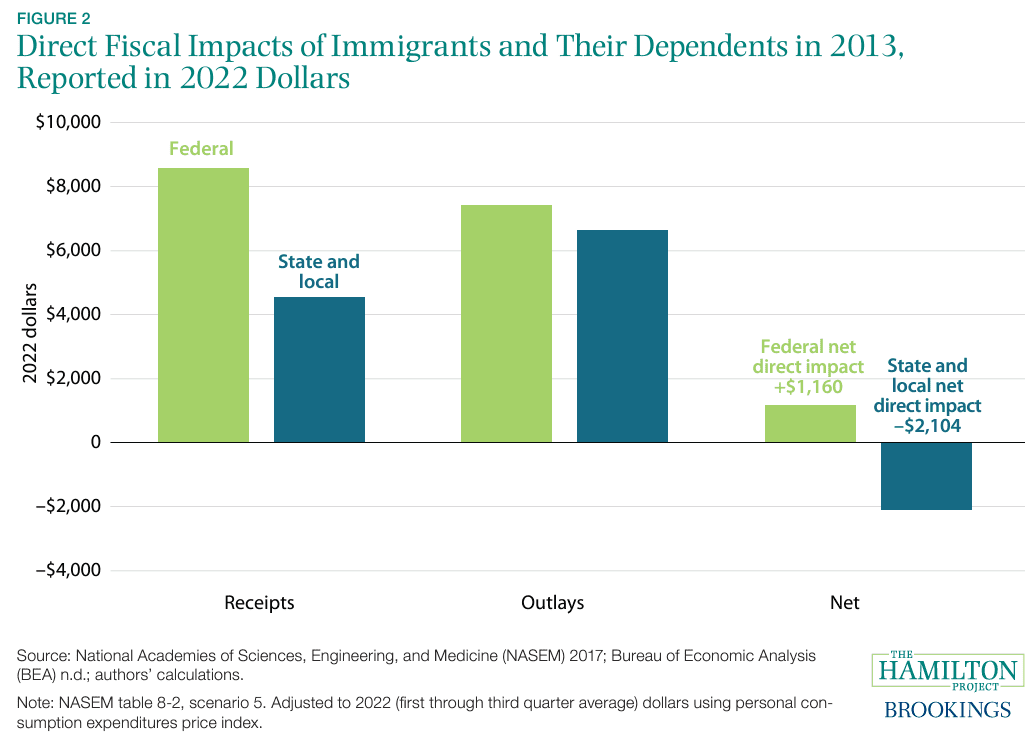

Problem

The United States as a whole economically benefits from immigration, and the federal government enjoys positive fiscal impacts from immigration. But the fiscal cost of immigration is disproportionately paid for by state and local governments, particularly in those areas receiving less-educated immigrants who are new to the country.

Proposal

Wendy Edelberg and Tara Watson propose mechanisms to redirect some of the federal gains from immigration toward those communities that bear more of its near-term costs. Specifically, this proposal:

- Proposes a method to ensure transfers go to communities that face higher fiscal costs as the result of immigration policy.

- Relates the size of the transfers to the best available evidence on the effects on revenues and spending from immigration flows.

- Minimizes bureaucratic costs by piggybacking on existing flows between the federal government and subnational governments via Title VII Impact Aid in schools and Federally Qualified Healthcare Centers (FQHC), which will also make these immigration-related transfers visible and transparent.

Renewing America, revamping immigration

Jennifer Hunt, Rutgers University

Problem

There are long-standing and substantial weaknesses in the current immigration system that invite wide-ranging reforms. The incomplete application of immigration laws is a salient and acute problem. Furthermore, the immigration system fails to provide the greatest possible economic benefits to the native born

Proposal

This paper proposes improvements to the immigration system within its existing framework because the current system has many good features, smaller changes are easier to implement, and the implications of these relatively small departures from the existing system are better understood economically.

- Increase immigration inflows in all categories except family-based immigration, where inflows would be reduced by ending the eligibility of most siblings of U.S. citizens.

- Shift inflows from family-based immigration to employment-based and humanitarian immigration, while high-skill workers’ share of employment-based inflows would increase.

- Facilitate long-term immigration and promote high wages for the most skilled immigrants of all ages.

- Facilitate entry for immigrant health and care workers of both medium and low skill to increase provision of crucial services.

- Render legal agricultural immigration more attractive, to reduce extralegal immigration.

- Provide new legal channels for temporary low-skill immigration outside agriculture.

As a result of these reforms, the stock of immigrants would increase by more than the inflows as high-skill immigrants on temporary visas take advantage of uncapped transitions to a green card. New immigrant arrivals would initially increase by approximately 130,000 annually, with caps subsequently expanded in line with GDP growth.

From “A more equitable distribution of the positive fiscal benefits of immigration.”

Labor

Policies to create quality jobs, enhance productivity, and foster broad-based economic growth are essential for raising the economic security of U.S. households. The Hamilton Project has commissioned policy proposals from leading experts on labor-related policy and has published a volume of proposals: Revitalizing Wage Growth. In addition, The Hamilton Project has produced many analyses on timely issues in the American labor market.

All workers should be able to earn time off: The federal government should guarantee it

Betsey Stevenson, University of Michigan

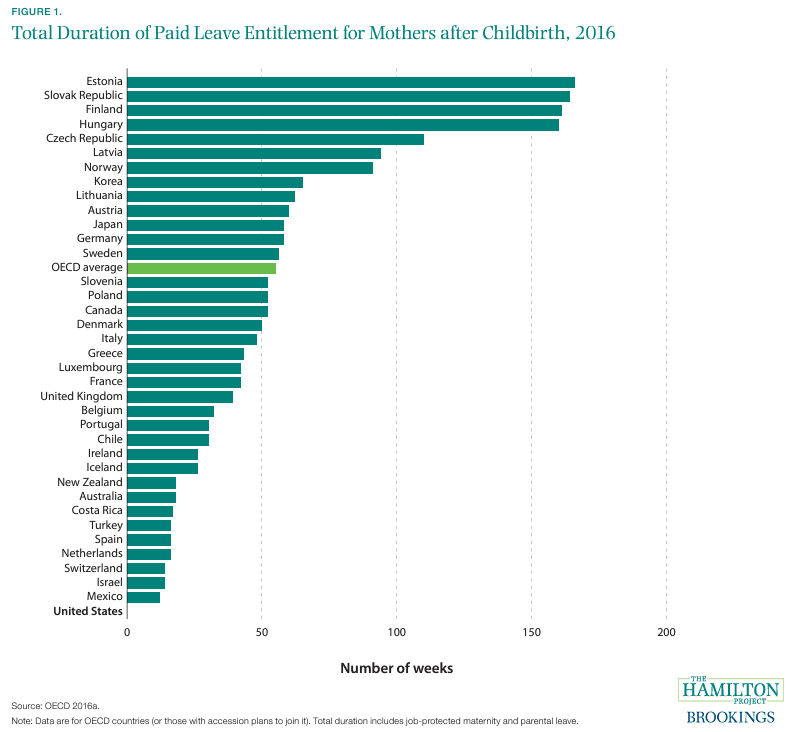

Problem

The United States is the only high-income country that does not guarantee workers paid time off as part of national workplace standards.

Proposal

Betsey Stevenson makes the case for a modernization of the FLSA that would set a new baseline for the American labor market: the 40-hour workweek, overtime protections, the federal minimum wage, and the right to earn paid time off for all qualified workers.

An industrial policy for good jobs

Dani Rodrik, Harvard Kennedy School

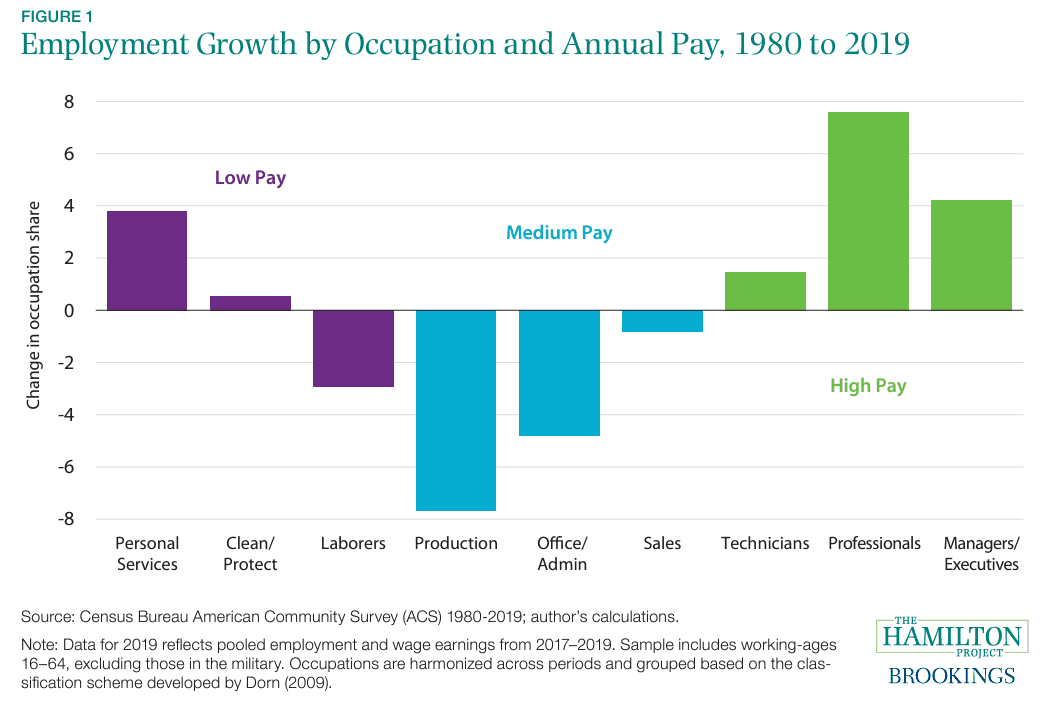

Problem

Since the 1980s there has been an evident failure of the economy to produce adequate numbers of “good jobs” to sustain a prosperous and growing middle class. The failure to generate good jobs has significant economic, social, and political costs, including reduced economic productivity and weakened support for democracy.

Proposal

- ARPA-Workers: A key plank of a good-jobs strategy is a national effort to steer technology in a more labor-friendly direction. The creation of ARPA-W(orkers) fosters development of new labor-friendly frontier technologies that complement rather than displace workers who have an intermediate range of skills and education. ARPA-W would prioritize technologies that complement and augment what workers can do, expand the range of tasks they can perform, increase their ability to customize services to specific needs and customer demand, and increase the labor share of value added in production.

- Local and Regional Industrial Policies: A competitive grant program that allocates funds and promulgates general principles for the operation of local good-jobs programs. In return for public services, firms would be asked to make provisional commitments on specific quantities of good jobs they will create at different qualification levels. In the proposal, Rodrik offers examples of “good jobs” metrics against which the local programs could be measured. Instead of open-ended tax incentives or subsidies, the conduct of industrial policy must then rely on the provision of customized public inputs through collaborative, iterative dialog with firms, and with soft conditionality on employment quantity and quality. This approach helps firms to internalize good-jobs externalities in their employment, training, investment, and technological choices.

Rebuilding communities job subsidies

David Neumark, University of California, Irvine

Problem

Many place-based policies have been unsuccessful, failing to deliver cost-effective benefits to disadvantaged communities. At the same time, the prevalence of extreme poverty areas—areas with a poverty rate of at least 40 percent—has been rising, as have the concentration of poor people in extremely poor areas.

Proposal

This proposal suggests federal government subsidies for employment in places that are struggling. This would entail a two-phase subsidy, administered by local nonprofits in partnership with local employers and community groups.

- Job subsidies in the first phase will cover 100 percent of wages at or somewhat above the relevant minimum wage for an 18-month period. The jobs must both have the potential to quickly build skills that lead to good jobs in the private sector and contribute to revitalizing and improving the disadvantaged areas where the jobs are subsidized.

- The second phase consists of a partially subsidized private sector job subsidized at a 50 percent rate for the first $30,000 of annual earnings.

Strengthening labor standards and institutions to promote wage growth

Heidi Sheirhotlz, Economic Policy Institute

Problem

For most of the period since the 1970s, the United States has suffered from two trends: stagnant wages for most workers, and rising inequality. While these trends have several causes, some of the most critical issues include erosion of labor standards, institutions, and norms that has reduced bargaining power of low- and moderate-wage workers.

Proposal

Heidi Sheirhotlz’s recommendations include:

- Increasing the real value of the minimum wage and the overtime salary threshold.

- Passing fair scheduling laws.

- Boosting unionization.

- Supporting joint employer standards.

- Passing paycheck transparency laws.

- Passing laws that make W-2 the default employment status.

- Limiting the use of non-competes.

- Banning the use of mandatory arbitration for statutory labor and employment claims.

- Ensuring immigrant workers have full labor rights.

- Boosting enforcement of labor standards.

- Leveraging procurement dollars to boost compliance.

From “An industrial policy for good jobs.”

Social Insurance

Social insurance protects workers and families by providing income support, assistance in meeting basic needs, or services to improve economic opportunity. The Hamilton Project has commissioned policy proposals from leading experts on social insurance policy and has two related volumes: Recession Ready and Recession Remedies. In addition, The Hamilton Project has produced many analyses on the social insurance system, particularly regarding nutrition assistance programs.

A plan to reform the unemployment insurance system in the United States

Arindrajit Dube, University of Massachusetts Amherst

Problem

The unemployment insurance (UI) system is the primary countercyclical income support policy for people of working age in the United States, but the system has not experienced significant reform since 1976. The COVID-19 pandemic highlighted the challenges facing the UI system due to poor and underfunded administrative capacities, too few unemployed workers qualifying for UI benefits, inadequate levels of regular UI benefits, lack of effective triggers to tie benefit duration to economic conditions, and meager utilization of work sharing programs.

Proposal

- Convert UI into a fully federal program.

- Ensure that more people who need UI are eligible.

- Create automatic triggers for state and national unemployment rates that extend the potential benefit duration (PBD) when needed due to economic downturns.

- Implement more progressive replacement rates and boost them during recessions.

- Improve short time compensation (STC), also known as “work sharing.”

Expanding access to earned sick leave to support caregiving

Nicole Maestas, Harvard Medical School

Problem

Nearly one in five Americans will be age 65 or older by 2030. The rapid growth of the older population in the United States will dramatically increase the need for elder care, most of which will be provided at home by family members. Supporting an older person sometimes comes at the cost of leaving the labor force, particularly for caregivers in jobs with an inflexible work schedule.

Proposal

Nicole Maestas proposes a federal earned sick leave mandate that guarantees one hour of flexible, multi-purpose sick leave for every 30 hours worked, allowing individual states to decide how they will comply with minimum standards. By helping workers periodically adjust their work schedules to accommodate intermittent and urgent caregiving activities, paid sick leave would increase both home caregiving and employment, as fewer workers would be forced to choose between these activities.

A national paid parental leave policy for the United States

Christopher J. Ruhm, University of Virginia

Problem

Despite widespread public support for paid parental leave, the United States is the only industrialized country without a national policy providing mothers with rights to paid leave following the birth of a child. Research conducted over the past two decades indicates that entitlements of up to six to nine months of paid leave provide substantial labor market and health benefits.

Proposal

This proposal outlines a national paid leave program designed to promote gender equity through an entitlement to 12 weeks of paid time off work for both mothers and fathers. The proposal includes:

- Job protection during the leave and broad eligibility to parents with minimal employment histories.

- A wage replacement rate that falls from 75 percent to 50 percent as earnings increase up to a capped total benefit.

- Financing through a stable stream of general revenues.

- Administration through a new office established within the Social Security Administration.

- Evaluation of the program three to five years after initial implementation.

From “A national paid parental leave policy for the United States.”

Tax

A progressive and efficient tax system promotes growth and encourages shared economic opportunity. The Hamilton Project has commissioned policy proposals from leading experts on tax policy and has published a volume of proposals: Tackling the Tax Code. In addition, The Hamilton Project has published extensive analysis regarding the Child Tax Credit.

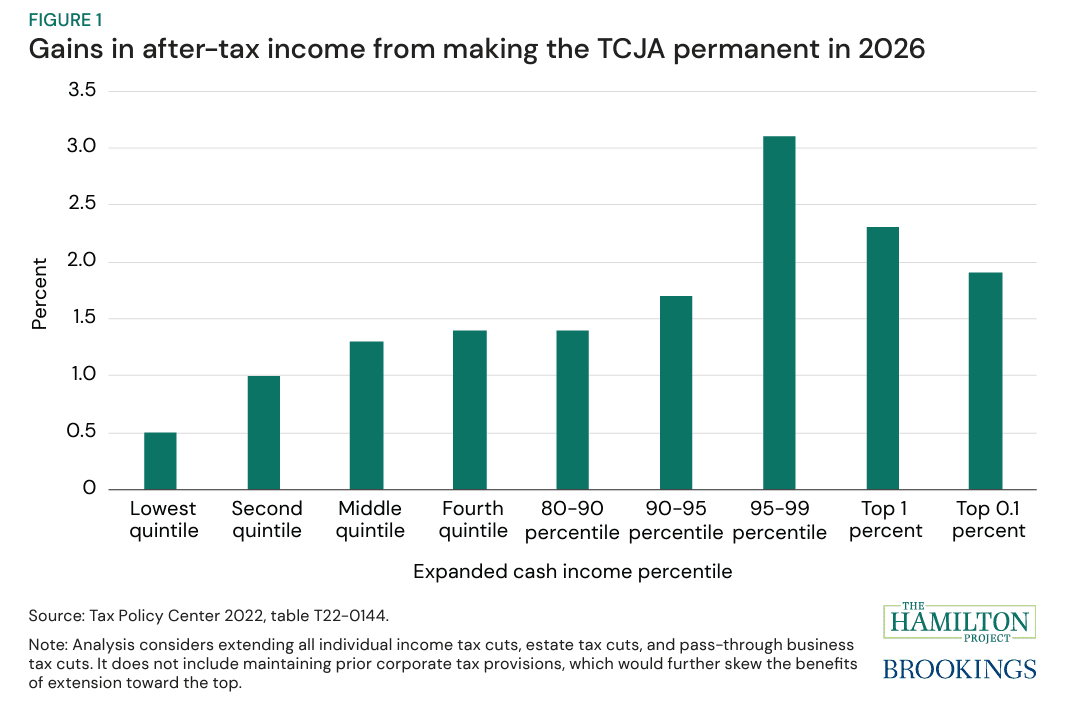

The coming fiscal cliff: A blueprint for tax reform in 2025

Kimberly Clausing, UCLA School of Law

Natasha Sarin, Yale Law School and Yale School of Management

Problem

Many provisions in the 2017 Tax Cuts and Jobs Act (TCJA) are scheduled to expire at the end of 2025. Policymakers will face significant pressure to extend at least some of the expiring TCJA provisions and will encounter important fiscal trade-offs. Beyond these trade-offs, the reopening of the tax code in 2025 is also an enormous opportunity to rethink tax policy. There is much to be gained from approaching tax reform in 2025 with the goals of raising revenue, increasing progressivity, enhancing efficiency, and improving global cooperation.

Proposal

This proposal describes a tax reform package that will help get the U.S. on a path to fiscal sustainability. Reforms include corporate, capital, carbon, and financial transactions taxation that could restore fiscal responsibility, build a more progressive tax system, while asking more from a broader swath of taxpayers, and promote efficiency. The proposed policy changes can all be scaled up or down and will create consistency with U.S. leadership in an evolving world economy.

A proposal for an enhanced partially refundable Child Tax Credit

Melissa Kearney, Aspen Institute and University of Maryland

Wendy Edelberg, The Hamilton Project, Brookings

Problem

Expanding the Child Tax Credit would meaningfully reduce child poverty and improve the long-term outcomes of children. At the same time, policymakers have posed concerns that these additional resources would be negatively offset by reduced labor supply, because struggling parents will not spend the additional cash in ways that are beneficial to children, and due to the net fiscal cost.

Proposal

Melissa Kearney and Wendy Edelberg make the case for a novel and efficient Child Tax Credit design that increases the value of the CTC and provide benefits to families with no income to support millions of American children while addressing common concerns about such expansions. Details include:

- Full credit amount of $3,000 for children between the ages of 6 and 17 and $3,600 for children under 6, consistent with the 2021 CTC expansion.

- Families with no earnings are eligible for half the full credit amount for each child, and there is a steep phase-in of the full credit slow phase-out of the full credit beginning at $75,000 for single filers and $110,000 for married joint filers; these are lower threshold amounts than the 2021 CTC and current law, and thus lower the fiscal costs.

Making work pay better through an expanded Earned Income Tax Credit

Hilary Hoynes, University of California Berkeley

Jesse Rothstein, University of California Berkeley

Krista Ruffini, Georgetown University

Problem

Over the past several decades, earnings prospects have stagnated or diminished for lower-skilled workers, and prime-age employment rates have fallen. The Earned Income Tax Credit (EITC) is a refundable tax credit that promotes work. Despite the strong evidence for the effectiveness of the EITC and recent bipartisan expansions, the maximum EITC has been frozen in inflation-adjusted terms for most families since 1996, so the 25 million EITC families with fewer than three children have not seen a real increase in more than 20 years.

Proposal

The authors suggest building on the successes of the EITC with a ten percent across-the-board increase in the federal credit. This expansion would provide a meaningful offset to stagnating real wages, encourage more people to enter employment, lift approximately 600,000 individuals out of poverty, and improve health and education outcomes for millions of children.

From “The coming fiscal cliff: A blueprint for tax reform in 2025.”